Michong Metaverse (China) Holdings Group Limited (HKG:8645) Soars 26% But It's A Story Of Risk Vs Reward

Michong Metaverse (China) Holdings Group Limited (HKG:8645) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 66% share price drop in the last twelve months.

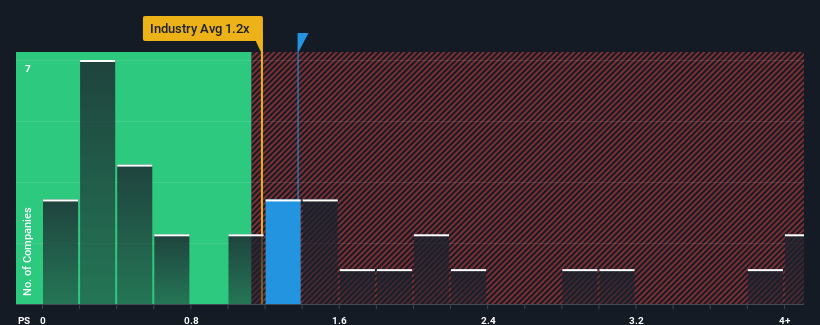

In spite of the firm bounce in price, it's still not a stretch to say that Michong Metaverse (China) Holdings Group's price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the IT industry in Hong Kong, where the median P/S ratio is around 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Michong Metaverse (China) Holdings Group

What Does Michong Metaverse (China) Holdings Group's P/S Mean For Shareholders?

For instance, Michong Metaverse (China) Holdings Group's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Michong Metaverse (China) Holdings Group's earnings, revenue and cash flow.How Is Michong Metaverse (China) Holdings Group's Revenue Growth Trending?

Michong Metaverse (China) Holdings Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.1%. Still, the latest three year period has seen an excellent 68% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 17% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Michong Metaverse (China) Holdings Group is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Michong Metaverse (China) Holdings Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't quite envision Michong Metaverse (China) Holdings Group's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Michong Metaverse (China) Holdings Group (2 are concerning) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Byte Metaverse Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8645

Byte Metaverse Holdings

An investment holding company, engages in the provision of network support services in Malaysia and the People's Republic of China.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives