- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

High Growth Tech Stocks In Hong Kong For October 2024

Reviewed by Simply Wall St

As global markets experience fluctuations, with the Hang Seng Index in Hong Kong recently witnessing a significant decline of 6.53%, investors are keenly observing the high-growth tech sector for potential opportunities amidst broader market challenges. In such an environment, identifying stocks that demonstrate robust innovation and adaptability to economic conditions can be crucial for navigating the complexities of today's financial landscape.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Innovent Biologics | 21.74% | 59.60% | ★★★★★☆ |

| Akeso | 33.44% | 53.00% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

BYD Electronic (International) (SEHK:285)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Electronic (International) Company Limited is an investment holding company that focuses on the design, manufacture, assembly, and sale of mobile handset components and modules both in China and internationally, with a market capitalization of approximately HK$73 billion.

Operations: The company generates revenue primarily from the manufacture, assembly, and sale of mobile handset components and modules, totaling CN¥152.36 billion. Its operations span both domestic and international markets.

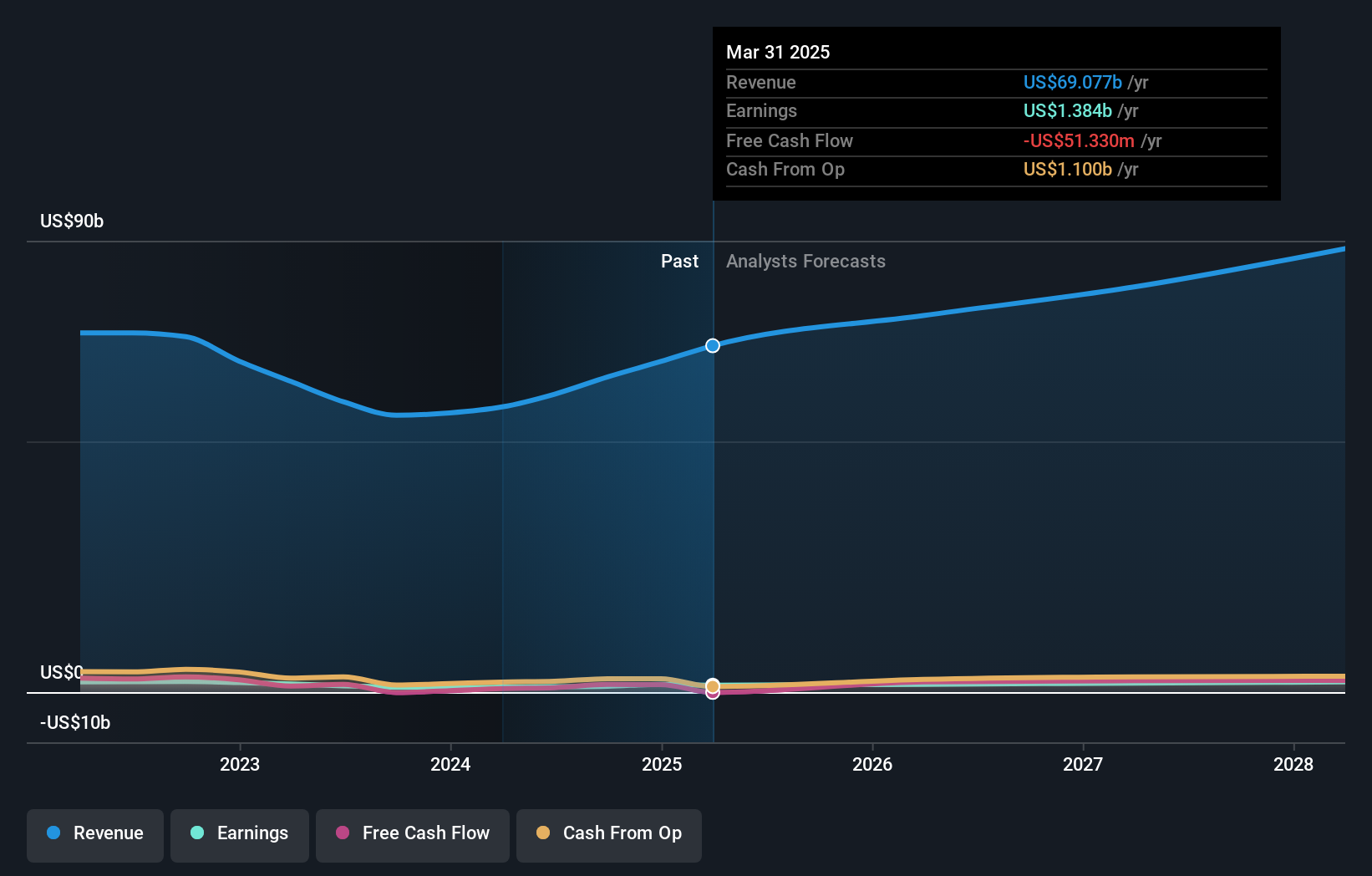

BYD Electronic (International) has demonstrated robust growth, with earnings surging by 47.6% over the past year, significantly outpacing the Communications industry's -14.5% performance. This growth is underpinned by a projected annual earnings increase of 24.9%, well above Hong Kong’s market average of 12.1%. The company's commitment to innovation is evident in its R&D investments, which have strategically driven these financial outcomes and solidified its competitive edge in high-tech sectors. Recent events further underscore BYD Electronic's proactive market stance; notably, their presentation at the Macquarie Asia TMT Conference highlighted strategic initiatives poised to capitalize on emerging tech trends. Despite a forecasted modest Return on Equity of 16.8% in three years, their operational agility and substantial revenue growth—expected at 12% annually—suggest a resilient adaptation to dynamic market demands, positioning them favorably for future technological advancements and sector shifts.

FIT Hon Teng (SEHK:6088)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited is a company that manufactures and sells mobile and wireless devices and connectors both in Taiwan and internationally, with a market capitalization of approximately HK$20.41 billion.

Operations: The company generates revenue primarily from consumer products and intermediate products, with the latter contributing significantly more at $3.94 billion compared to $690.95 million for consumer products.

