- Hong Kong

- /

- Tech Hardware

- /

- SEHK:3315

These 4 Measures Indicate That Goldpac Group (HKG:3315) Is Using Debt Safely

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Goldpac Group Limited (HKG:3315) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Goldpac Group

What Is Goldpac Group's Debt?

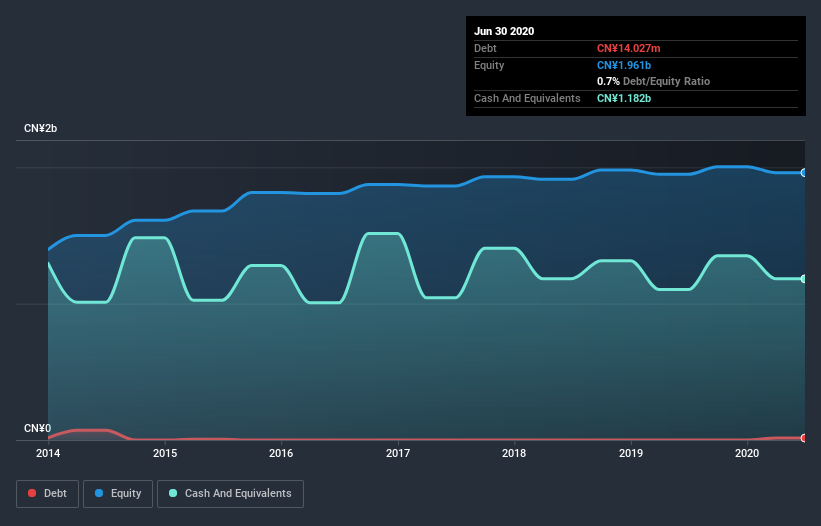

You can click the graphic below for the historical numbers, but it shows that as of June 2020 Goldpac Group had CN¥14.0m of debt, an increase on none, over one year. However, it does have CN¥1.18b in cash offsetting this, leading to net cash of CN¥1.17b.

A Look At Goldpac Group's Liabilities

Zooming in on the latest balance sheet data, we can see that Goldpac Group had liabilities of CN¥496.4m due within 12 months and liabilities of CN¥37.5m due beyond that. On the other hand, it had cash of CN¥1.18b and CN¥446.8m worth of receivables due within a year. So it can boast CN¥1.09b more liquid assets than total liabilities.

This luscious liquidity implies that Goldpac Group's balance sheet is sturdy like a giant sequoia tree. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Simply put, the fact that Goldpac Group has more cash than debt is arguably a good indication that it can manage its debt safely.

On the other hand, Goldpac Group's EBIT dived 11%, over the last year. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. There's no doubt that we learn most about debt from the balance sheet. But it is Goldpac Group's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Goldpac Group may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Goldpac Group actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

While we empathize with investors who find debt concerning, the bottom line is that Goldpac Group has net cash of CN¥1.17b and plenty of liquid assets. And it impressed us with free cash flow of CN¥143m, being 108% of its EBIT. So is Goldpac Group's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - Goldpac Group has 2 warning signs (and 1 which is concerning) we think you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Goldpac Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3315

Goldpac Group

An investment holding company, provides embedded software, secure payment products, and smart financial self-service kiosks in the Mainland China and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives