- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:8051

CircuTech International Holdings Limited's (HKG:8051) Stock On An Uptrend: Could Fundamentals Be Driving The Momentum?

CircuTech International Holdings' (HKG:8051) stock is up by a considerable 14% over the past month. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. Specifically, we decided to study CircuTech International Holdings' ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for CircuTech International Holdings

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for CircuTech International Holdings is:

7.2% = HK$10.0m ÷ HK$139m (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every HK$1 of its shareholder's investments, the company generates a profit of HK$0.07.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of CircuTech International Holdings' Earnings Growth And 7.2% ROE

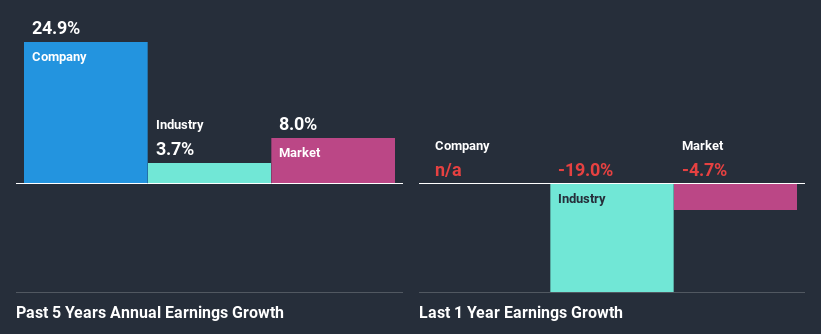

At first glance, CircuTech International Holdings' ROE doesn't look very promising. However, given that the company's ROE is similar to the average industry ROE of 7.7%, we may spare it some thought. Moreover, we are quite pleased to see that CircuTech International Holdings' net income grew significantly at a rate of 25% over the last five years. Taking into consideration that the ROE is not particularly high, we reckon that there could also be other factors at play which could be influencing the company's growth. For instance, the company has a low payout ratio or is being managed efficiently.

As a next step, we compared CircuTech International Holdings' net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 3.7%.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about CircuTech International Holdings''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is CircuTech International Holdings Making Efficient Use Of Its Profits?

Summary

In total, it does look like CircuTech International Holdings has some positive aspects to its business. Despite its low rate of return, the fact that the company reinvests a very high portion of its profits into its business, no doubt contributed to its high earnings growth. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. To know the 1 risk we have identified for CircuTech International Holdings visit our risks dashboard for free.

When trading CircuTech International Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8051

CircuTech International Holdings

An investment holding company, engages in sale and distribution of IT products, and provision of repair and other support services for IT products in Hong Kong, Japan, the United States, Australia, and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026