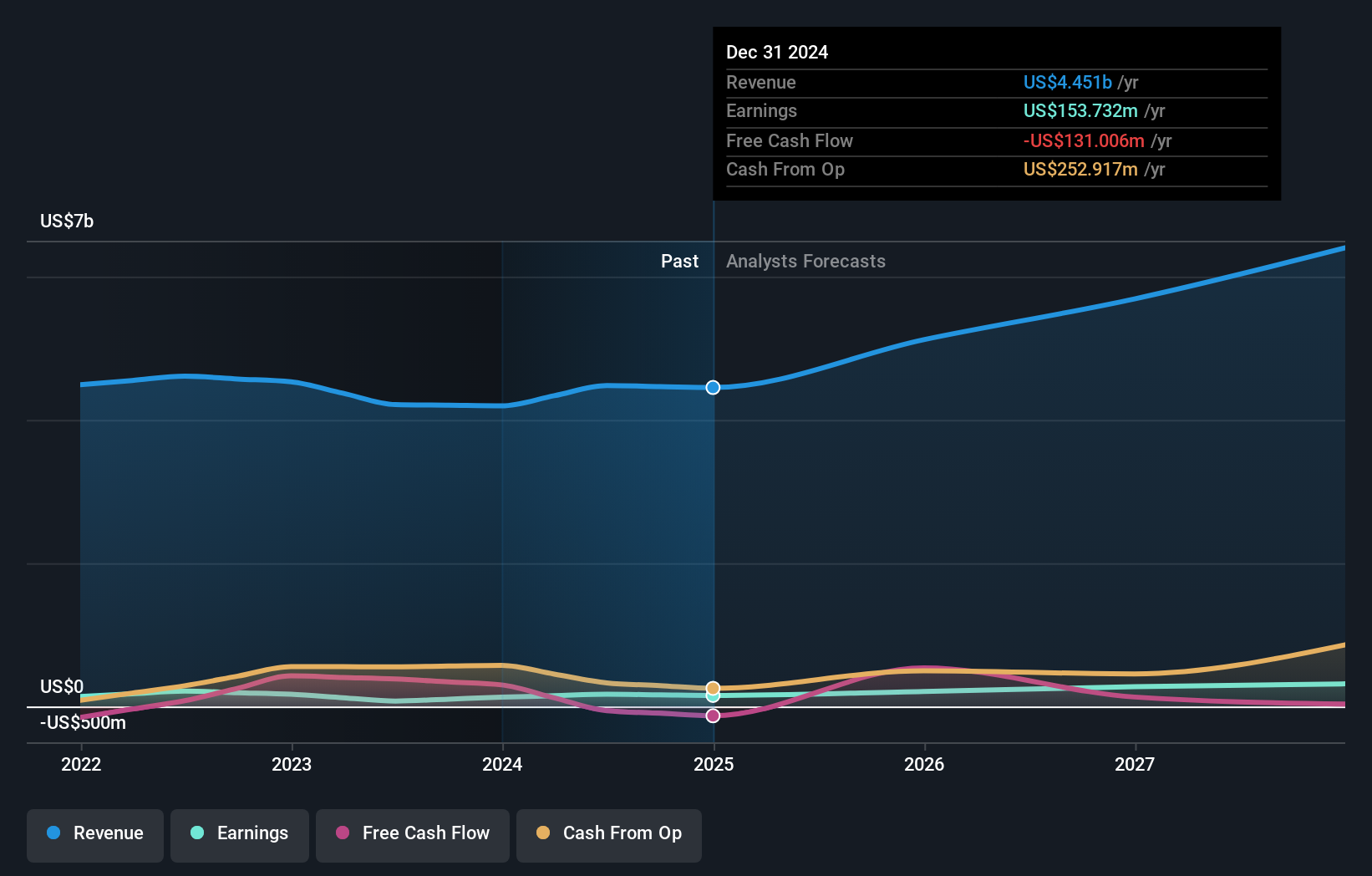

FIT Hon Teng's recent performance underscores its growth trajectory, with a significant turnaround from a net loss of USD 8.95 million to a net income of USD 32.52 million in the first half of 2024. This recovery is mirrored by an impressive sales increase from USD 1,784.08 million to USD 2,066.76 million over the same period. The company's commitment to R&D is evident as it continues to allocate substantial resources towards innovation—crucial for sustaining its competitive edge in the fast-evolving tech landscape of Hong Kong. Despite challenges in maintaining high Return on Equity, which is projected at just 10.9% over three years, FIT Hon Teng’s revenue growth forecast at an annual rate of 18.4% positions it well above Hong Kong’s market average growth rate of 7.3%. This suggests potential for ongoing market share gains and robust financial health if current trends persist.

- Unlock comprehensive insights into our analysis of FIT Hon Teng stock in this health report.

Understand FIT Hon Teng's track record by examining our Past report.

Lenovo Group (SEHK:992)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services with a market capitalization of HK$135.46 billion.

Operations: The company's revenue is primarily driven by its Intelligent Devices Group (IDG), which accounts for $45.76 billion, followed by the Infrastructure Solutions Group (ISG) at $10.17 billion and the Solutions and Services Group (SSG) at $7.64 billion.

Lenovo Group's commitment to innovation is evident from its R&D spending, which has been a significant part of its strategy to stay competitive in the tech industry. In 2024, Lenovo allocated 7.9% of its revenue towards R&D efforts, underscoring its focus on developing cutting-edge technologies such as AI-optimized devices for enhanced productivity and collaboration. This investment aligns with the company's recent launch of the ThinkSmart Core Gen 2, an AI-driven device designed to improve video conferencing efficiencies—a testament to Lenovo’s push towards smarter technology solutions in a rapidly evolving market. Additionally, with expected revenue growth at 7.9% annually—slightly above Hong Kong's average—Lenovo is strategically positioning itself to capture more market share while enhancing its product offerings through substantial technological advancements.

- Take a closer look at Lenovo Group's potential here in our health report.

Evaluate Lenovo Group's historical performance by accessing our past performance report.

Seize The Opportunity

- Dive into all 43 of the SEHK High Growth Tech and AI Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Excellent balance sheet and good value.