- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:700

High Growth Tech Stocks In Hong Kong Featuring AAC Technologies Holdings And 2 More

Reviewed by Simply Wall St

As global markets continue to recover from recent sell-offs, with the technology-heavy Nasdaq Composite leading gains, investor sentiment is cautiously optimistic about high-growth tech stocks. In this favorable environment, identifying strong tech stocks in Hong Kong like AAC Technologies Holdings can be pivotal for capturing growth potential.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.71% | 25.80% | ★★★★★☆ |

| Be Friends Holding | 33.82% | 32.27% | ★★★★★★ |

| Inspur Digital Enterprise Technology | 21.83% | 38.02% | ★★★★★☆ |

| RemeGen | 27.04% | 57.55% | ★★★★★☆ |

| iDreamSky Technology Holdings | 29.81% | 104.11% | ★★★★★★ |

| Cowell e Holdings | 30.91% | 34.80% | ★★★★★★ |

| Innovent Biologics | 21.21% | 50.78% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.35% | 100.10% | ★★★★★☆ |

| Beijing Fourth Paradigm Technology | 20.08% | 104.53% | ★★★★★☆ |

| Beijing Airdoc Technology | 31.64% | 83.90% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

AAC Technologies Holdings (SEHK:2018)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AAC Technologies Holdings Inc. is an investment holding company that provides solutions for smart devices across various regions including Mainland China, Hong Kong, Taiwan, other Asian countries, the United States, and Europe, with a market cap of HK$34.82 billion.

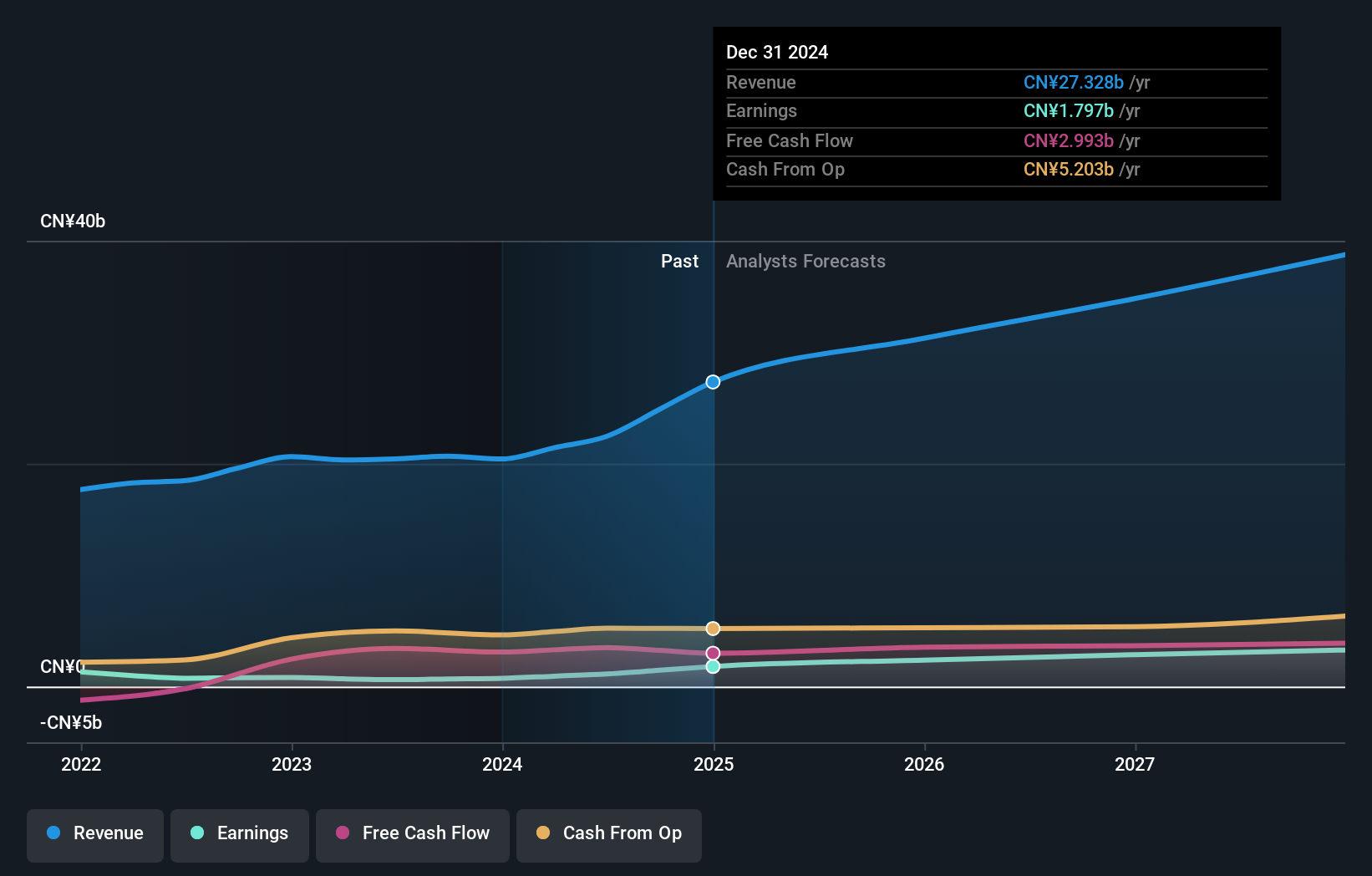

Operations: AAC Technologies Holdings generates revenue primarily from five segments: Acoustics Products (CN¥7.50 billion), Electromagnetic Drives and Precision Mechanics (CN¥8.25 billion), Optics Products (CN¥3.63 billion), Sensor and Semiconductor Products (CN¥1.03 billion), and Other Products (CN¥22.78 million).

AAC Technologies Holdings, a prominent player in the tech sector, is poised for substantial growth with its earnings forecasted to increase by 23.7% annually. Despite a recent 9.9% decline in past year earnings, the company's revenue is expected to grow at 12.1% per year, outpacing the Hong Kong market's average of 7.4%. With significant investments in R&D and a focus on innovation within its acoustic and optical segments, AAC aims to leverage these strengths for future expansion and stability. In recent developments, AAC announced a final dividend of HKD 0.10 per share for FY2023, reflecting strategic financial management despite challenging market conditions. The company also repurchased shares in the latest fiscal year as part of its capital allocation strategy aimed at enhancing shareholder value. As software firms increasingly shift towards SaaS models ensuring recurring subscription revenue streams, AAC's commitment to R&D expenditure underscores its dedication to maintaining technological leadership and competitive edge within this dynamic industry landscape.

- Unlock comprehensive insights into our analysis of AAC Technologies Holdings stock in this health report.

Gain insights into AAC Technologies Holdings' past trends and performance with our Past report.

Sunny Optical Technology (Group) (SEHK:2382)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunny Optical Technology (Group) Company Limited, with a market cap of HK$49.19 billion, is an investment holding company that designs, researches, develops, manufactures, and sells optical and optical-related products as well as scientific instruments.

Operations: Sunny Optical Technology (Group) generates revenue primarily from three segments: Optical Components (CN¥11.03 billion), Optoelectronic Products (CN¥21.64 billion), and Optical Instruments (CN¥629.22 million). The company's focus on these segments highlights its expertise in optical and optoelectronic technologies.

Sunny Optical Technology (Group) has demonstrated a remarkable recovery in the smartphone market, with profits for the first half of 2024 expected to surge by approximately 140% to 150%, reaching RMB 1.05 billion to RMB 1.09 billion. This impressive growth is driven by an improved product mix and higher average selling prices, leading to increased shipment volumes of handset lens sets and camera modules. R&D expenses have been a focal point, with substantial investments contributing to technological advancements and competitive edge in optical components, ensuring sustained innovation in this dynamic industry.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited, an investment holding company, provides a range of services including value-added services (VAS), online advertising, fintech, and business services in China and globally, with a market cap of approximately HK$3.43 trillion.

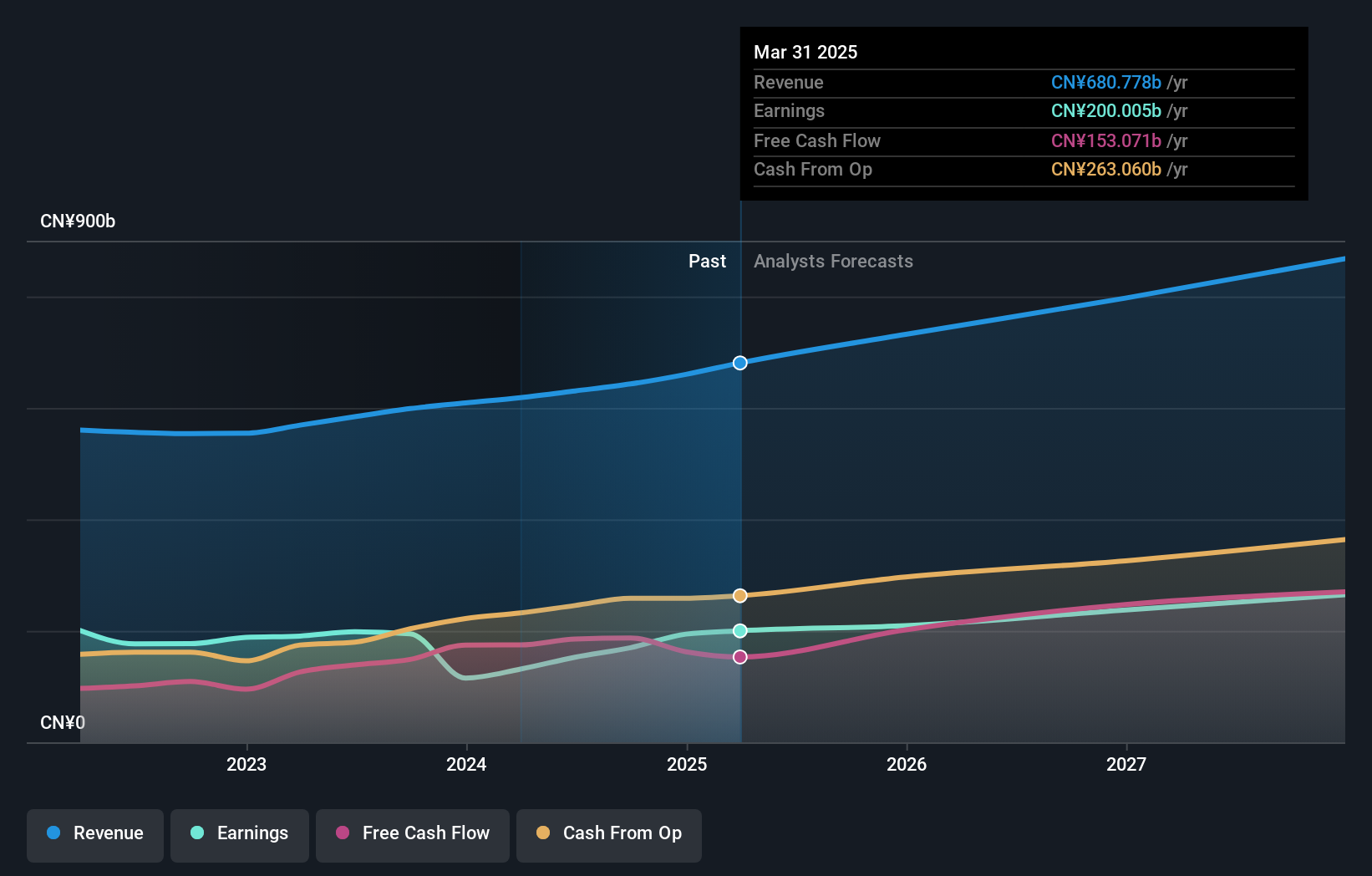

Operations: Tencent generates revenue primarily from value-added services (CN¥302.28 billion), fintech and business services (CN¥209.17 billion), and online advertising (CN¥111.89 billion). The company's diverse portfolio spans across digital entertainment, financial technology, and targeted advertising solutions both in China and internationally.

Tencent Holdings, a major player in the tech industry, has shown robust growth with forecasted earnings increasing by 12.7% per year. The company’s R&D expenses have been substantial, amounting to $3.5 billion in 2023, reflecting its commitment to innovation and technological advancements. Despite a negative earnings growth of -23% last year, Tencent's revenue is expected to grow at 8.3% annually, outpacing the Hong Kong market average of 7.4%. This focus on R&D and strategic investments positions Tencent well for sustained future growth in the competitive tech landscape.

Make It Happen

- Click through to start exploring the rest of the 43 SEHK High Growth Tech and AI Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:700

Tencent Holdings

An investment holding company, offers value-added services (VAS), online advertising, fintech, and business services in the People’s Republic of China and internationally.

Very undervalued with flawless balance sheet.