- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:8205

We're Hopeful That Shanghai Jiaoda Withub Information Industrial (HKG:8205) Will Use Its Cash Wisely

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Shanghai Jiaoda Withub Information Industrial (HKG:8205) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Shanghai Jiaoda Withub Information Industrial

Does Shanghai Jiaoda Withub Information Industrial Have A Long Cash Runway?

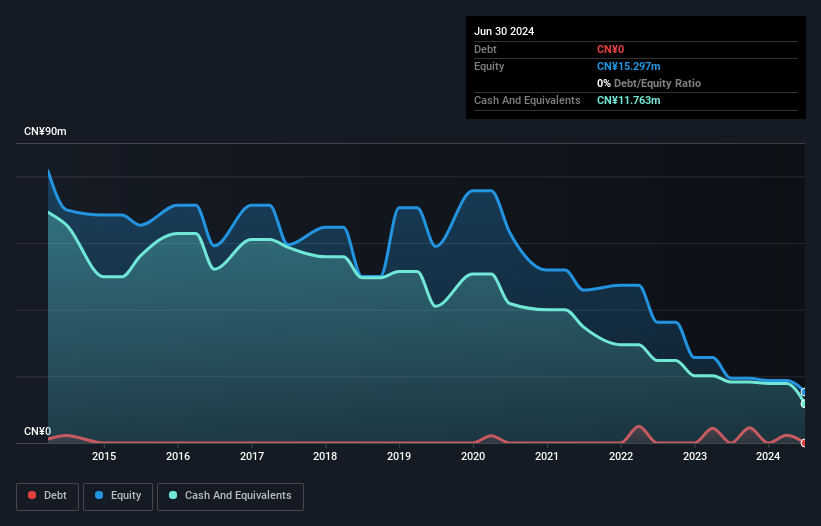

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at June 2024, Shanghai Jiaoda Withub Information Industrial had cash of CN¥12m and no debt. Importantly, its cash burn was CN¥4.7m over the trailing twelve months. So it had a cash runway of about 2.5 years from June 2024. Arguably, that's a prudent and sensible length of runway to have. The image below shows how its cash balance has been changing over the last few years.

How Well Is Shanghai Jiaoda Withub Information Industrial Growing?

Happily, Shanghai Jiaoda Withub Information Industrial is travelling in the right direction when it comes to its cash burn, which is down 63% over the last year. And it could also show revenue growth of 10% in the same period. We think it is growing rather well, upon reflection. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Shanghai Jiaoda Withub Information Industrial has developed its business over time by checking this visualization of its revenue and earnings history.

How Easily Can Shanghai Jiaoda Withub Information Industrial Raise Cash?

While Shanghai Jiaoda Withub Information Industrial seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Shanghai Jiaoda Withub Information Industrial's cash burn of CN¥4.7m is about 2.4% of its CN¥197m market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

So, Should We Worry About Shanghai Jiaoda Withub Information Industrial's Cash Burn?

As you can probably tell by now, we're not too worried about Shanghai Jiaoda Withub Information Industrial's cash burn. For example, we think its cash burn relative to its market cap suggests that the company is on a good path. Its weak point is its revenue growth, but even that wasn't too bad! Looking at all the measures in this article, together, we're not worried about its rate of cash burn, which seems to be under control. Taking a deeper dive, we've spotted 3 warning signs for Shanghai Jiaoda Withub Information Industrial you should be aware of, and 2 of them are potentially serious.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8205

Shanghai Jiaoda Withub Information Industrial

Engages in development and provision of business application solutions and application software services in the People’s Republic of China.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success