- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3969

China Railway Signal & Communication (SEHK:3969) Net Margin Rises, Reinforcing Profit Stability Narrative

Reviewed by Simply Wall St

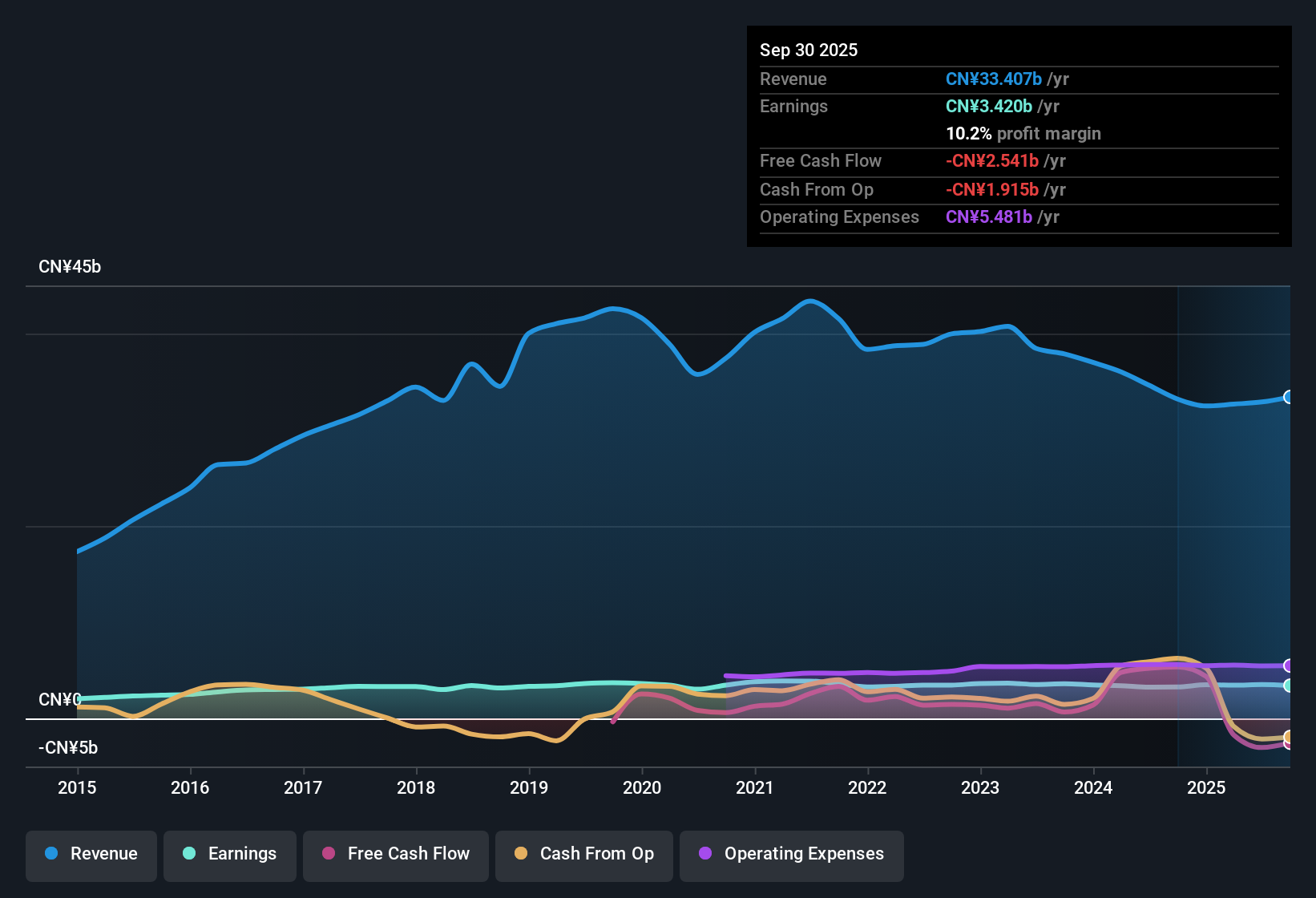

China Railway Signal & Communication (SEHK:3969) reported net profit margins of 10.2%, up from last year’s 9.9%, as earnings rose 4.6% over the past year. This marks a notable improvement compared to the company’s average annual decline of 1.6% over the past five years. Revenue is forecast to grow at 5.2% per year, which trails behind the broader Hong Kong market’s expected 8.6% pace. High quality earnings and better profitability define this reporting period, helping to shape near-term investor sentiment amid a cautious growth outlook.

See our full analysis for China Railway Signal & Communication.Next, we’ll see how these latest results hold up against the market’s dominant narratives and what surprises may be in store for investors.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Climbs to 10.2%

- Profit margins reached 10.2%, a step up from last year's 9.9%, signaling that China Railway Signal & Communication is holding on to more earnings per dollar of revenue even as industry-wide cost pressures persist.

- This margin improvement fits with the prevailing market view that the company's alignment with state-backed rail and infrastructure projects is helping stabilize profitability.

- Recent earnings resilience illustrates how participation in long-term government contracts and rail modernization efforts acts as a buffer against sector swings.

- While bulls often expect even stronger gains, the actual step up may moderate expectations about how much the company can expand margins purely through cost discipline.

Valuation Discount Versus Industry Peers

- The company’s price-to-earnings ratio of 10x stands out against both the Hong Kong electronic industry average (15.4x) and a peer group average (16.8x), suggesting investors are paying less per unit of earnings.

- Prevailing analysis points to this valuation as a reward for patient investors.

- A lower multiple heavily supports the view that the current share price (HK$3.54) offers a margin of safety compared to the sector, even though it is above the DCF fair value of HK$3.06.

- Such a discount may reflect tempered expectations for future growth, but also positions the stock as relatively attractive if market sentiment turns positive on infrastructure names.

Growth Trailing Market’s Pace

- Revenue is forecast to grow 5.2% annually, which lags significantly behind the Hong Kong market's 8.6% projected rate.

- Market watchers focusing on policy-driven stability caution that slower growth could cap near-term upside.

- Muted revenue acceleration contrasts with the sector’s overall faster growth, meaning the company must rely more on profitability and consistent orders to strengthen its case.

- Yet, the steadiness in margins and improved earnings year-over-year provides a partial counterweight to these growth concerns and keeps sentiment from turning negative despite below-average top-line expansion.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on China Railway Signal & Communication's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While China Railway Signal & Communication is boosting margins, its revenue growth falls short of both peers and the broader Hong Kong market’s brisk pace.

If you’re aiming for stronger upside, consider high growth potential stocks screener (62 results) targeting established companies that are positioned for robust earnings growth in the next few years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3969

China Railway Signal & Communication

Provides rail transportation control system solutions in China and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives