- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2038

Exploring 3 Undiscovered Gems in Asia for Savvy Investors

Reviewed by Simply Wall St

As global markets grapple with fluctuating consumer sentiment and economic uncertainties, Asia's stock markets present a unique landscape where easing trade tensions and strategic pragmatism are fostering renewed investor interest. In this environment, identifying stocks that exhibit strong fundamentals and resilience can be particularly rewarding for investors seeking opportunities in the region's dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| VICOM | NA | 6.95% | 4.06% | ★★★★★★ |

| AzureWave Technologies | 4.84% | -0.95% | 13.13% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Shenyang Yuanda Intellectual Industry GroupLtd | NA | 9.86% | 33.52% | ★★★★★★ |

| Advancetek EnterpriseLtd | 57.48% | 28.66% | 48.38% | ★★★★★☆ |

| Daewon Cable | 23.95% | 7.90% | 48.06% | ★★★★★☆ |

| MNtech | 66.79% | 12.39% | -12.13% | ★★★★★☆ |

| Qijing Machinery | 38.27% | 3.10% | -2.56% | ★★★★☆☆ |

| Aurora OptoelectronicsLtd | 4.59% | -12.12% | 20.63% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

FIH Mobile (SEHK:2038)

Simply Wall St Value Rating: ★★★★★★

Overview: FIH Mobile Limited is an investment holding company that offers integrated manufacturing services for the global handset industry, with a market cap of approximately HK$14.96 billion.

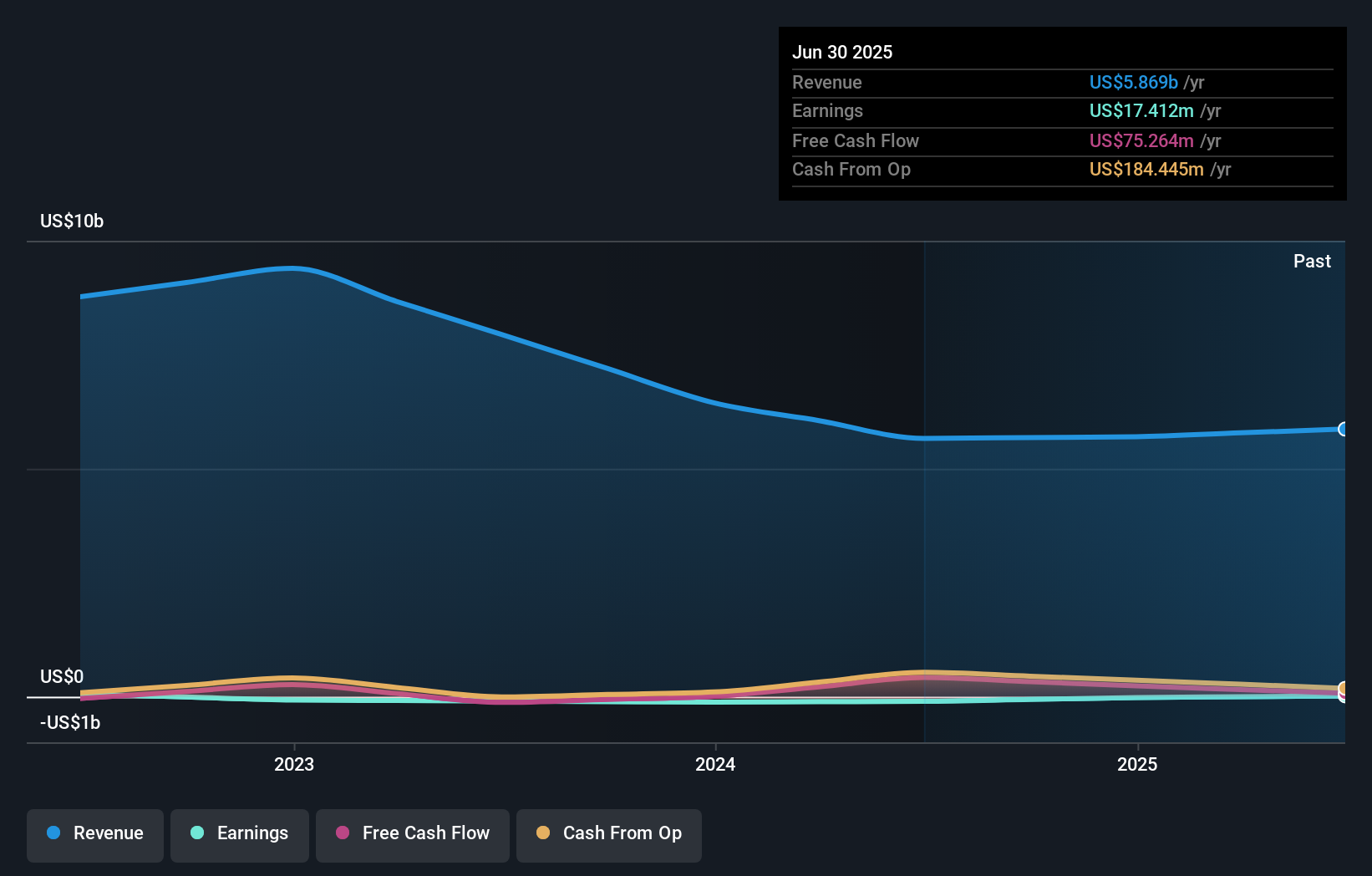

Operations: FIH Mobile generates revenue primarily from its integrated manufacturing services, with significant contributions from Asia ($2.38 billion), America ($1.99 billion), and Europe ($1.50 billion).

FIH Mobile has shown a significant reduction in its debt to equity ratio from 44.3% to 8.7% over the past five years, indicating improved financial health. This company has become profitable this year, outpacing the electronics industry's growth rate of 9%. With high-quality earnings and more cash than total debt, FIH Mobile's financial stability seems solid. Recent leadership changes could bring fresh perspectives with Philip Huang's appointment as chairman, given his extensive experience in corporate management and digital transformation across various industries. These factors position FIH Mobile well for potential future growth within its sector.

- Click here and access our complete health analysis report to understand the dynamics of FIH Mobile.

Explore historical data to track FIH Mobile's performance over time in our Past section.

Tiangong International (SEHK:826)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tiangong International Company Limited, along with its subsidiaries, is engaged in the manufacturing and sale of alloy steel, cutting tools, titanium alloys, and related products with a market capitalization of HK$8.91 billion.

