J&T Global Express Limited (HKG:1519) Soars 34% But It's A Story Of Risk Vs Reward

Those holding J&T Global Express Limited (HKG:1519) shares would be relieved that the share price has rebounded 34% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

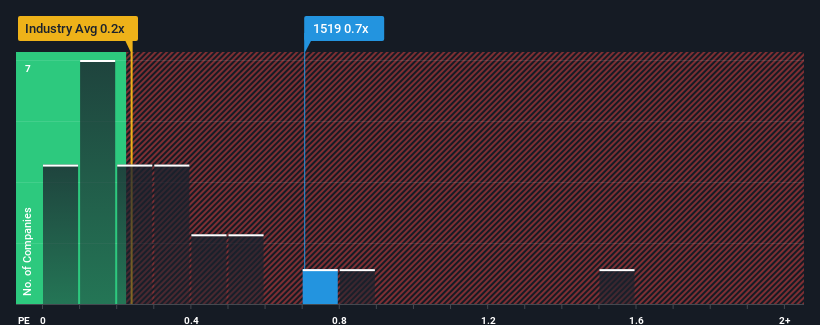

Even after such a large jump in price, you could still be forgiven for feeling indifferent about J&T Global Express' P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Logistics industry in Hong Kong is also close to 0.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

We check all companies for important risks. See what we found for J&T Global Express in our free report.Check out our latest analysis for J&T Global Express

What Does J&T Global Express' P/S Mean For Shareholders?

J&T Global Express certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on J&T Global Express will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For J&T Global Express?

The only time you'd be comfortable seeing a P/S like J&T Global Express' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 111% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 13% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 8.0% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that J&T Global Express' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On J&T Global Express' P/S

J&T Global Express appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, J&T Global Express' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for J&T Global Express with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1519

J&T Global Express

An investment holding company, offers integrated express delivery services in the People’s Republic of China, Indonesia, the Philippines, Malaysia, Thailand, Vietnam, Saudi Arabia, the United Arab Emirates, Mexico, Brazil, and Egypt.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives