- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2239

Some Confidence Is Lacking In SMIT Holdings Limited (HKG:2239) As Shares Slide 27%

SMIT Holdings Limited (HKG:2239) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 54% loss during that time.

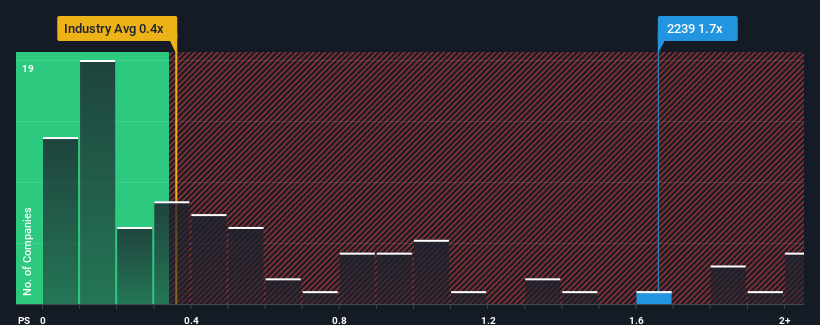

In spite of the heavy fall in price, given close to half the companies operating in Hong Kong's Electronic industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider SMIT Holdings as a stock to potentially avoid with its 1.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for SMIT Holdings

What Does SMIT Holdings' P/S Mean For Shareholders?

For instance, SMIT Holdings' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for SMIT Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, SMIT Holdings would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. The last three years don't look nice either as the company has shrunk revenue by 43% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 23% shows it's an unpleasant look.

With this in mind, we find it worrying that SMIT Holdings' P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does SMIT Holdings' P/S Mean For Investors?

SMIT Holdings' P/S remain high even after its stock plunged. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that SMIT Holdings currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 2 warning signs for SMIT Holdings that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2239

SMIT Holdings

Designs, develops, and markets security devices primarily for pay TV broadcasting access worldwide.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success