- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:3683

Subdued Growth No Barrier To Great Harvest Maeta Holdings Limited's (HKG:3683) Price

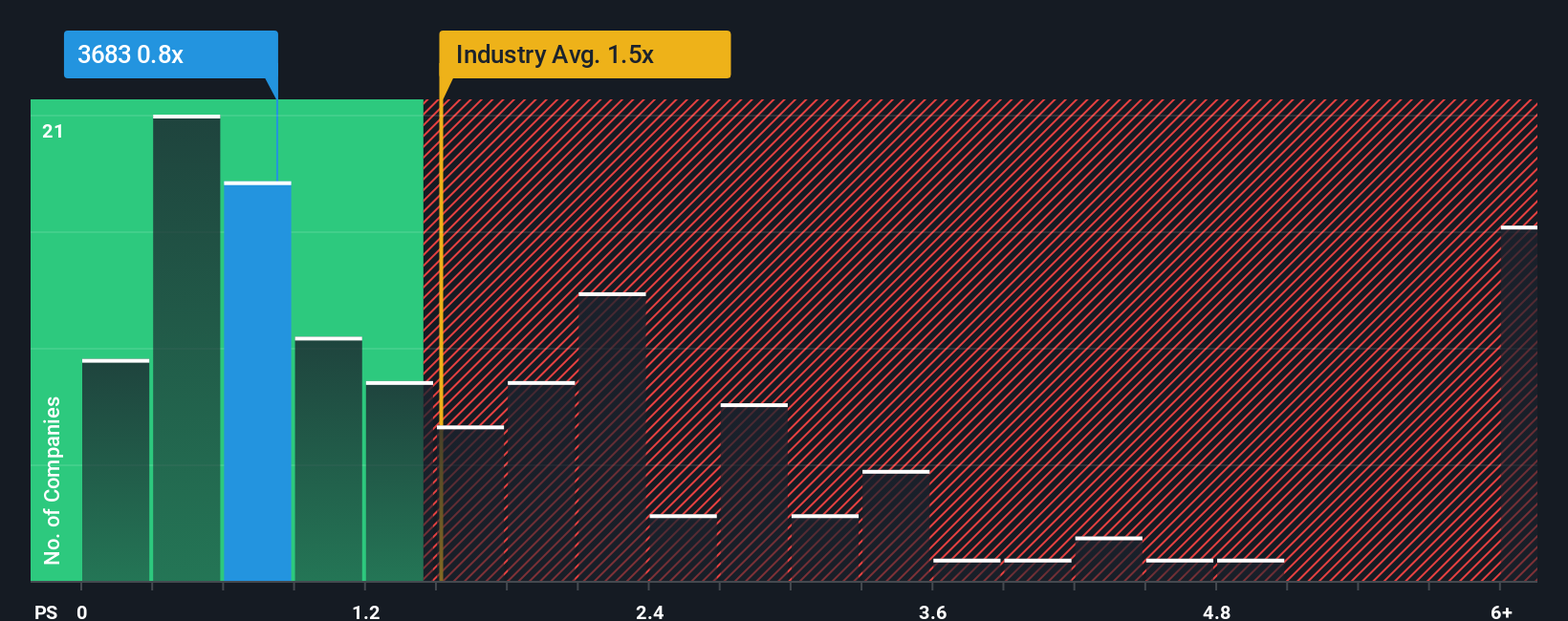

There wouldn't be many who think Great Harvest Maeta Holdings Limited's (HKG:3683) price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S for the Shipping industry in Hong Kong is similar at about 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Great Harvest Maeta Holdings

What Does Great Harvest Maeta Holdings' P/S Mean For Shareholders?

The recent revenue growth at Great Harvest Maeta Holdings would have to be considered satisfactory if not spectacular. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. Those who are bullish on Great Harvest Maeta Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Great Harvest Maeta Holdings will help you shine a light on its historical performance.How Is Great Harvest Maeta Holdings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Great Harvest Maeta Holdings' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 4.4%. Still, lamentably revenue has fallen 35% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to decline by 7.8% over the next year, or less than the company's recent medium-term annualised revenue decline.

With this information, it's perhaps strange that Great Harvest Maeta Holdings is trading at a fairly similar P/S in comparison. In general, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Great Harvest Maeta Holdings currently trades on a higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. This would place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about these 3 warning signs we've spotted with Great Harvest Maeta Holdings (including 1 which is significant).

If you're unsure about the strength of Great Harvest Maeta Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3683

Great Harvest Maeta Holdings

An investment holding company, engages in chartering of dry bulk vessel chartering services worldwide.

Low risk and slightly overvalued.

Market Insights

Community Narratives