Shareholders in IRICO Group New Energy (HKG:438) have lost 84%, as stock drops 13% this past week

While not a mind-blowing move, it is good to see that the IRICO Group New Energy Company Limited (HKG:438) share price has gained 10% in the last three months. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 84% in that time. So it sure is nice to see a bit of an improvement. Only time will tell if the company can sustain the turnaround. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

With the stock having lost 13% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for IRICO Group New Energy

IRICO Group New Energy wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, IRICO Group New Energy grew revenue at 18% per year. That's a pretty good rate of top-line growth. So it seems unlikely the 23% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

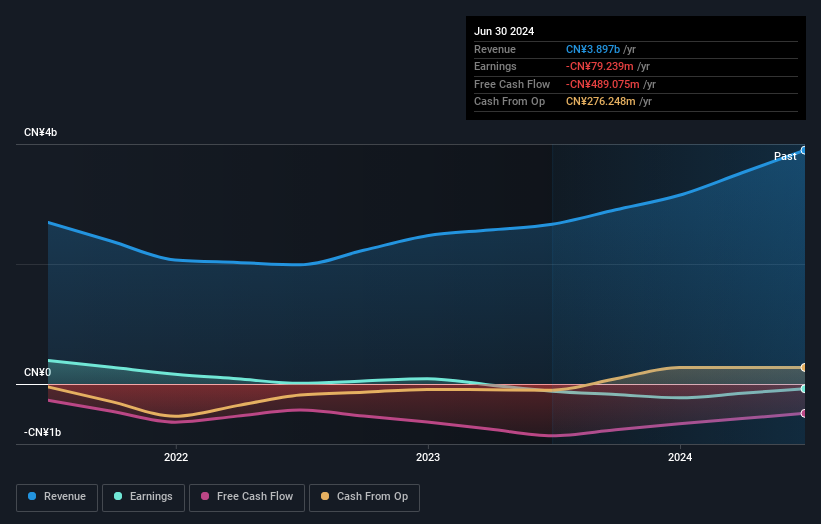

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

IRICO Group New Energy shareholders are up 13% for the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 11% per year, over five years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for IRICO Group New Energy you should be aware of, and 1 of them shouldn't be ignored.

Of course IRICO Group New Energy may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:438

IRICO Group New Energy

Engages in the research and development, manufacturing, and sale of solar photovoltaic glass in the People’s Republic of China.

Adequate balance sheet and slightly overvalued.