Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies. Lenovo Group Limited (HKG:992) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Lenovo Group

What Is Lenovo Group's Debt?

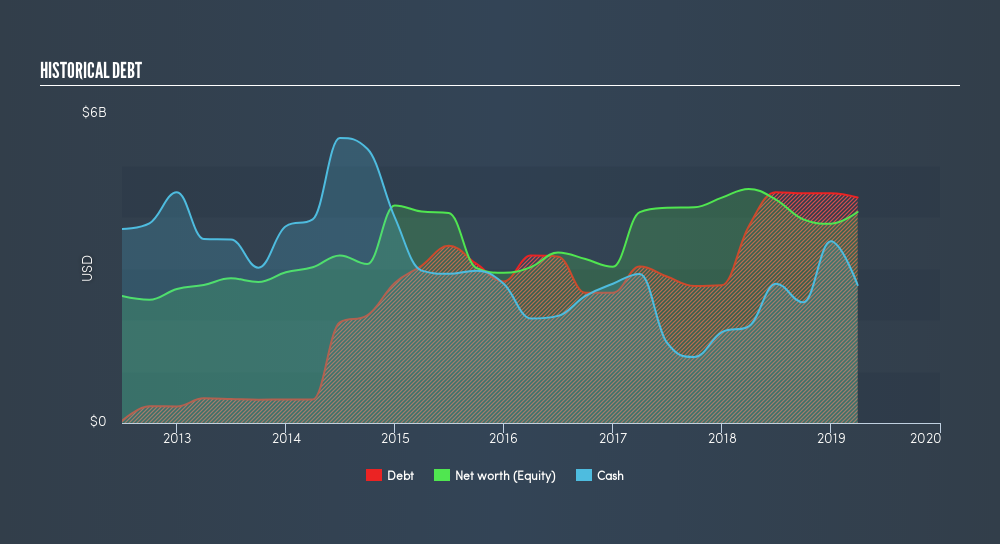

As you can see below, at the end of March 2019, Lenovo Group had US$4.38b of debt, up from US$3.82b a year ago. Click the image for more detail. However, it also had US$2.68b in cash, and so its net debt is US$1.70b.

How Healthy Is Lenovo Group's Balance Sheet?

We can see from the most recent balance sheet that Lenovo Group had liabilities of US$20.5b falling due within a year, and liabilities of US$5.40b due beyond that. Offsetting this, it had US$2.68b in cash and US$9.48b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$13.7b.

Given this deficit is actually higher than the company's market capitalization of US$9.31b, we think shareholders really should watch Lenovo Group's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. Either way, since Lenovo Group does have more debt than cash, it's worth keeping an eye on its balance sheet.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Looking at its net debt to EBITDA of 0.99 and interest cover of 5.04 times, it seems to us that Lenovo Group is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Importantly, Lenovo Group grew its EBIT by 48% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Lenovo Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Lenovo Group's free cash flow amounted to 36% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Neither Lenovo Group's ability to handle its total liabilities nor its conversion of EBIT to free cash flow gave us confidence in its ability to take on more debt. But its EBIT growth rate tells a very different story, and suggests some resilience. Taking the abovementioned factors together we do think Lenovo Group's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. Given our hesitation about the stock, it would be good to know if Lenovo Group insiders have sold any shares recently. You click here to find out if insiders have sold recently.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:992

Lenovo Group

An investment holding company, develops, manufactures, and markets technology products and services.

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives