Is Gogox Holdings (HKG:2246) In A Good Position To Deliver On Growth Plans?

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Gogox Holdings (HKG:2246) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for Gogox Holdings

Does Gogox Holdings Have A Long Cash Runway?

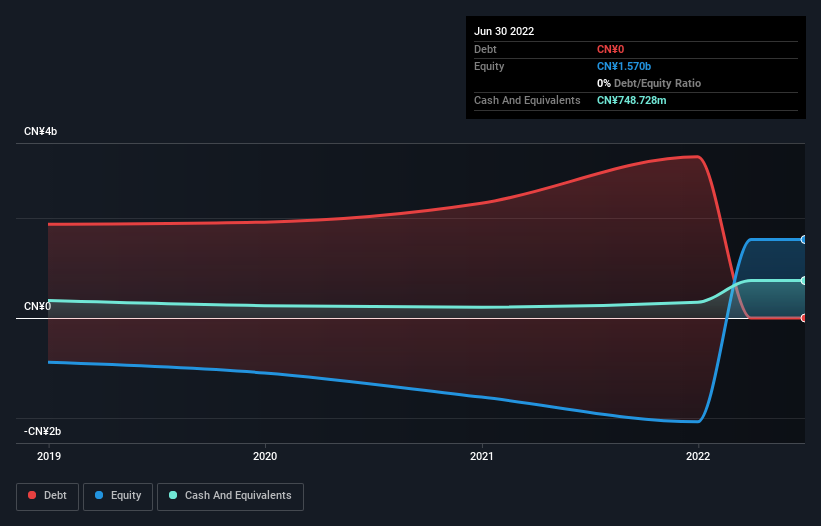

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In June 2022, Gogox Holdings had CN¥749m in cash, and was debt-free. In the last year, its cash burn was CN¥355m. Therefore, from June 2022 it had 2.1 years of cash runway. That's decent, giving the company a couple years to develop its business. The image below shows how its cash balance has been changing over the last few years.

How Well Is Gogox Holdings Growing?

At first glance it's a bit worrying to see that Gogox Holdings actually boosted its cash burn by 46%, year on year. The good news is that operating revenue increased by 33% in the last year, indicating that the business is gaining some traction. Considering the factors above, the company doesn’t fare badly when it comes to assessing how it is changing over time. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Gogox Holdings Raise More Cash Easily?

Gogox Holdings seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Gogox Holdings' cash burn of CN¥355m is about 23% of its CN¥1.5b market capitalisation. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

Is Gogox Holdings' Cash Burn A Worry?

On this analysis of Gogox Holdings' cash burn, we think its revenue growth was reassuring, while its increasing cash burn has us a bit worried. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Gogox Holdings' situation. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 1 warning sign for Gogox Holdings that potential shareholders should take into account before putting money into a stock.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2246

Gogox Holdings

An investment holding company, provides logistic and delivery solutions in Mainland China, Hong Kong, Korea, Singapore, and internationally.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives