- Hong Kong

- /

- Diversified Financial

- /

- SEHK:2598

SEHK Growth Companies With Up To 25% Insider Ownership

Reviewed by Simply Wall St

As global markets experience varied economic shifts, the Hong Kong market has seen its benchmark Hang Seng Index decline by over 6% amid fading optimism regarding Beijing's stimulus measures. This environment underscores the importance of insider ownership as a potential indicator of strong alignment between company leadership and shareholder interests, particularly in growth companies where strategic decisions can significantly impact performance.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Akeso (SEHK:9926) | 20.5% | 53% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| DPC Dash (SEHK:1405) | 38.1% | 106.5% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 29.4% | 93.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 69.7% |

| MicroTech Medical (Hangzhou) (SEHK:2235) | 25.8% | 105% |

Let's take a closer look at a couple of our picks from the screened companies.

Lianlian DigiTech (SEHK:2598)

Simply Wall St Growth Rating: ★★★★★☆

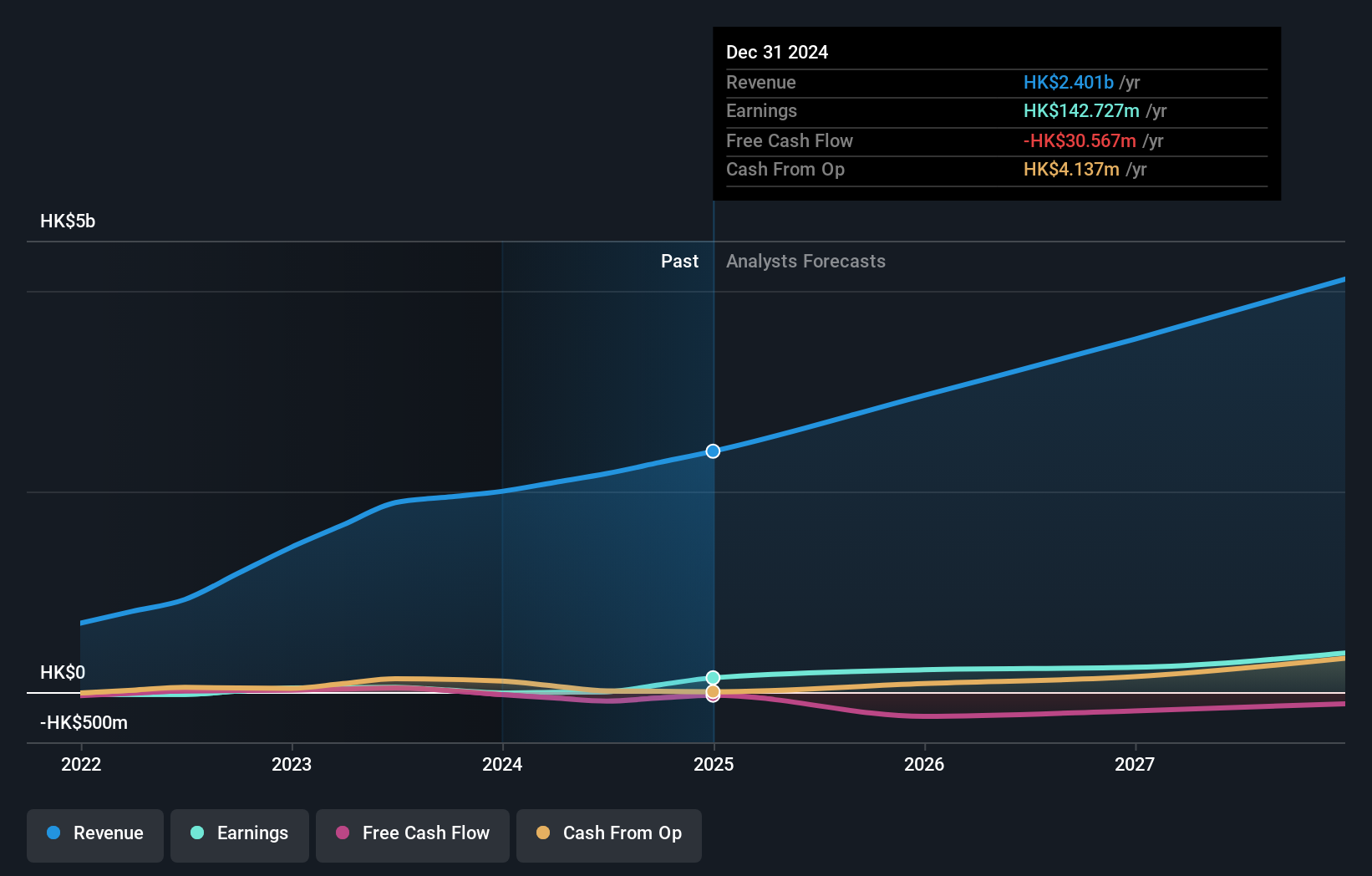

Overview: Lianlian DigiTech Co., Ltd. and its subsidiaries offer digital payment and value-added services to small and midsized merchants and enterprises in China, with a market cap of approximately HK$10.63 billion.

Operations: The company's revenue is primarily derived from its Global Payment segment at CN¥722.95 million, followed by Domestic Payment at CN¥309.92 million and Value-Added Services at CN¥153.01 million.

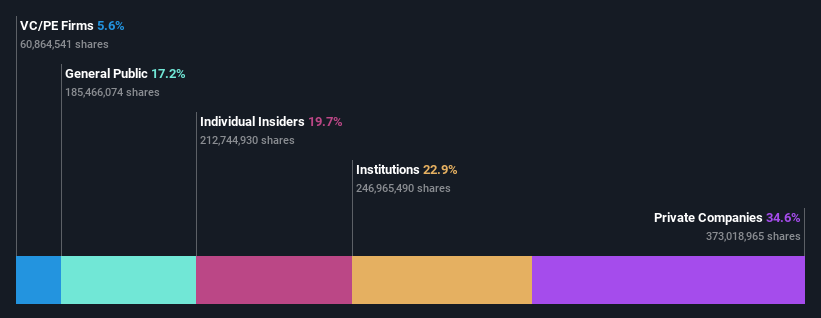

Insider Ownership: 19.7%

Lianlian DigiTech is poised for significant growth, with revenue expected to increase by 22.3% annually, outpacing the Hong Kong market's average. Despite current net losses, earnings are forecasted to grow substantially at 95.65% per year and become profitable within three years, indicating robust future potential. Recent earnings showed increased sales of CNY 617.39 million but a reduced net loss compared to last year, reflecting gradual financial improvement without substantial insider trading activity recently reported.

- Get an in-depth perspective on Lianlian DigiTech's performance by reading our analyst estimates report here.

- The analysis detailed in our Lianlian DigiTech valuation report hints at an inflated share price compared to its estimated value.

Vobile Group (SEHK:3738)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Japan, Mainland China, and internationally, with a market cap of approximately HK$5.77 billion.

Operations: The company's revenue is primarily derived from its software as a service offerings, amounting to HK$2.18 billion.

Insider Ownership: 23.1%

Vobile Group shows strong growth prospects with annual revenue expected to rise by 21.4%, surpassing the Hong Kong market average. Earnings are forecasted to grow significantly at 68.5% per year, despite a low return on equity projection of 5.1%. Recent share repurchase plans could enhance net asset value and earnings per share, although past shareholder dilution is noted. The company reported increased half-year sales of HK$1.18 billion and improved net income compared to last year.

- Navigate through the intricacies of Vobile Group with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Vobile Group implies its share price may be too high.

Techtronic Industries (SEHK:669)

Simply Wall St Growth Rating: ★★★★☆☆

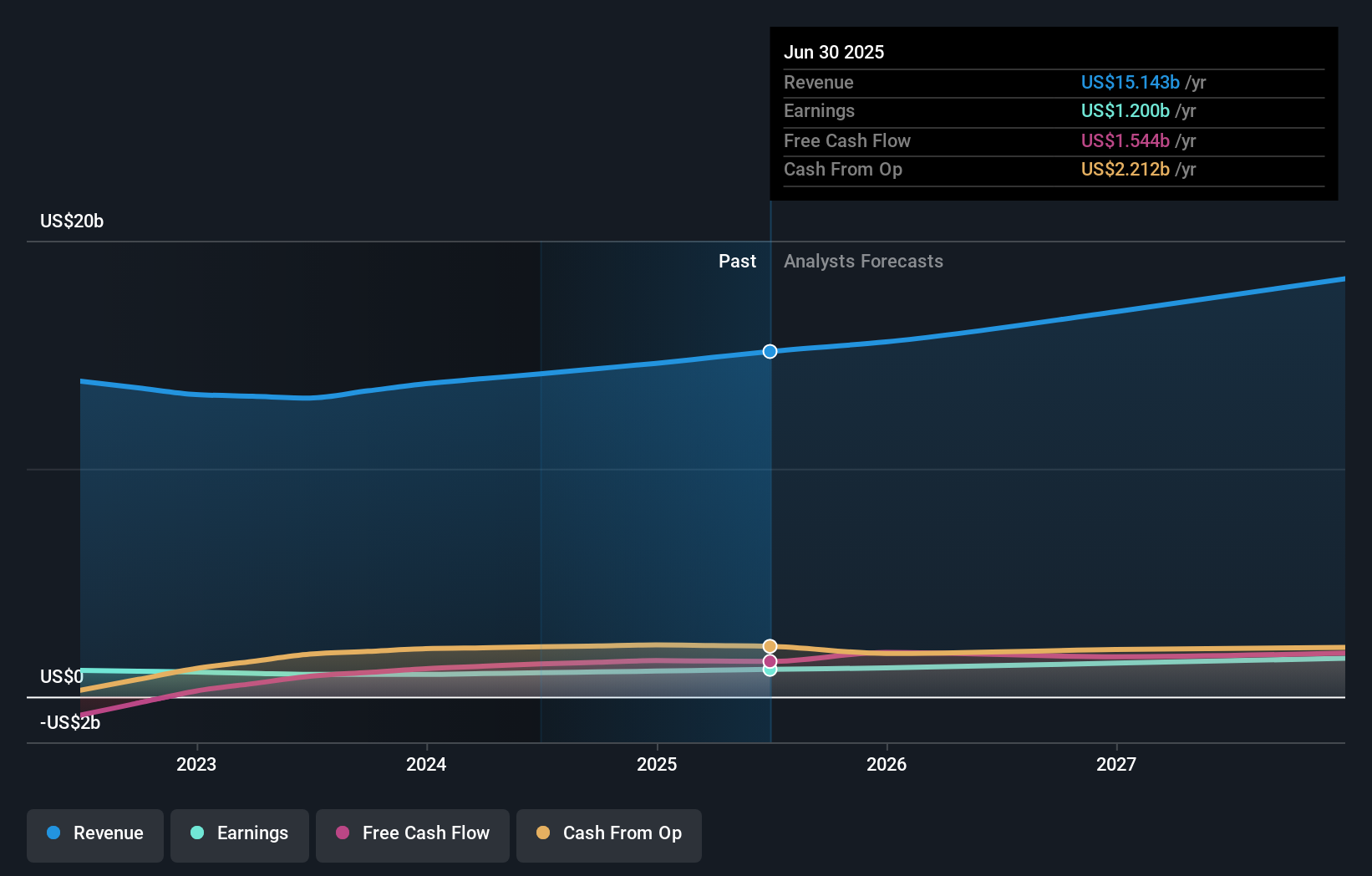

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products across North America, Europe, and internationally with a market cap of approximately HK$207.81 billion.

Operations: The company generates revenue from its Power Equipment segment at $13.23 billion and Floorcare & Cleaning products at $965.09 million.

Insider Ownership: 25.4%

Techtronic Industries demonstrates growth potential with earnings expected to rise 15.32% annually, outpacing the Hong Kong market's 12%. Recent board appointments of experienced directors could strengthen strategic direction. The company reported a net income increase to US$550.37 million for the half-year ending June 2024, alongside a dividend of HK$1.08 per share. Despite trading at a discount to fair value, revenue growth is projected at 8.5%, slightly above the market average of 7.3%.

- Dive into the specifics of Techtronic Industries here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Techtronic Industries is trading beyond its estimated value.

Where To Now?

- Investigate our full lineup of 47 Fast Growing SEHK Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2598

Lianlian DigiTech

Provides digital payment services and value-added services to small and midsized merchants and enterprises in China.

Reasonable growth potential with adequate balance sheet.