- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2498

Robosense Technology (SEHK:2498) Eyes Growth with ADAS LiDAR Success and AI Chip Development

Reviewed by Simply Wall St

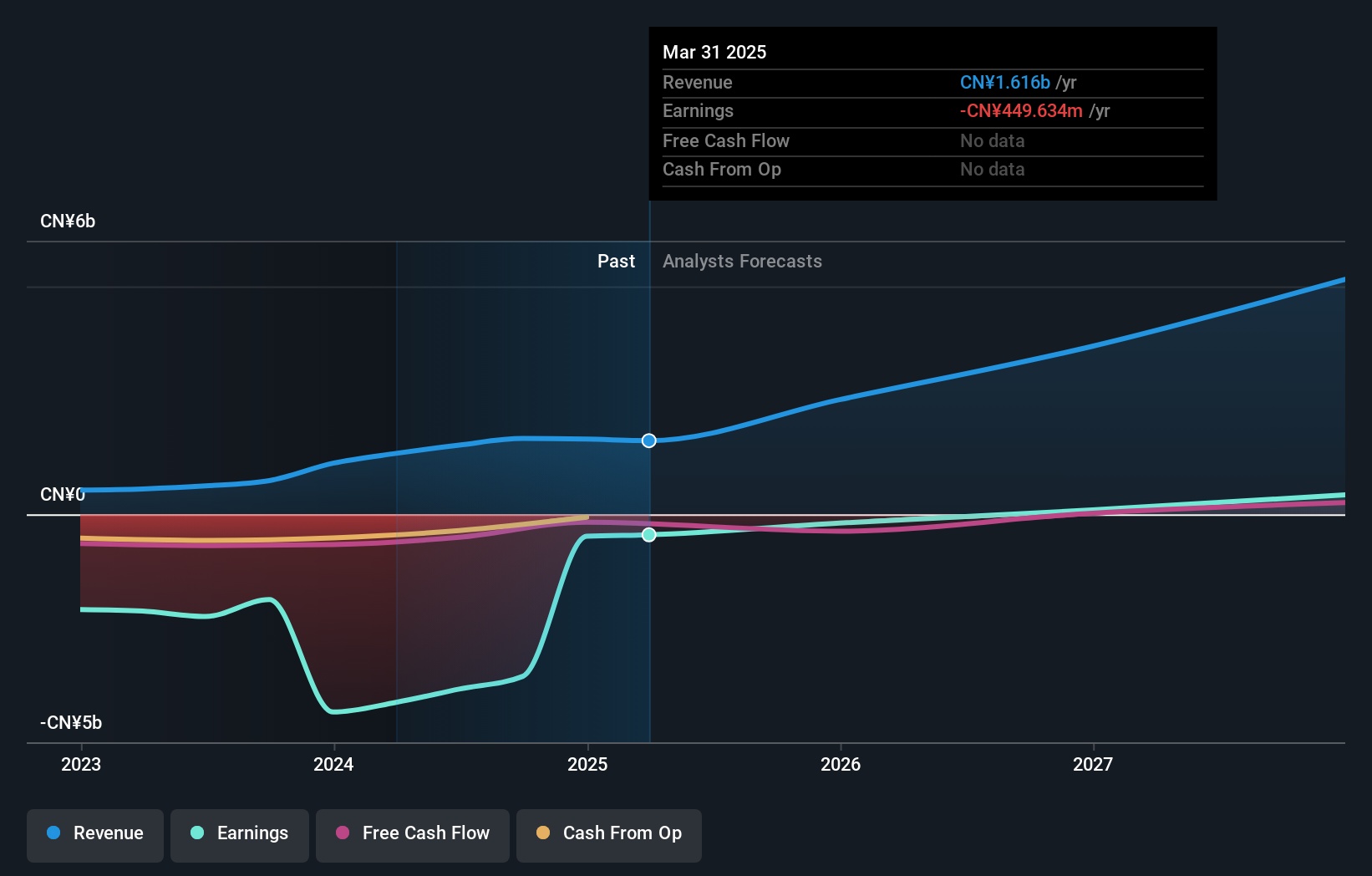

Robosense Technology (SEHK:2498) has recently reported a remarkable 54.7% increase in revenue for Q3 2024, driven by a strong performance in ADAS LiDAR product sales, which surged by 87.1% year-on-year. Despite these gains, the company faces challenges such as continued unprofitability and declining gross margins, compounded by a volatile share price and increased operational costs. The following report explores these key areas, including the company's financial stability, market opportunities, and competitive pressures.

Click to explore a detailed breakdown of our findings on Robosense Technology.

Core Advantages Driving Sustained Success for Robosense Technology

Robosense Technology has demonstrated impressive revenue growth, with total revenue reaching RMB 407.9 million in Q3 2024, marking a 54.7% increase from the previous year. This growth is largely driven by the sales of their ADAS LiDAR products, which saw a significant year-on-year increase of 87.1%, as highlighted by Wing Kee Lau, CFO. The company’s debt-free status further enhances its financial stability, allowing it to focus on expansion and innovation without the burden of interest payments. Additionally, the company is trading at a significant discount to its estimated fair value, which could reflect a strong market position despite being seen as expensive relative to industry peers. These factors collectively position Robosense well for sustained success in the competitive market.

Internal Limitations Hindering Robosense Technology's Growth

Despite the impressive revenue figures, Robosense Technology faces challenges, such as being currently unprofitable and projected to remain so for the next three years. The decrease in the average selling price of ADAS LiDAR products, from RMB 3,300 to RMB 2,500 per unit, partially offsets the benefits of increased sales volume. This situation is compounded by a negative return on equity of -122.26%, indicating inefficiencies in generating profit from shareholders' equity. The company also struggles with increasing losses over the past five years, highlighting operational inefficiencies that need addressing to align with industry standards.

Emerging Markets Or Trends for Robosense Technology

There are promising opportunities for Robosense Technology, particularly in the expansion of ADAS applications. The company is capitalizing on the growing demand for automotive-grade solid-state LiDAR, which supports higher levels of autonomous driving. Furthermore, the recruitment of additional R&D personnel specialized in AI and proprietary chip development signifies a strategic move to enhance product offerings and maintain a competitive edge. Trading at 64.2% below estimated fair value suggests potential for price appreciation, aligning with the forecasted revenue growth that exceeds market averages.

Competitive Pressures and Market Risks Facing Robosense Technology

The company faces threats from a highly volatile share price over the past three months, which could undermine investor confidence. Additionally, a decrease in high-margin projects has led to a decline in gross margins, from 70.8% to 59.6%, as noted in the latest earnings call. This decline is primarily due to a reduction in reference solution projects, which traditionally offer higher margins. Moreover, the increased cost of sales, rising by 39.9% to RMB 336.7 million, exerts further pressure on profitability, challenging the company to manage costs effectively while navigating competitive pressures.

See what the latest analyst reports say about Robosense Technology's future prospects and potential market movements.

Conclusion

Robosense Technology's impressive revenue growth, driven by the success of its ADAS LiDAR products, underscores its potential for sustained success, especially given its debt-free status which allows for strategic expansion and innovation. However, challenges such as unprofitability and declining average selling prices highlight the need for operational efficiencies to improve profitability, particularly as the company faces increased costs and competitive pressures. The company's strategic investments in R&D for AI and proprietary chip development position it well to capitalize on emerging trends in autonomous driving. Trading at a significant discount to its estimated fair value, despite a higher Price-To-Sales ratio compared to peers, suggests a potential for price appreciation, provided Robosense can effectively navigate its internal limitations and market risks.

Next Steps

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2498

Robosense Technology

An investment holding company, provides LiDAR and perception solutions in the People’s Republic of China and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives