As global markets grapple with AI concerns and fluctuating valuations, Asian indices have mirrored this sentiment with varied performances across the region. For investors willing to explore beyond the mainstream, penny stocks—despite their somewhat outdated moniker—remain a compelling area of interest. These smaller or newer companies can offer unique opportunities for those seeking value and growth potential in today's complex market landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.53 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.48 | HK$2.06B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.04 | SGD421.5M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.92 | THB2.95B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Gunkul Engineering (SET:GUNKUL) | THB1.89 | THB16.26B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.36 | SGD13.22B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.03 | NZ$146.62M | ✅ 2 ⚠️ 5 View Analysis > |

| ITE (Holdings) (SEHK:8092) | HK$0.029 | HK$26.84M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.80 | NZ$235.47M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 959 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

LifeTech Scientific (SEHK:1302)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LifeTech Scientific Corporation is an investment holding company that develops, manufactures, and trades interventional medical devices for cardiovascular and peripheral vascular diseases globally, with a market cap of HK$8.61 billion.

Operations: The company's revenue is primarily derived from its Peripheral Vascular Diseases Business at CN¥762.08 million, followed by the Structural Heart Diseases Business at CN¥527.87 million, and the Cardiac Pacing and Electrophysiology Business contributing CN¥37.63 million.

Market Cap: HK$8.61B

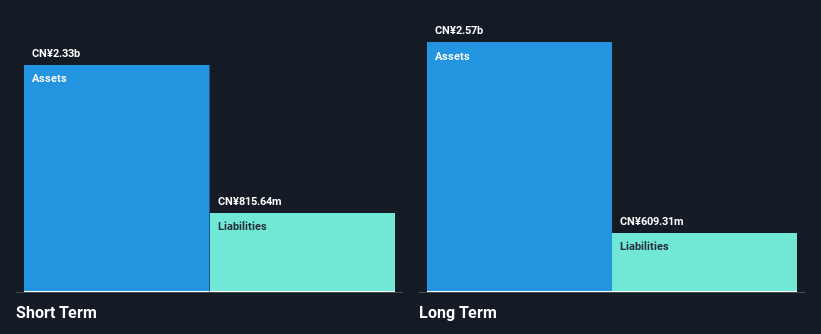

LifeTech Scientific Corporation, with a market cap of HK$8.61 billion, has recently experienced significant board changes and regulatory approvals. Despite a decline in net income to CN¥55.07 million for the half-year ending June 2025 from CN¥205.56 million the previous year, the company remains debt-free with strong asset coverage over liabilities. Recent approval of its G-BranchTM system by China's NMPA highlights its potential in innovative medical devices, though profit margins have decreased from 19.4% to 5.4%. The management team is seasoned but faces challenges in reversing negative earnings growth trends over recent years.

- Dive into the specifics of LifeTech Scientific here with our thorough balance sheet health report.

- Assess LifeTech Scientific's previous results with our detailed historical performance reports.

Vobile Group (SEHK:3738)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vobile Group Limited is an investment holding company offering software as a service for digital content asset protection and transactions across the United States, Mainland China, and internationally, with a market cap of HK$12.42 billion.

Operations: The company generates revenue of HK$2.68 billion from its software as a service offerings.

Market Cap: HK$12.42B

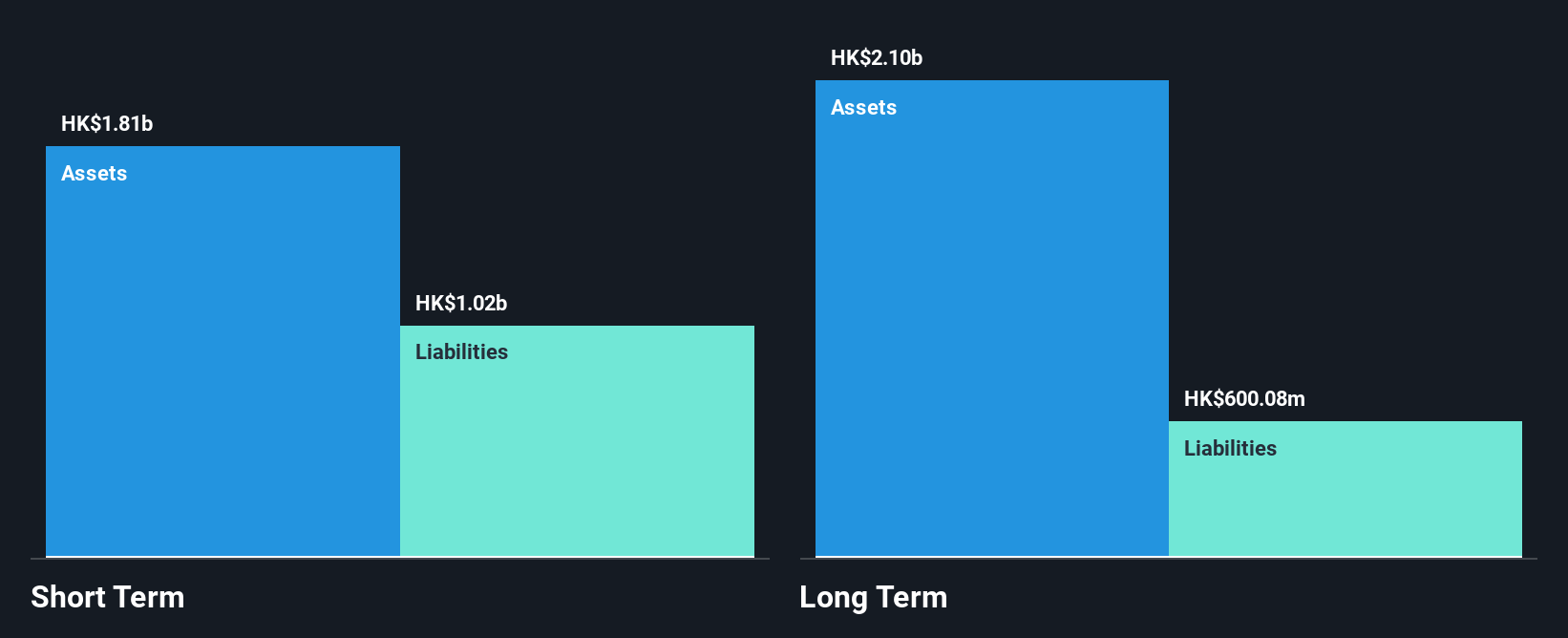

Vobile Group Limited, with a market cap of HK$12.42 billion, has demonstrated robust earnings growth, with a 4431.4% increase over the past year and revenue rising to HK$2.68 billion. Despite its low Return on Equity at 7%, the company's debt management is satisfactory, as evidenced by a net debt to equity ratio of 16%. Recent results show a 27% revenue increase for Q3 2025 compared to the previous year, highlighting strong performance in Mainland China and monthly recurring revenue growth of 28%. The management and board are seasoned, contributing to stable operations amid high volatility.

- Take a closer look at Vobile Group's potential here in our financial health report.

- Review our growth performance report to gain insights into Vobile Group's future.

Delfi (SGX:P34)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Delfi Limited is an investment holding company that manufactures, markets, distributes, and sells chocolate and confectionery products in Indonesia, the Philippines, Malaysia, Singapore, and internationally with a market cap of SGD525.60 million.

Operations: The company's revenue is primarily derived from its operations in Indonesia, contributing $331.12 million, and its Regional Markets segment, which adds $194.94 million.

Market Cap: SGD525.6M

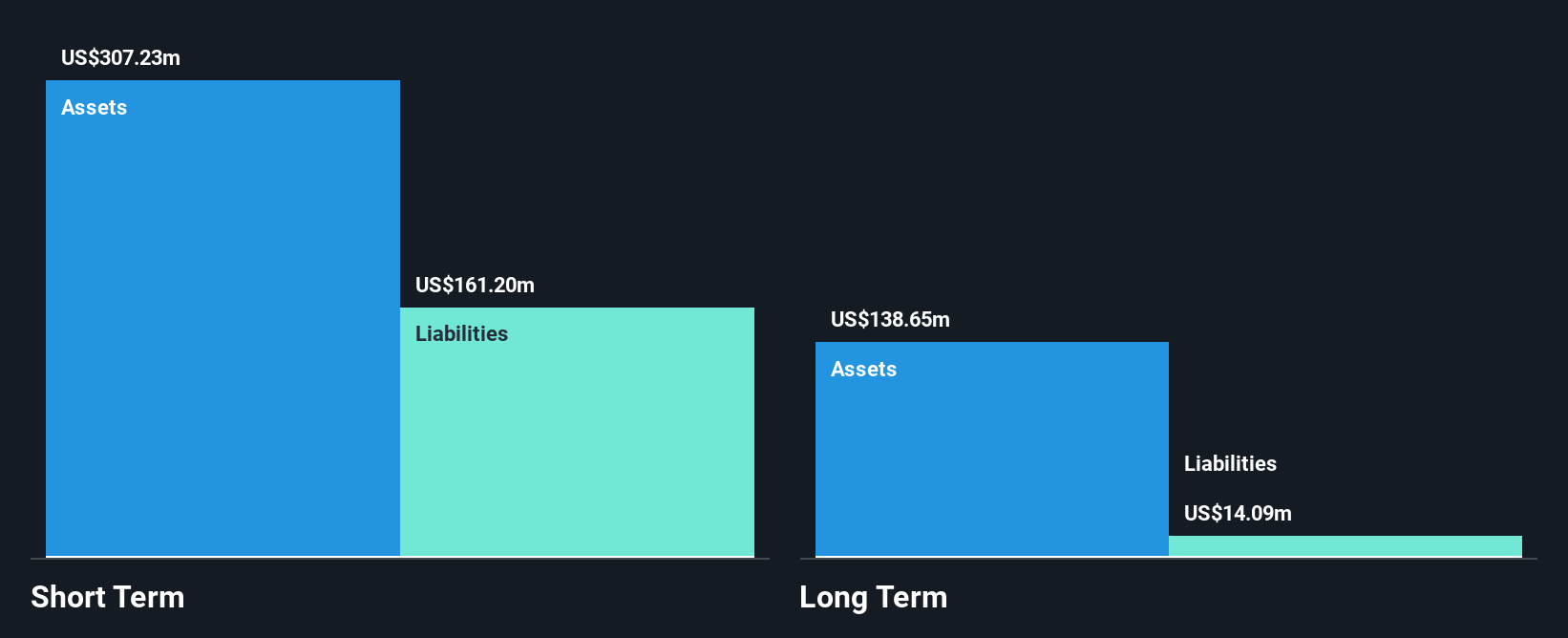

Delfi Limited, with a market cap of SGD525.60 million, shows financial stability as its short-term assets (SGD307.2 million) exceed both short-term (SGD161.2 million) and long-term liabilities (SGD14.1 million). The company maintains more cash than total debt, indicating prudent debt management. However, Delfi's earnings declined by 34.6% over the past year despite a forecasted growth of 11.05% annually moving forward. Its net profit margins have decreased to 5.3% from last year's 7.9%, and while dividends are unstable, the company's board and management teams are experienced with average tenures of 8.8 and 5.3 years respectively.

- Jump into the full analysis health report here for a deeper understanding of Delfi.

- Learn about Delfi's future growth trajectory here.

Summing It All Up

- Take a closer look at our Asian Penny Stocks list of 959 companies by clicking here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:P34

Delfi

An investment holding company, manufactures, markets, distributes, and sells chocolate, chocolate confectionery, and consumer products in Indonesia, the Philippines, Malaysia, Singapore, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success