- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2363

Is Tongda Hong Tai Holdings (HKG:2363) Using Debt In A Risky Way?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Tongda Hong Tai Holdings Limited (HKG:2363) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Tongda Hong Tai Holdings

How Much Debt Does Tongda Hong Tai Holdings Carry?

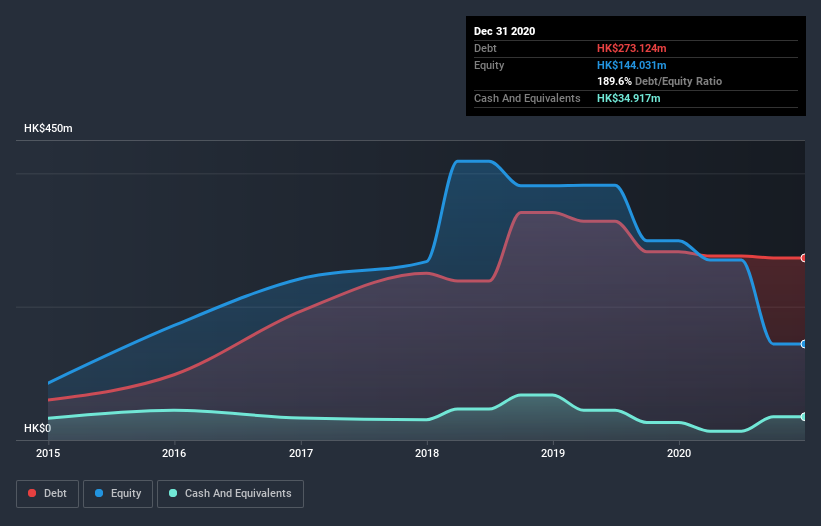

As you can see below, Tongda Hong Tai Holdings had HK$273.1m of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of HK$34.9m, its net debt is less, at about HK$238.2m.

A Look At Tongda Hong Tai Holdings' Liabilities

Zooming in on the latest balance sheet data, we can see that Tongda Hong Tai Holdings had liabilities of HK$458.7m due within 12 months and liabilities of HK$9.14m due beyond that. On the other hand, it had cash of HK$34.9m and HK$242.5m worth of receivables due within a year. So it has liabilities totalling HK$190.5m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the HK$70.9m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Tongda Hong Tai Holdings would probably need a major re-capitalization if its creditors were to demand repayment. There's no doubt that we learn most about debt from the balance sheet. But it is Tongda Hong Tai Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Tongda Hong Tai Holdings had a loss before interest and tax, and actually shrunk its revenue by 11%, to HK$472m. That's not what we would hope to see.

Caveat Emptor

While Tongda Hong Tai Holdings's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable HK$157m at the EBIT level. If you consider the significant liabilities mentioned above, we are extremely wary of this investment. Of course, it may be able to improve its situation with a bit of luck and good execution. Nevertheless, we would not bet on it given that it lost HK$165m in just last twelve months, and it doesn't have much by way of liquid assets. So while it's not wise to assume the company will fail, we do think it's risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Tongda Hong Tai Holdings has 3 warning signs (and 2 which don't sit too well with us) we think you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Tongda Hong Tai Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tongda Hong Tai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2363

Tongda Hong Tai Holdings

An investment holding company, engages in the manufacture and sale of casings for laptops, notebooks, and tablets in Mainland China.

Moderate risk with questionable track record.

Market Insights

Community Narratives