Amidst ongoing concerns about AI-driven valuations and economic uncertainties, Asian markets have seen fluctuating investor sentiment. For those interested in exploring opportunities beyond established giants, penny stocks—often representing smaller or newer companies—remain a relevant area of interest. Despite the term's vintage connotation, these stocks can offer affordability and growth potential when backed by strong financial fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.98 | THB3.09B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.42 | HK$2.01B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.02 | SGD413.39M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.92 | THB2.95B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.35 | SGD13.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.93 | HK$2.49B | ✅ 3 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.04 | NZ$148.04M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.80 | NZ$235.47M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 964 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Phoenix Media Investment (Holdings) (SEHK:2008)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Phoenix Media Investment (Holdings) Limited is an investment holding company that offers satellite television broadcasting services in China and internationally, with a market capitalization of approximately HK$823.95 million.

Operations: The company's revenue is primarily derived from Internet Media (HK$796.03 million), Television Broadcasting - Primary Channels (HK$540.06 million), Outdoor Media (HK$357.78 million), and Television Broadcasting - Others (HK$315.21 million), with additional contributions from Real Estate (HK$68.37 million).

Market Cap: HK$823.95M

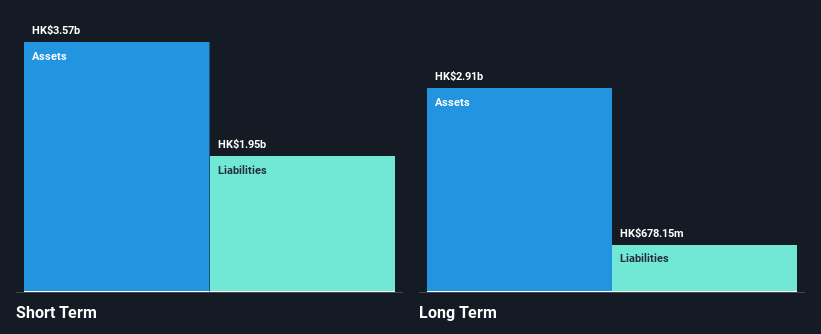

Phoenix Media Investment (Holdings) Limited, with a market capitalization of approximately HK$823.95 million, is currently unprofitable but has reduced its losses over the past five years by 25.6% annually. The company benefits from substantial short-term assets (HK$3.1 billion) exceeding both long-term and short-term liabilities, and it maintains more cash than total debt. Despite significant insider selling recently, the management team is experienced with an average tenure of 4.8 years. A new Program License Agreement expands its offerings to include AI-related applications and transportation use in China, potentially enhancing revenue streams with an annual fee adjustment to RMB 55 million.

- Take a closer look at Phoenix Media Investment (Holdings)'s potential here in our financial health report.

- Gain insights into Phoenix Media Investment (Holdings)'s past trends and performance with our report on the company's historical track record.

Future Data Group (SEHK:8229)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Future Data Group Limited is an investment holding company that offers system integration and maintenance services in South Korea and Hong Kong, with a market cap of HK$390.98 million.

Operations: The company's revenue is primarily derived from system integration services, generating HK$203.75 million, and maintenance services excluding cyber security, contributing HK$168.23 million.

Market Cap: HK$390.98M

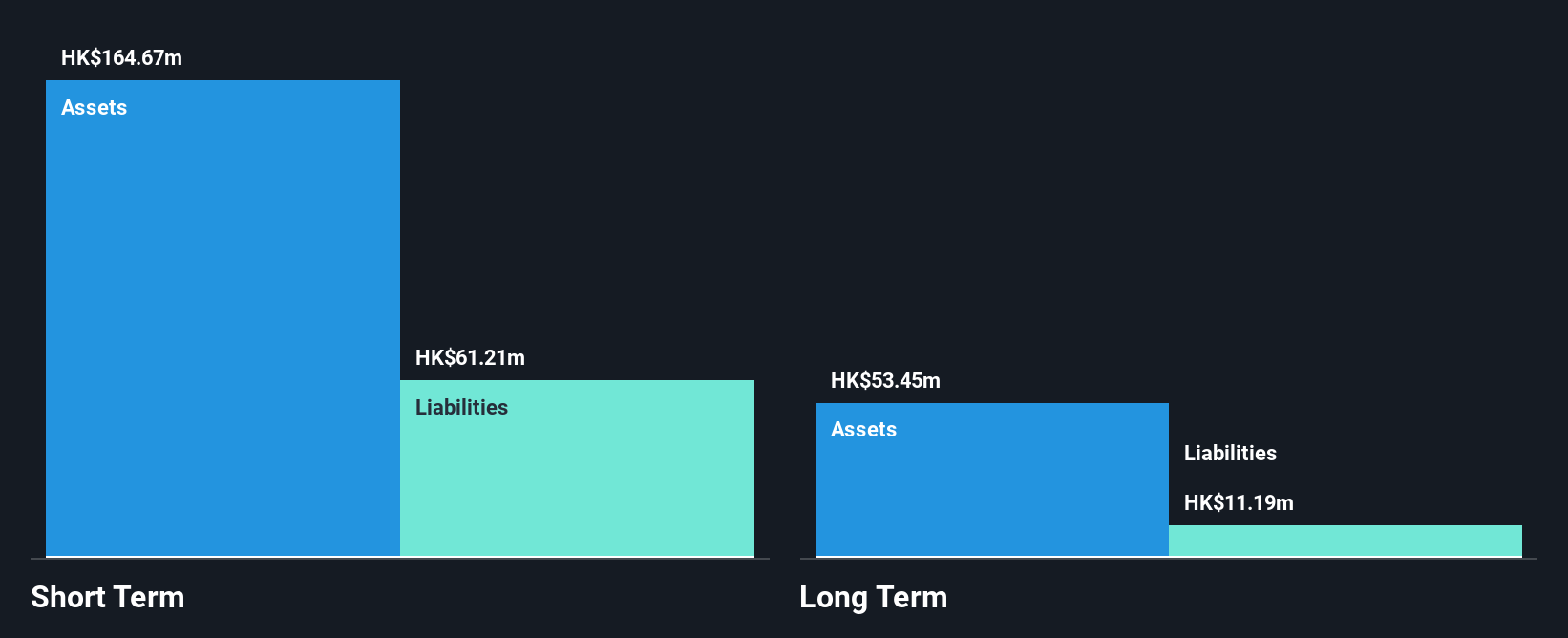

Future Data Group Limited, with a market cap of HK$390.98 million, has faced financial challenges despite having more cash than debt and reducing its debt-to-equity ratio over the past five years. The company remains unprofitable, with increasing losses at 67% annually over the same period. Recent earnings reported a decline in sales to HK$160.98 million for the half year ending June 2025, alongside a net loss of HK$17.9 million. While short-term assets exceed liabilities, both operating cash flow and return on equity are negative, reflecting ongoing volatility and financial instability in its operations across South Korea and Hong Kong.

- Navigate through the intricacies of Future Data Group with our comprehensive balance sheet health report here.

- Explore historical data to track Future Data Group's performance over time in our past results report.

Tat Seng Packaging Group (SGX:T12)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tat Seng Packaging Group Ltd designs, manufactures, and sells corrugated paper products and other packaging solutions in Singapore and the People's Republic of China, with a market capitalization of SGD142.27 million.

Operations: The company's revenue primarily comes from its Packaging & Containers segment, generating SGD237.80 million.

Market Cap: SGD142.27M

Tat Seng Packaging Group, with a market cap of SGD142.27 million, demonstrates solid financial fundamentals despite challenges in earnings growth. The company has more cash than total debt and its operating cash flow effectively covers its debt obligations. Short-term assets significantly exceed both short- and long-term liabilities, indicating strong liquidity. However, earnings have declined by 5.4% annually over the past five years and net profit margins have decreased from last year’s figures. While trading at 38% below estimated fair value suggests potential upside, the company's return on equity remains low at 7.9%, highlighting areas for improvement in profitability metrics.

- Get an in-depth perspective on Tat Seng Packaging Group's performance by reading our balance sheet health report here.

- Assess Tat Seng Packaging Group's previous results with our detailed historical performance reports.

Seize The Opportunity

- Embark on your investment journey to our 964 Asian Penny Stocks selection here.

- Want To Explore Some Alternatives? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2008

Phoenix Media Investment (Holdings)

An investment holding company, provides satellite television broadcasting services in the People’s Republic of China and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives