- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:2510

T.S. Lines Limited's (HKG:2510) Shares Leap 40% Yet They're Still Not Telling The Full Story

T.S. Lines Limited (HKG:2510) shares have continued their recent momentum with a 40% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

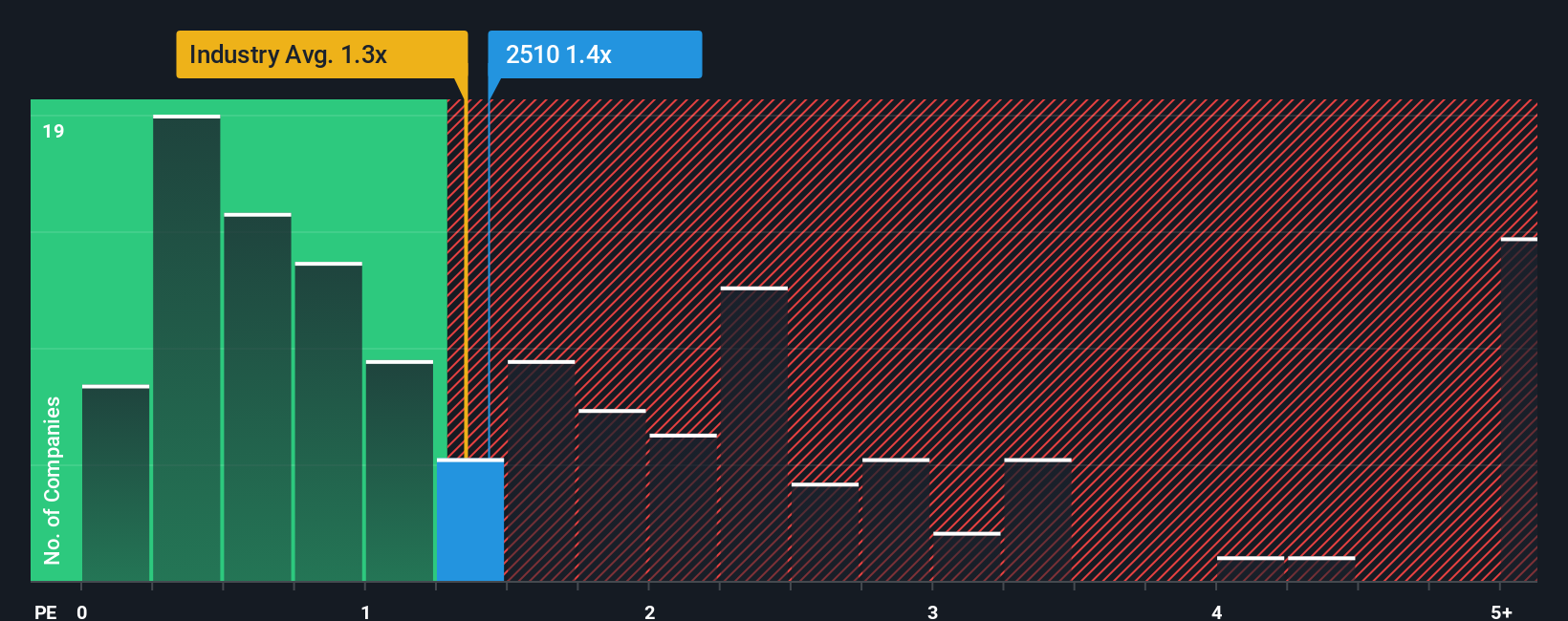

Even after such a large jump in price, it's still not a stretch to say that T.S. Lines' price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the Shipping industry in Hong Kong, where the median P/S ratio is around 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for T.S. Lines

How T.S. Lines Has Been Performing

Recent times have been advantageous for T.S. Lines as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on T.S. Lines will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like T.S. Lines' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 53%. Still, revenue has fallen 27% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 7.4% per year during the coming three years according to the three analysts following the company. With the rest of the industry predicted to shrink by 1.2% per year, that would be a fantastic result.

With this information, we find it odd that T.S. Lines is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What We Can Learn From T.S. Lines' P/S?

Its shares have lifted substantially and now T.S. Lines' P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that T.S. Lines currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You need to take note of risks, for example - T.S. Lines has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

If these risks are making you reconsider your opinion on T.S. Lines, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if T.S. Lines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2510

T.S. Lines

An investment holding company, provides shipping container and related services in Hong Kong, Mainland China, Taiwan, the Philippines, Japan, Australia, Thailand, India, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives