Stock Analysis

- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:700

Exploring High Growth Tech Stocks In Hong Kong October 2024

Reviewed by Simply Wall St

As global markets navigate a complex economic landscape, Hong Kong's tech sector remains a focal point, with the Hang Seng Index recently experiencing fluctuations amidst broader market sentiment and economic indicators. In this context, identifying high-growth tech stocks involves assessing companies' potential to innovate and adapt to evolving technological trends while considering their resilience in the face of current market dynamics.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 23.28% | 38.76% | ★★★★★☆ |

| RemeGen | 26.23% | 52.03% | ★★★★★☆ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Innovent Biologics | 22.00% | 59.21% | ★★★★★☆ |

| Akeso | 33.50% | 53.28% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.61% | 7.62% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

BYD Electronic (International) (SEHK:285)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Electronic (International) Company Limited focuses on the design, manufacture, assembly, and sale of mobile handset components and modules both in China and globally, with a market capitalization of approximately HK$74.24 billion.

Operations: The company generates revenue primarily through the manufacture, assembly, and sale of mobile handset components and modules, amounting to CN¥152.36 billion. With a market capitalization of approximately HK$74.24 billion, it operates both within China and internationally.

Amid a dynamic tech landscape, BYD Electronic (International) stands out with its robust earnings growth of 47.6% over the past year, surpassing the Communications industry's decline of 14.5%. This performance is underpinned by significant investment in innovation, as evidenced by its R&D expenses which are pivotal to sustaining its competitive edge. The company's recent financial results reflect a strong trajectory with sales jumping from CNY 56.18 billion to CNY 78.58 billion and maintaining stable net income around CNY 1.52 billion. Looking forward, BYD Electronic is poised for continued growth with earnings expected to surge by approximately 24.9% annually, outpacing the Hong Kong market's average of 12.2%. This forecast aligns with their strategic presentations at high-profile events like the Macquarie Asia TMT Conference, signaling ongoing momentum and potential for future advancements in technology sectors critical to Hong Kong’s high-growth ecosystem.

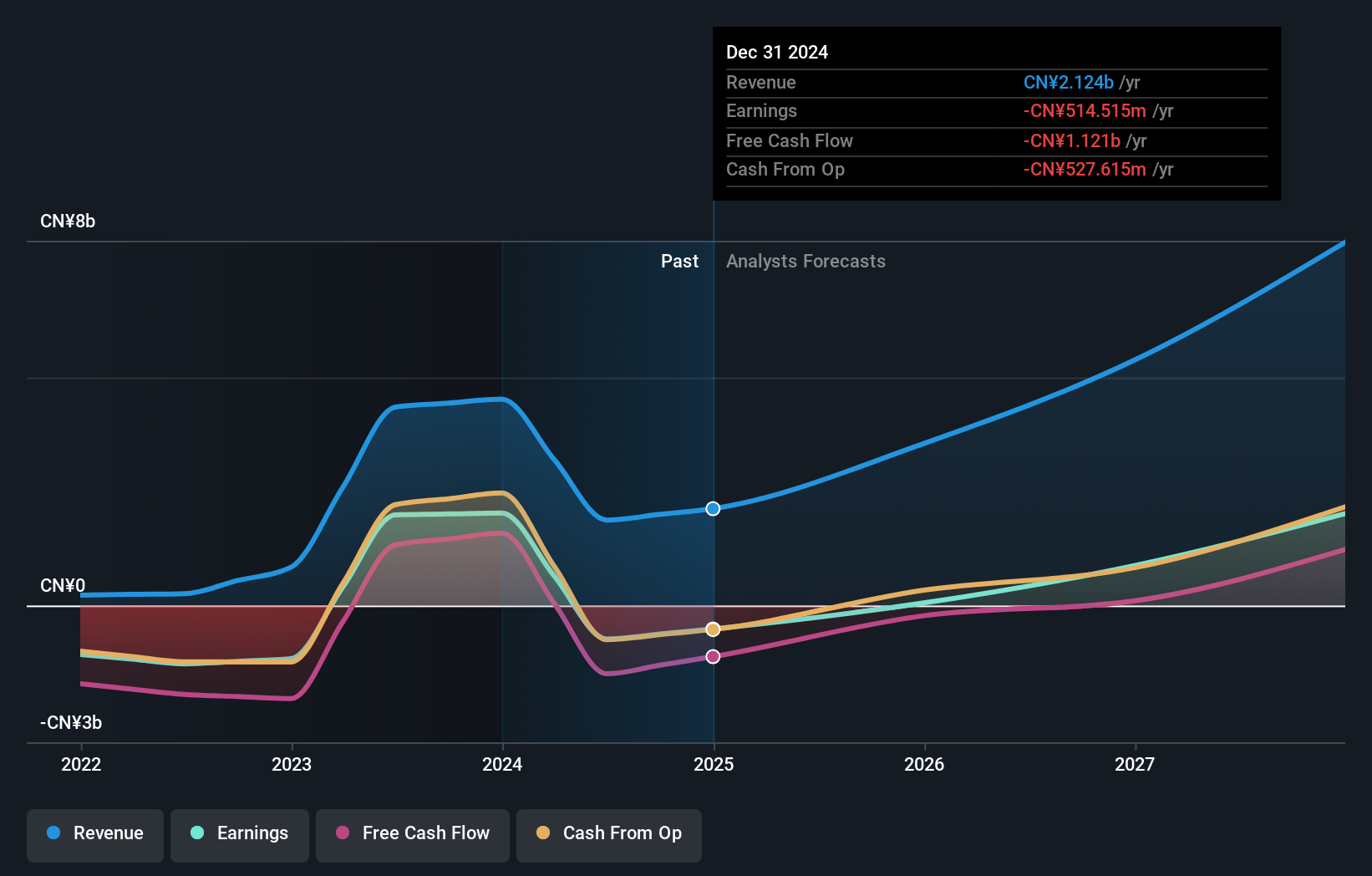

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited is an investment holding company that provides value-added services, online advertising, fintech, and business services both in China and globally, with a market capitalization of approximately HK$3.88 trillion.

Operations: Tencent generates revenue primarily from Value-Added Services (VAS), online advertising, and fintech and business services, with VAS contributing the largest share at CN¥302.28 billion. Online advertising and fintech and business services follow with revenues of CN¥111.89 billion and CN¥209.17 billion, respectively.

Tencent Holdings, amidst swirling M&A rumors with Ubisoft, is not just expanding its gaming empire but also demonstrating robust financial health. With a revenue growth forecast at 8.2% per year, it outpaces the Hong Kong market average of 7.4%. This is complemented by an anticipated earnings growth of 12.9% annually, reflecting strong operational efficiency and market adaptation. The firm's commitment to innovation is evident from its R&D expenses which notably contribute to sustaining competitive advantage in the fast-evolving tech sector. Recent financial disclosures reveal substantial increases in both revenue and net income, underscoring Tencent’s capacity to leverage its broad multimedia and entertainment portfolio effectively despite broader market challenges.

- Click here and access our complete health analysis report to understand the dynamics of Tencent Holdings.

Evaluate Tencent Holdings' historical performance by accessing our past performance report.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of antibody drugs with a market capitalization of HK$60.76 billion.

Operations: The company generates revenue primarily through the research, development, production, and sale of biopharmaceutical products, amounting to CN¥1.87 billion.

Akeso, a burgeoning force in Hong Kong's tech landscape, recently reported a striking 33.5% annual revenue growth, surpassing the local market's 7.4% average. This growth trajectory is bolstered by its innovative R&D initiatives which have led to significant clinical advancements such as the cadonilimab regimen for cervical cancer, showing promise with a 53.3% forecasted annual earnings increase. The company also successfully raised HKD 1.94 billion through an equity offering, underscoring investor confidence and providing capital to fuel further research and expansion efforts in biotechnology—a sector ripe with potential for breakthrough therapies and substantial returns.

Next Steps

- Embark on your investment journey to our 43 SEHK High Growth Tech and AI Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:700

Tencent Holdings

An investment holding company, offers value-added services (VAS), online advertising, fintech, and business services in the People’s Republic of China and internationally.