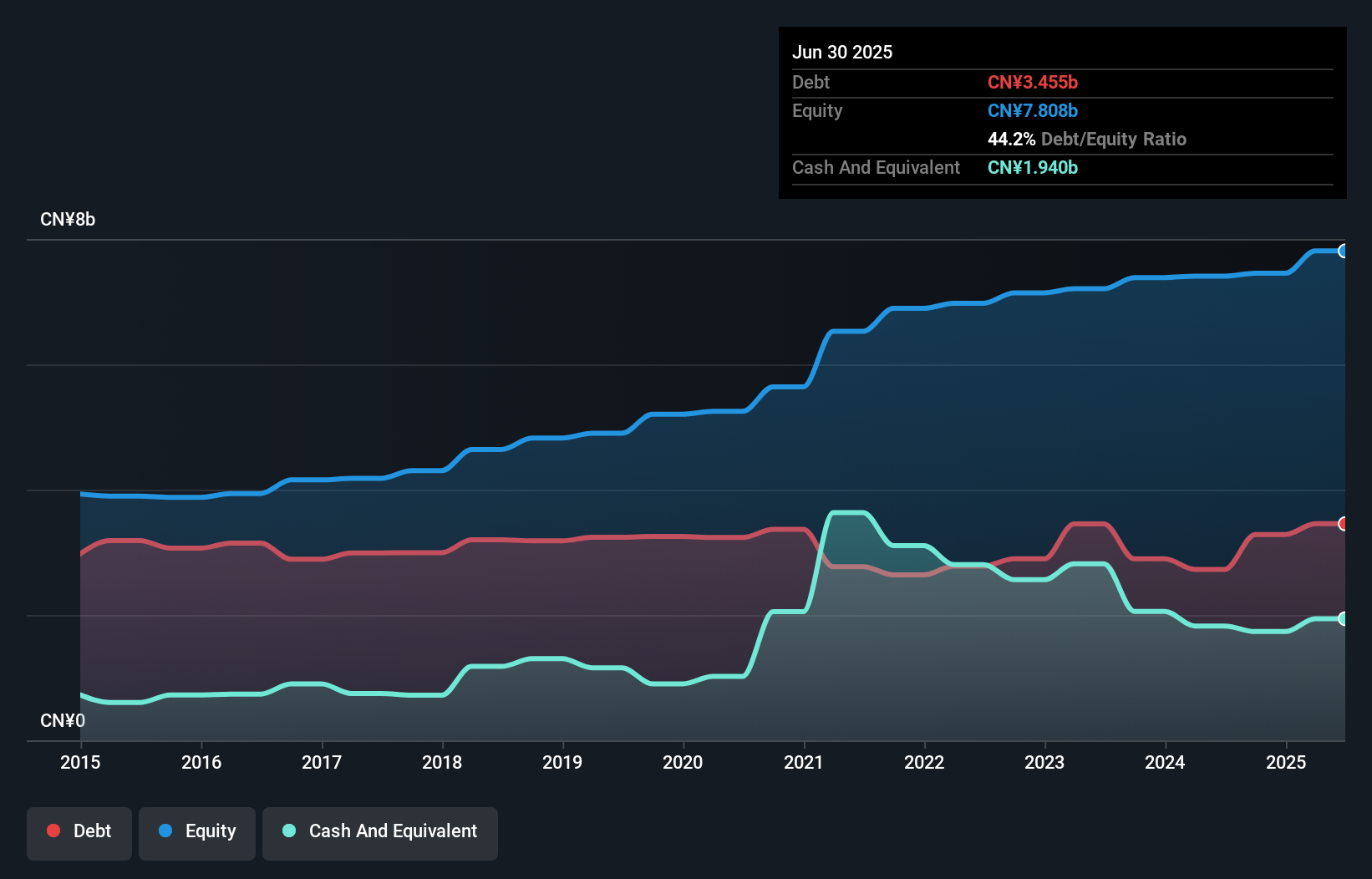

Operations: The company generates revenue primarily from the sale of die steel (CN¥2.25 billion), high-speed steel (CN¥1.04 billion), cutting tools (CN¥818.48 million), and titanium alloys (CN¥720.32 million).

Tiangong International, a niche player in the metals and mining sector, has seen a reduction in its debt to equity ratio from 61.6% to 44.2% over five years, signaling improved financial leverage. Despite its earnings growth of 12.5% lagging behind the industry’s 29.6%, the company remains profitable with satisfactory net debt to equity at 19.4%. Recently, it secured an unsecured HK$78 million loan facility for dividends, reflecting strategic financial maneuvers amidst challenges like interest coverage by EBIT at just 2.5x—below ideal levels—while maintaining high-quality earnings and robust free cash flow generation.

Walton Advanced Engineering (TWSE:8110)

Simply Wall St Value Rating: ★★★★★☆

Overview: Walton Advanced Engineering, Inc. operates in Taiwan and China, offering semiconductor packaging and testing services, with a market capitalization of NT$19.37 billion.

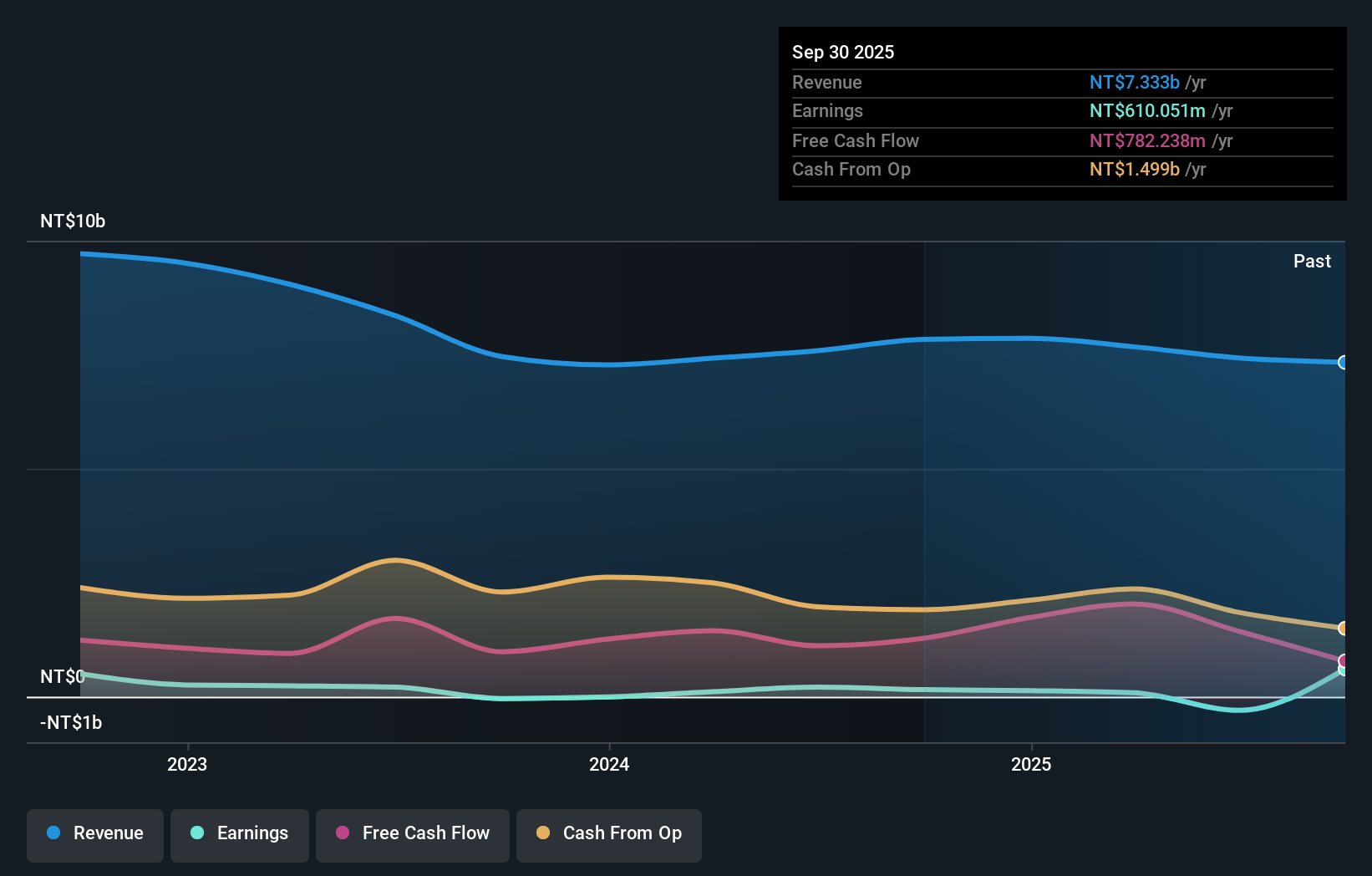

Operations: The company generates revenue primarily from semiconductor packaging and testing services. Its financial performance is highlighted by a net profit margin of 6.5%, indicating the efficiency in converting revenue into actual profit.

Walton Advanced Engineering, a notable player in the semiconductor space, has shown remarkable resilience despite facing challenges. Over the past year, earnings surged by 298%, outpacing the industry average of -2%. The company reported a net income of NT$871.76 million for Q3 2025, turning around from a net loss of NT$39.1 million last year. Its debt to equity ratio improved significantly from 38.9% to 16.3% over five years, indicating better financial health. However, earnings have declined by an average of 18% annually over five years due to large one-off losses like NT$188 million impacting recent results.

- Take a closer look at Walton Advanced Engineering's potential here in our health report.

Learn about Walton Advanced Engineering's historical performance.

Where To Now?

- Take a closer look at our Asian Undiscovered Gems With Strong Fundamentals list of 2448 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2038

FIH Mobile

An investment holding company, provides integrated manufacturing services for the handset industry worldwide.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives