- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1478

Q Technology (Group) Company Limited's (HKG:1478) Stock Retreats 25% But Earnings Haven't Escaped The Attention Of Investors

Q Technology (Group) Company Limited (HKG:1478) shares have had a horrible month, losing 25% after a relatively good period beforehand. The good news is that in the last year, the stock has shone bright like a diamond, gaining 139%.

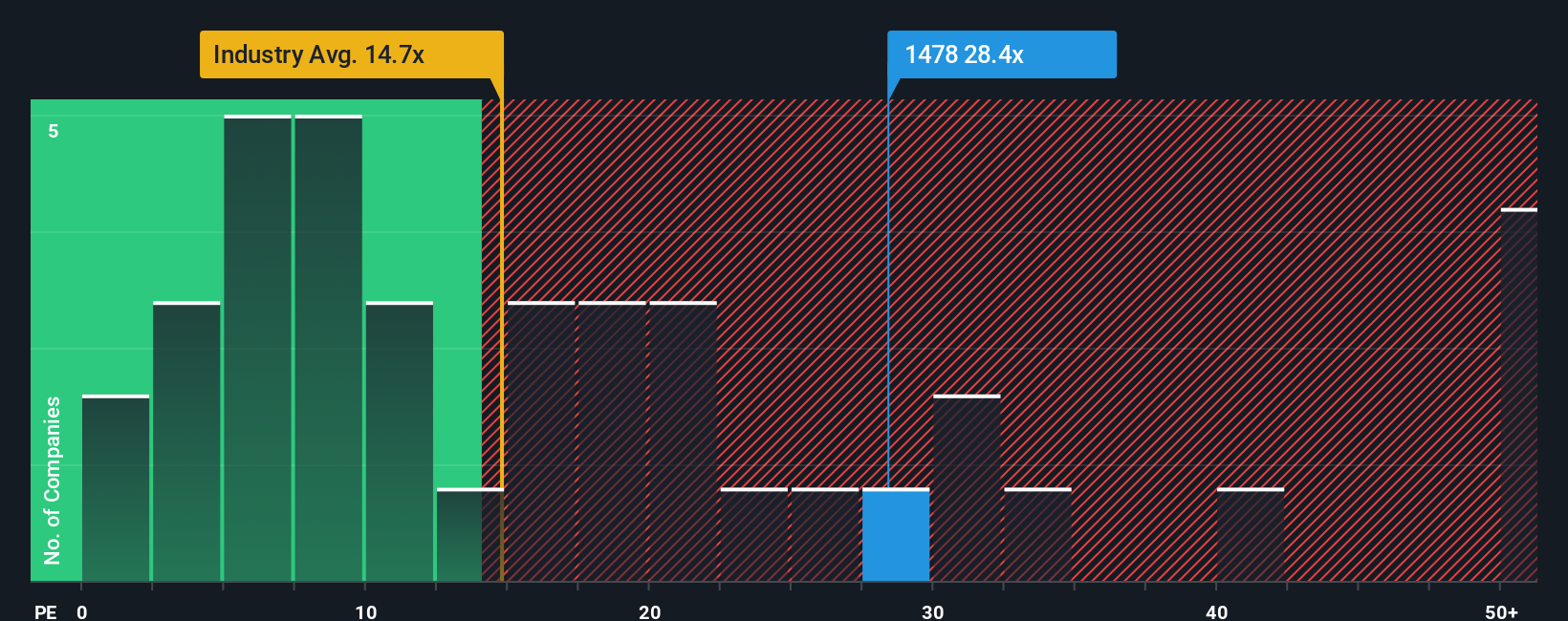

Even after such a large drop in price, Q Technology (Group) may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 28.4x, since almost half of all companies in Hong Kong have P/E ratios under 12x and even P/E's lower than 7x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Q Technology (Group) certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Q Technology (Group)

Is There Enough Growth For Q Technology (Group)?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Q Technology (Group)'s to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 167% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 27% each year during the coming three years according to the analysts following the company. With the market only predicted to deliver 15% per year, the company is positioned for a stronger earnings result.

With this information, we can see why Q Technology (Group) is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

A significant share price dive has done very little to deflate Q Technology (Group)'s very lofty P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Q Technology (Group)'s analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Q Technology (Group) with six simple checks.

If you're unsure about the strength of Q Technology (Group)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Q Technology (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1478

Q Technology (Group)

An investment holding company, engages in the design, research and development, manufacturing, and sale of camera and fingerprint recognition modules in the Mainland of China, Hong Kong, India, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives