- Hong Kong

- /

- Entertainment

- /

- SEHK:2400

High Growth Tech Stocks In Hong Kong To Watch This August 2024

Reviewed by Simply Wall St

As global markets continue to recover and investor sentiment improves, the Hong Kong tech sector has shown resilience and potential for high growth. In this context, identifying promising stocks involves looking at companies with strong innovation capabilities, solid financial health, and the ability to capitalize on emerging market trends.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.71% | 25.80% | ★★★★★☆ |

| Be Friends Holding | 33.82% | 32.27% | ★★★★★★ |

| MedSci Healthcare Holdings | 45.88% | 45.90% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 21.83% | 38.02% | ★★★★★☆ |

| iDreamSky Technology Holdings | 29.81% | 104.11% | ★★★★★★ |

| Cowell e Holdings | 30.96% | 35.72% | ★★★★★★ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Innovent Biologics | 21.21% | 50.78% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.35% | 100.10% | ★★★★★☆ |

| Beijing Airdoc Technology | 31.64% | 83.90% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Q Technology (Group) (SEHK:1478)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Q Technology (Group) Company Limited is an investment holding company involved in the design, research and development, manufacturing, and sale of camera and fingerprint recognition modules across Mainland China, Hong Kong, India, and internationally with a market cap of HK$5.92 billion.

Operations: The company generates revenue primarily from the sale of camera modules (CN¥13.79 billion) and fingerprint recognition modules (CN¥781.23 million). Camera modules form the bulk of its revenue stream.

Q Technology (Group) has shown remarkable growth, with earnings surging 583.8% over the past year, significantly outpacing the Electronic industry’s -7.2%. The company's revenue is forecasted to grow at 7.4% annually, aligning with market expectations in Hong Kong. Notably, Q Technology's R&D expenses have been substantial, contributing to their innovative edge; for instance, the firm reported CN¥7.68 billion in sales for H1 2024 compared to CN¥5.48 billion a year ago and net income of CN¥115 million versus CN¥21 million previously. The firm's camera modules and fingerprint recognition modules continue to drive sales volume—33 million units and 14 million units respectively in July alone—highlighting robust demand across its product lines. Despite a volatile share price recently, Q Technology's strategic focus on high-growth segments within tech positions it well for future advancements and profitability improvements as evidenced by their projected annual profit growth of 36%.

- Navigate through the intricacies of Q Technology (Group) with our comprehensive health report here.

Evaluate Q Technology (Group)'s historical performance by accessing our past performance report.

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Innovent Biologics, Inc. is a biopharmaceutical company that develops and commercializes monoclonal antibodies and other drug assets for oncology, ophthalmology, autoimmune, cardiovascular, and metabolic diseases in China with a market cap of approximately HK$70.79 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to CN¥6.21 billion. Innovent Biologics focuses on developing and commercializing monoclonal antibodies and other drug assets across multiple therapeutic areas in China.

Innovent Biologics has exhibited strong growth, with earnings forecasted to increase by 50.78% annually and revenue expected to grow at 21.2% per year, outpacing the Hong Kong market's 7.4%. The company’s R&D expenses are significant, reflecting its commitment to innovation; for instance, total product revenue in Q2 2024 exceeded ¥2 billion ($0.27 billion), marking a robust year-over-year growth of approximately 50%. Recent approvals of Dupert (fulzerasib) for advanced NSCLC and strategic partnerships in AI-driven drug discovery further underscore Innovent's dynamic approach in the biotech sector.

- Click here to discover the nuances of Innovent Biologics with our detailed analytical health report.

Examine Innovent Biologics' past performance report to understand how it has performed in the past.

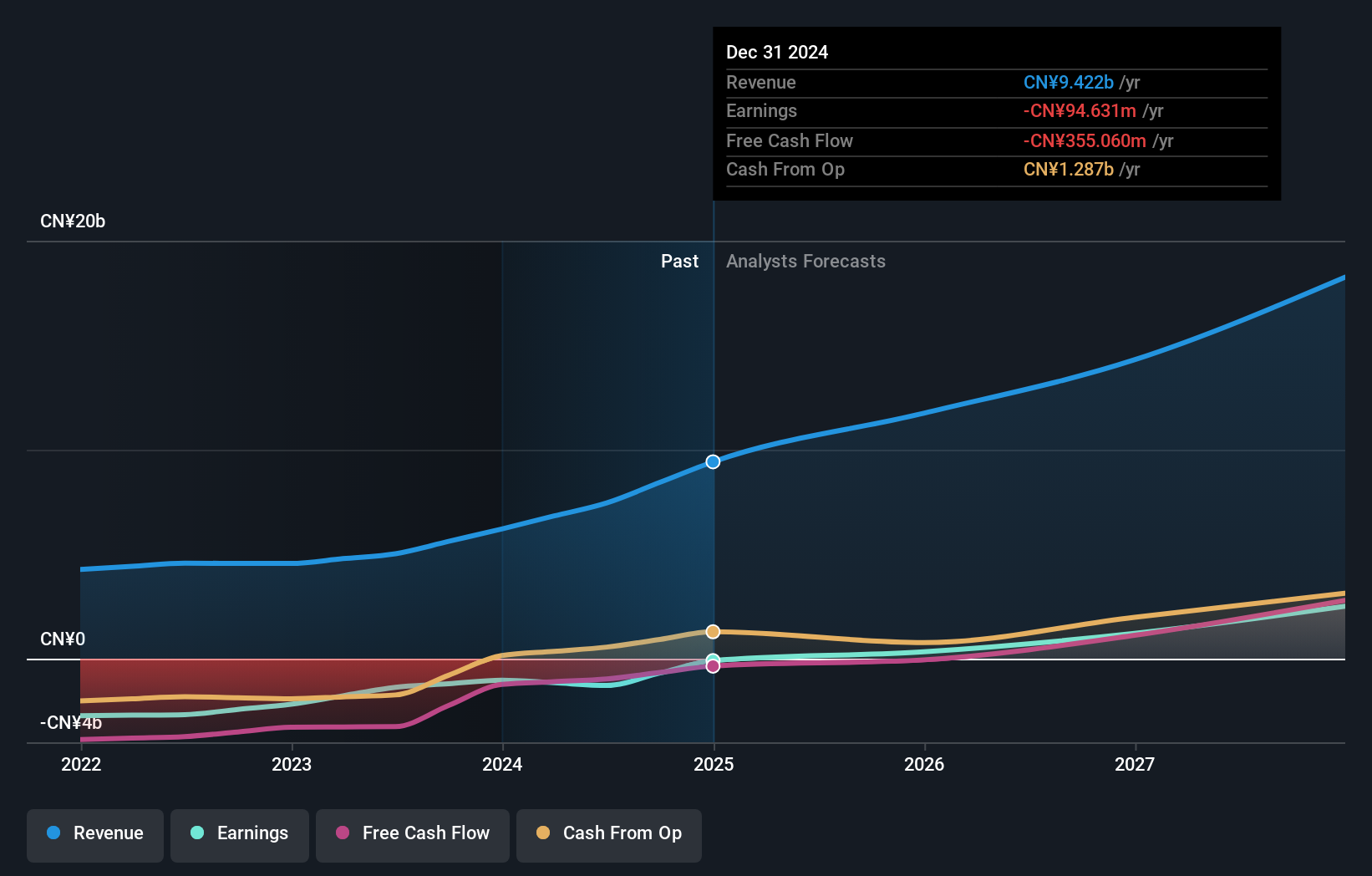

XD (SEHK:2400)

Simply Wall St Growth Rating: ★★★★★☆

Overview: XD Inc. (SEHK:2400) is an investment holding company that develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally, with a market cap of HK$9.85 billion.

Operations: XD Inc. generates revenue primarily from its game development and publishing operations (CN¥2.09 billion) and the TapTap platform (CN¥1.30 billion). The company focuses on the mobile and web gaming market, catering to both domestic and international audiences.

XD Inc. is poised for significant growth, with revenue forecasted to increase by 16.3% annually, outpacing the Hong Kong market's 7.4%. The company expects a net profit between ¥220 million and ¥270 million for H1 2024, a jump of up to 162.7% from the previous year, driven by new game launches like GoGo Muffin and Sword of Convallaria. R&D expenses are substantial, reflecting XD’s commitment to innovation; in Q2 alone, they allocated approximately ¥300 million towards development efforts.

- Delve into the full analysis health report here for a deeper understanding of XD.

Assess XD's past performance with our detailed historical performance reports.

Taking Advantage

- Dive into all 47 of the SEHK High Growth Tech and AI Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2400

XD

An investment holding company, develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally.

High growth potential with excellent balance sheet.