- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1710

Many Still Looking Away From Trio Industrial Electronics Group Limited (HKG:1710)

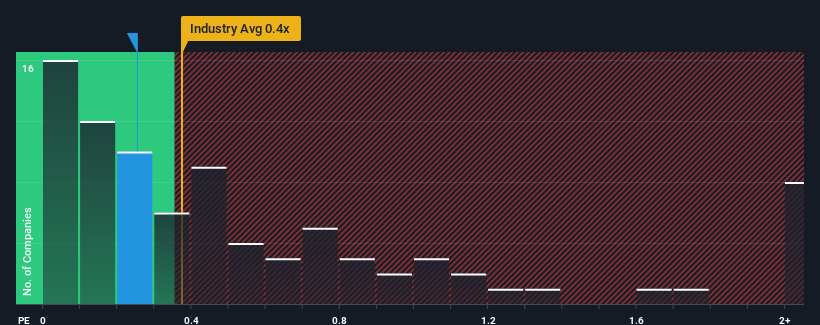

There wouldn't be many who think Trio Industrial Electronics Group Limited's (HKG:1710) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Electronic industry in Hong Kong is similar at about 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Trio Industrial Electronics Group

What Does Trio Industrial Electronics Group's P/S Mean For Shareholders?

Trio Industrial Electronics Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Trio Industrial Electronics Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Trio Industrial Electronics Group's earnings, revenue and cash flow.How Is Trio Industrial Electronics Group's Revenue Growth Trending?

In order to justify its P/S ratio, Trio Industrial Electronics Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 63% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 12% shows it's noticeably more attractive.

With this information, we find it interesting that Trio Industrial Electronics Group is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We didn't quite envision Trio Industrial Electronics Group's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Having said that, be aware Trio Industrial Electronics Group is showing 3 warning signs in our investment analysis, and 1 of those is significant.

If these risks are making you reconsider your opinion on Trio Industrial Electronics Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Trio Industrial Electronics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1710

Trio Industrial Electronics Group

An investment holding company, provides engineering and contract manufacturing services in the People's Republic of China, South-east Asia, North America, Europe, and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives