- Hong Kong

- /

- Auto Components

- /

- SEHK:1571

3 SEHK Dividend Stocks With Up To 8.7% Yield

Reviewed by Simply Wall St

As global markets respond to various economic shifts, the Hong Kong market has seen its Hang Seng Index decline by 2.11%, reflecting broader uncertainties and investor caution. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors looking to navigate these turbulent times.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| China Hongqiao Group (SEHK:1378) | 8.43% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.08% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.01% | ★★★★★☆ |

| Playmates Toys (SEHK:869) | 8.70% | ★★★★★☆ |

| Lion Rock Group (SEHK:1127) | 7.97% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.06% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 8.30% | ★★★★★☆ |

| Tianjin Development Holdings (SEHK:882) | 6.92% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.53% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.65% | ★★★★★☆ |

Click here to see the full list of 90 stocks from our Top SEHK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Xin Point Holdings (SEHK:1571)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xin Point Holdings Limited is an investment holding company that manufactures and sells automotive and electronic components across China, North America, Europe, and other international markets with a market cap of HK$3.95 billion.

Operations: Xin Point Holdings Limited generates revenue of CN¥3.23 billion from its manufacturing and sale of automotive and electronic components.

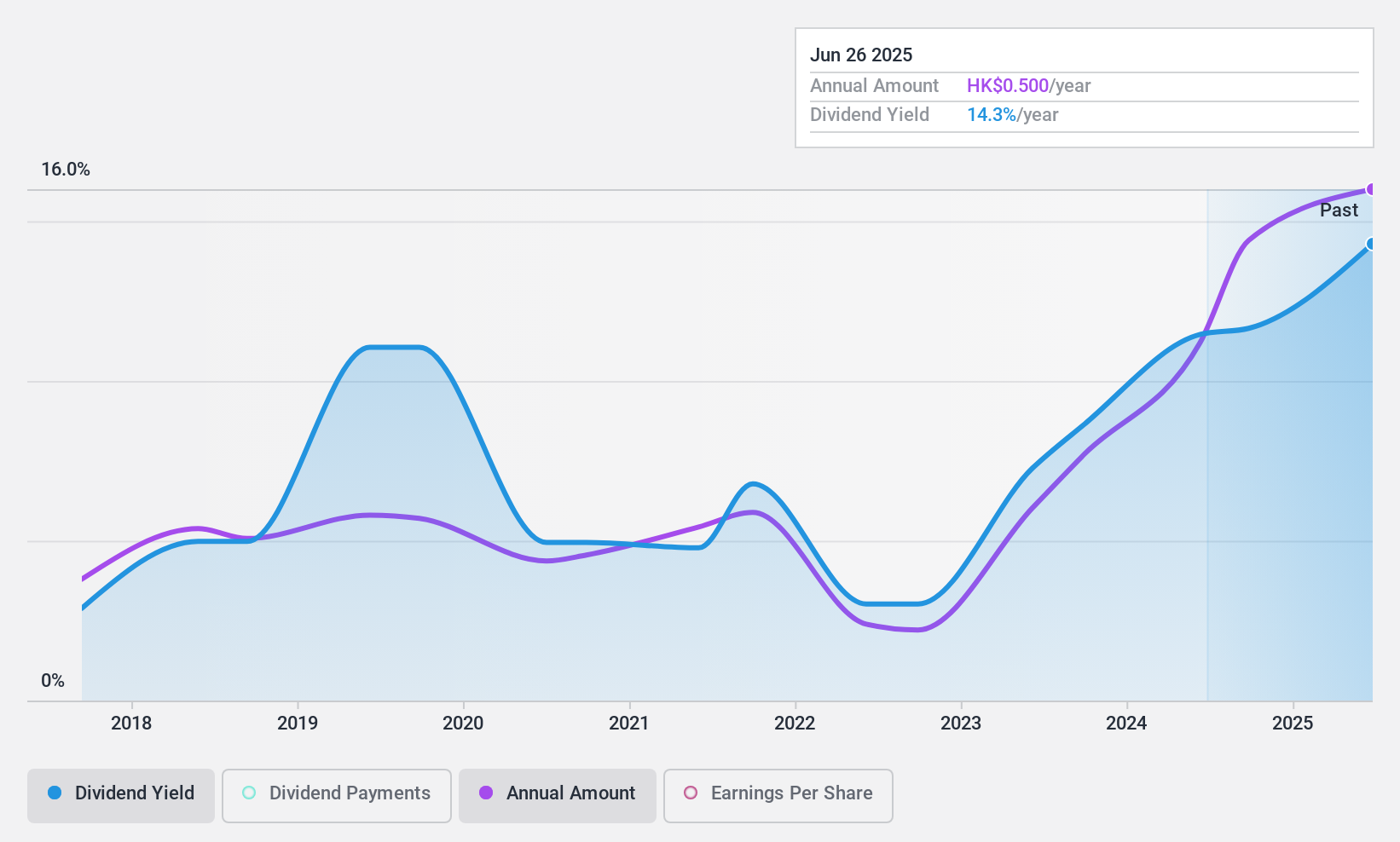

Dividend Yield: 8.7%

Xin Point Holdings offers a compelling dividend yield of 8.74%, placing it in the top 25% of Hong Kong's dividend payers. Despite its unstable track record over seven years, recent earnings growth of 27.4% supports its payouts, with dividends covered by both earnings (61.9%) and cash flows (49.2%). However, volatility in past payments raises concerns about reliability. The interim dividend was increased to HKD 0.20 per share, reflecting improved financial performance this year.

- Click here and access our complete dividend analysis report to understand the dynamics of Xin Point Holdings.

- According our valuation report, there's an indication that Xin Point Holdings' share price might be on the cheaper side.

Man Wah Holdings (SEHK:1999)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Man Wah Holdings Limited is an investment holding company involved in the manufacture, wholesale, trading, and distribution of sofas and ancillary products across China, Europe, Vietnam, Mexico, and other international markets with a market cap of HK$22.18 billion.

Operations: Man Wah Holdings generates its revenue primarily from the Sofa and Ancillary Products segment, which accounts for HK$12.66 billion, followed by Bedding and Ancillary Products at HK$2.99 billion, and Home Group Business contributing HK$674.14 million.

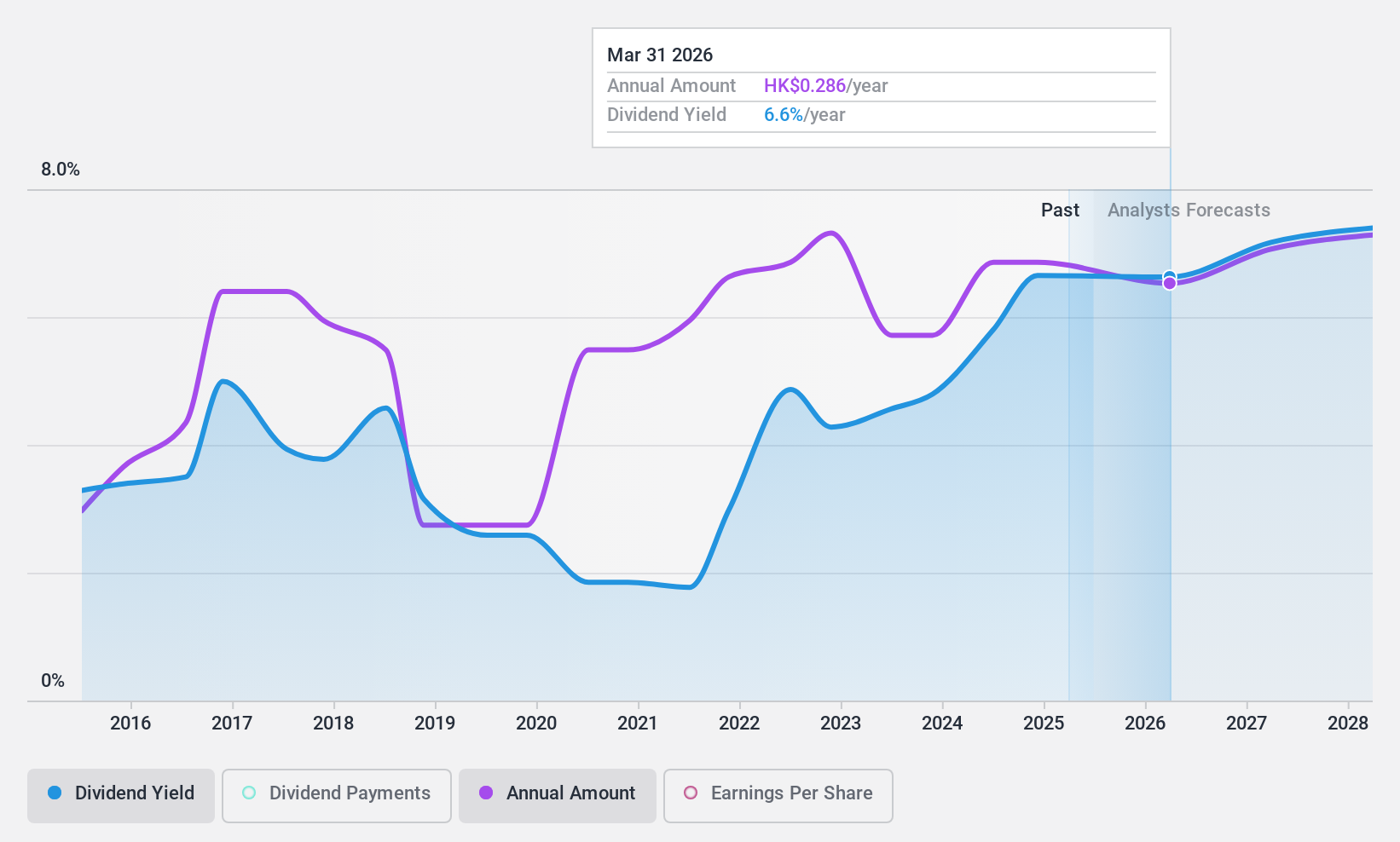

Dividend Yield: 5.2%

Man Wah Holdings trades at a significant discount to its estimated fair value, offering potential for capital appreciation. Despite earnings growth of 20.2% last year and coverage by both earnings (50.8% payout ratio) and cash flows (84.4% cash payout ratio), the dividend track record is unstable with volatility over the past decade. The current yield of 5.24% is below top-tier levels in Hong Kong, suggesting room for improvement in dividend reliability and growth stability.

- Unlock comprehensive insights into our analysis of Man Wah Holdings stock in this dividend report.

- Our expertly prepared valuation report Man Wah Holdings implies its share price may be lower than expected.

Pacific Basin Shipping (SEHK:2343)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pacific Basin Shipping Limited is an investment holding company that provides dry bulk shipping services globally, with a market cap of HK$11.83 billion.

Operations: The company's revenue is primarily derived from its dry bulk shipping services, amounting to $2.43 billion.

Dividend Yield: 4.2%

Pacific Basin Shipping's dividend payments have been volatile and unreliable over the past decade, despite being well-covered by earnings (44.6% payout ratio) and cash flows (30.2% cash payout ratio). Recent interim dividend decreased to HK$0.041 per share amid declining profit margins from 11.9% to 3.4%. The company completed a share buyback worth HK$113.8 million, which may impact future dividends, while executive changes could affect financial strategy stability.

- Get an in-depth perspective on Pacific Basin Shipping's performance by reading our dividend report here.

- Our valuation report unveils the possibility Pacific Basin Shipping's shares may be trading at a discount.

Next Steps

- Take a closer look at our Top SEHK Dividend Stocks list of 90 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1571

Xin Point Holdings

An investment holding company, manufactures and sells automotive and electronic components in China, North America, Europe, and internationally.

Solid track record with excellent balance sheet and pays a dividend.