As global markets navigate a mix of economic signals, including a temporary U.S.-China trade truce and steady interest rates from the Bank of Japan, investors are increasingly looking towards Asia for opportunities that align with these shifting dynamics. In this context, dividend stocks can be particularly attractive as they offer potential income stability amidst market fluctuations and evolving economic policies.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.98% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.79% | ★★★★★★ |

| NCD (TSE:4783) | 4.48% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.99% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.53% | ★★★★★★ |

| Daicel (TSE:4202) | 4.52% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.61% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.48% | ★★★★★★ |

Click here to see the full list of 1038 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

SITC International Holdings (SEHK:1308)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SITC International Holdings Company Limited is a shipping logistics company offering integrated transportation and logistics solutions across Mainland China, Hong Kong, Taiwan, Japan, Southeast Asia, and internationally with a market cap of HK$83.11 billion.

Operations: SITC International Holdings Company Limited generates revenue of $3.42 billion from its Transportation - Shipping segment.

Dividend Yield: 6.9%

SITC International Holdings offers a compelling dividend yield, ranking in the top 25% of Hong Kong market payers. Despite a history of volatile dividends, recent payouts are well-covered by both earnings and cash flows, with payout ratios at 71.3% and 57.9%, respectively. The company declared an interim dividend of HK$1.3 per share for H1 2025 amidst strong financial performance, reporting net income growth to US$630 million from US$350.67 million year-over-year, though insider selling raises caution.

- Navigate through the intricacies of SITC International Holdings with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, SITC International Holdings' share price might be too pessimistic.

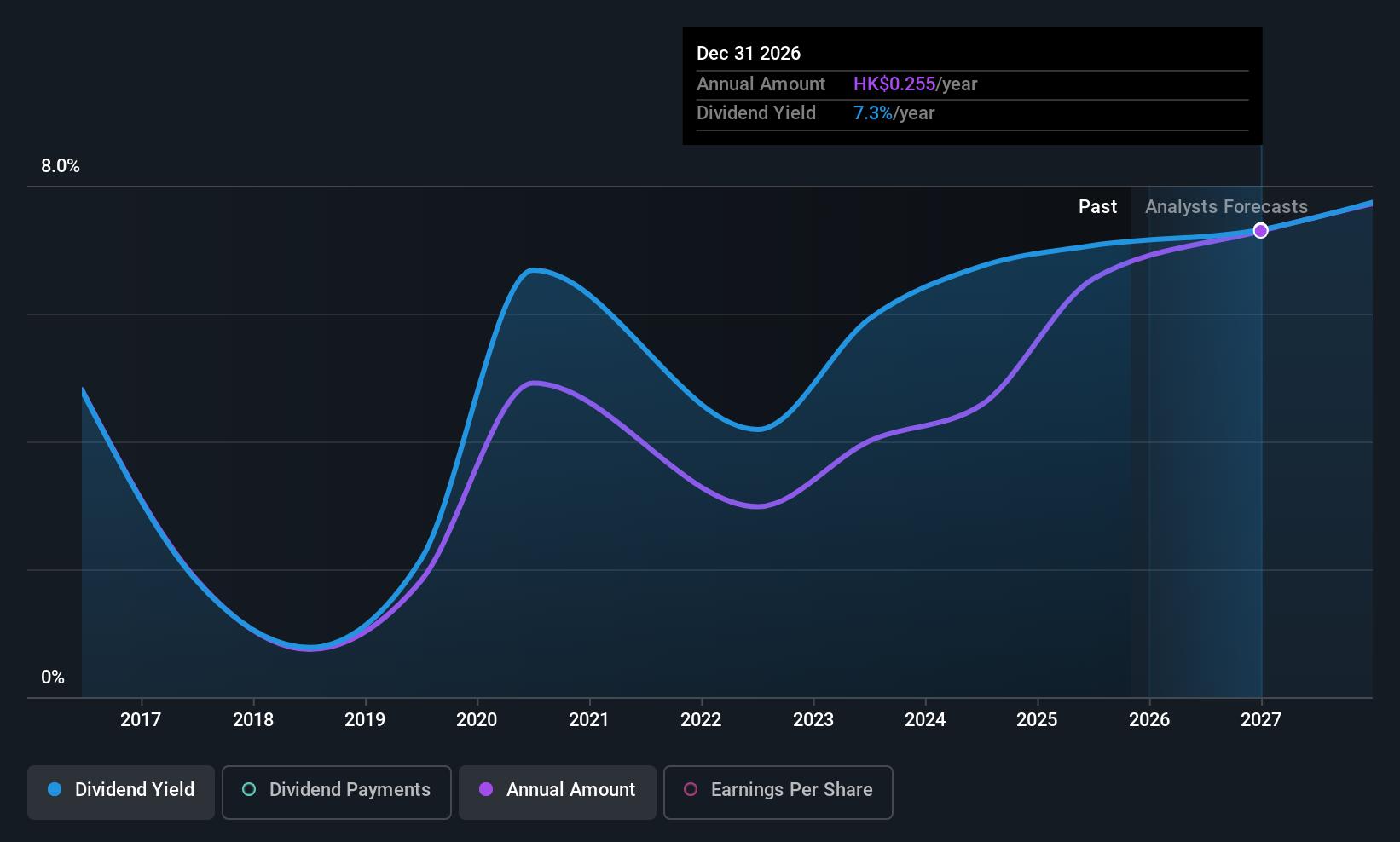

Huishang Bank (SEHK:3698)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Huishang Bank Corporation Limited, along with its subsidiaries, offers a range of commercial banking products and services primarily in Anhui and Jiangsu regions as well as internationally, with a market cap of approximately HK$48.48 billion.

Operations: Huishang Bank Corporation Limited generates revenue from its Treasury segment (CN¥10.27 billion) and Corporate Banking segment (CN¥15.49 billion).

Dividend Yield: 6.6%

Huishang Bank's dividend yield is slightly below the top 25% of Hong Kong market payers, but its dividends are well covered by earnings with a low payout ratio of 19.4%. Despite an unstable dividend history, recent financial performance shows resilience, with net income rising to CNY 9.11 billion for H1 2025 from CNY 8.63 billion a year prior. The bank's addition to the S&P Global BMI Index may enhance investor visibility and confidence.

- Unlock comprehensive insights into our analysis of Huishang Bank stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Huishang Bank is priced lower than what may be justified by its financials.

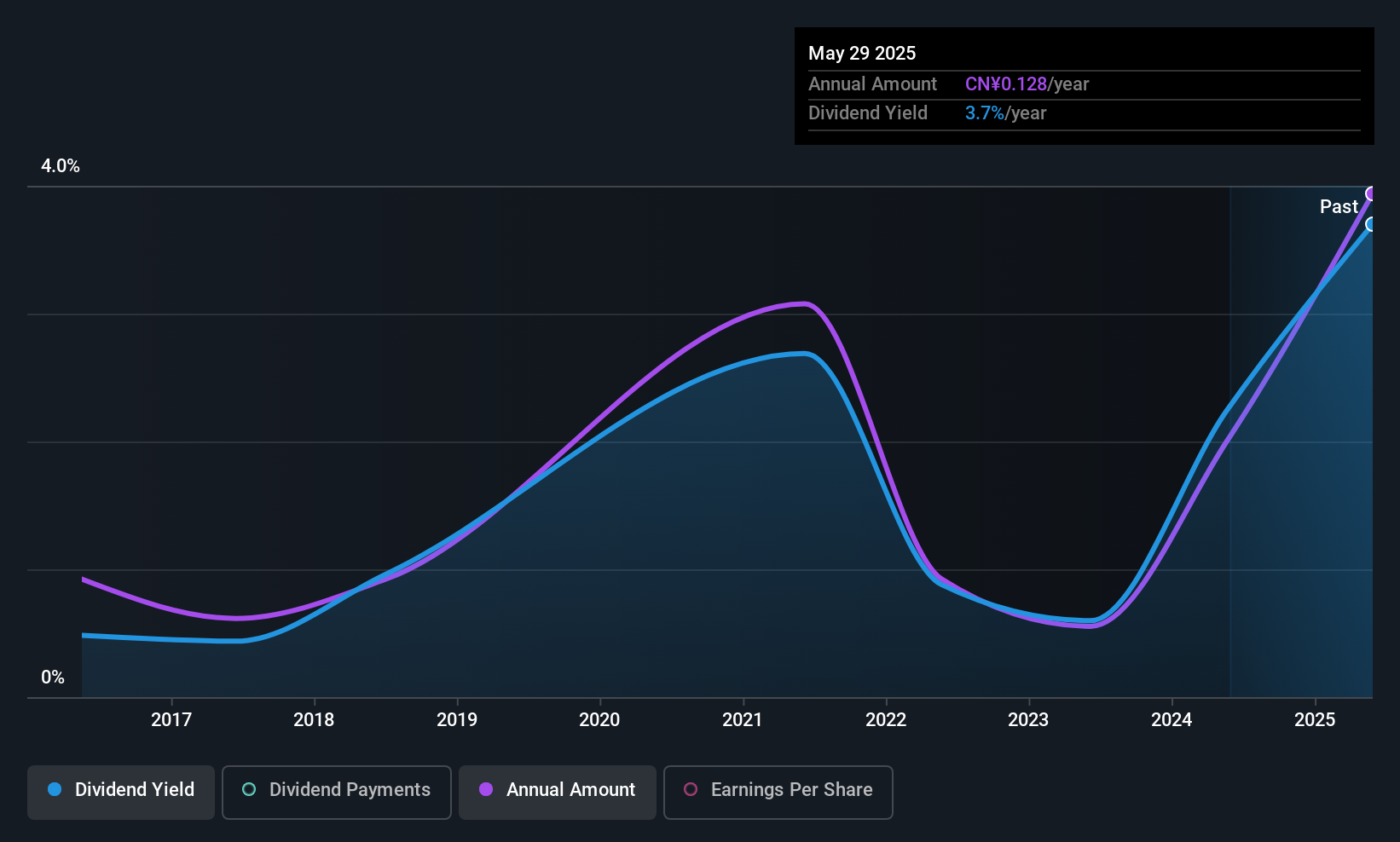

V V Food & BeverageLtd (SHSE:600300)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: V V Food & Beverage Co., Ltd is involved in the research, development, production, and sale of food and beverage products both in China and internationally, with a market cap of CN¥5.85 billion.

Operations: V V Food & Beverage Co., Ltd generates its revenue through the research, development, production, and sale of food and beverage products across domestic and international markets.

Dividend Yield: 3.5%

V V Food & Beverage Ltd's dividend yield ranks in the top 25% of China's market, supported by a sustainable earnings payout ratio of 51.1% and a low cash payout ratio of 24.8%. However, its dividend history is marked by volatility and unreliability over the past decade. Recent earnings show stability with net income at CNY 241.25 million for the nine months ending September 2025, despite declining sales compared to last year.

- Dive into the specifics of V V Food & BeverageLtd here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of V V Food & BeverageLtd shares in the market.

Where To Now?

- Take a closer look at our Top Asian Dividend Stocks list of 1038 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600300

V V Food & BeverageLtd

Engages in the research, development, production, and sale of food and beverage products in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives