- China

- /

- Electronic Equipment and Components

- /

- SZSE:002139

Exploring Kingdee International Software Group And 2 Other Prominent High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

Amidst a backdrop of mixed performances in global indices and ongoing economic uncertainties, the Asian tech sector continues to capture investor interest, particularly as concerns about elevated valuations and artificial intelligence spending drive market dynamics. In this environment, identifying high growth stocks requires careful consideration of companies' adaptability to changing market conditions and their ability to innovate within emerging technological trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.61% | 35.52% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Zhongji Innolight | 31.35% | 32.09% | ★★★★★★ |

| Fositek | 37.43% | 49.42% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Gold Circuit Electronics | 25.79% | 31.13% | ★★★★★★ |

| eWeLLLtd | 25.08% | 25.14% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingdee International Software Group Company Limited is an investment holding company that operates in the enterprise resource planning sector, with a market capitalization of HK$50.57 billion.

Operations: Kingdee International Software Group focuses on enterprise resource planning solutions, generating revenue primarily through software sales and cloud services. The company has observed a notable trend in its gross profit margin, which reflects its operational efficiency in the competitive software sector.

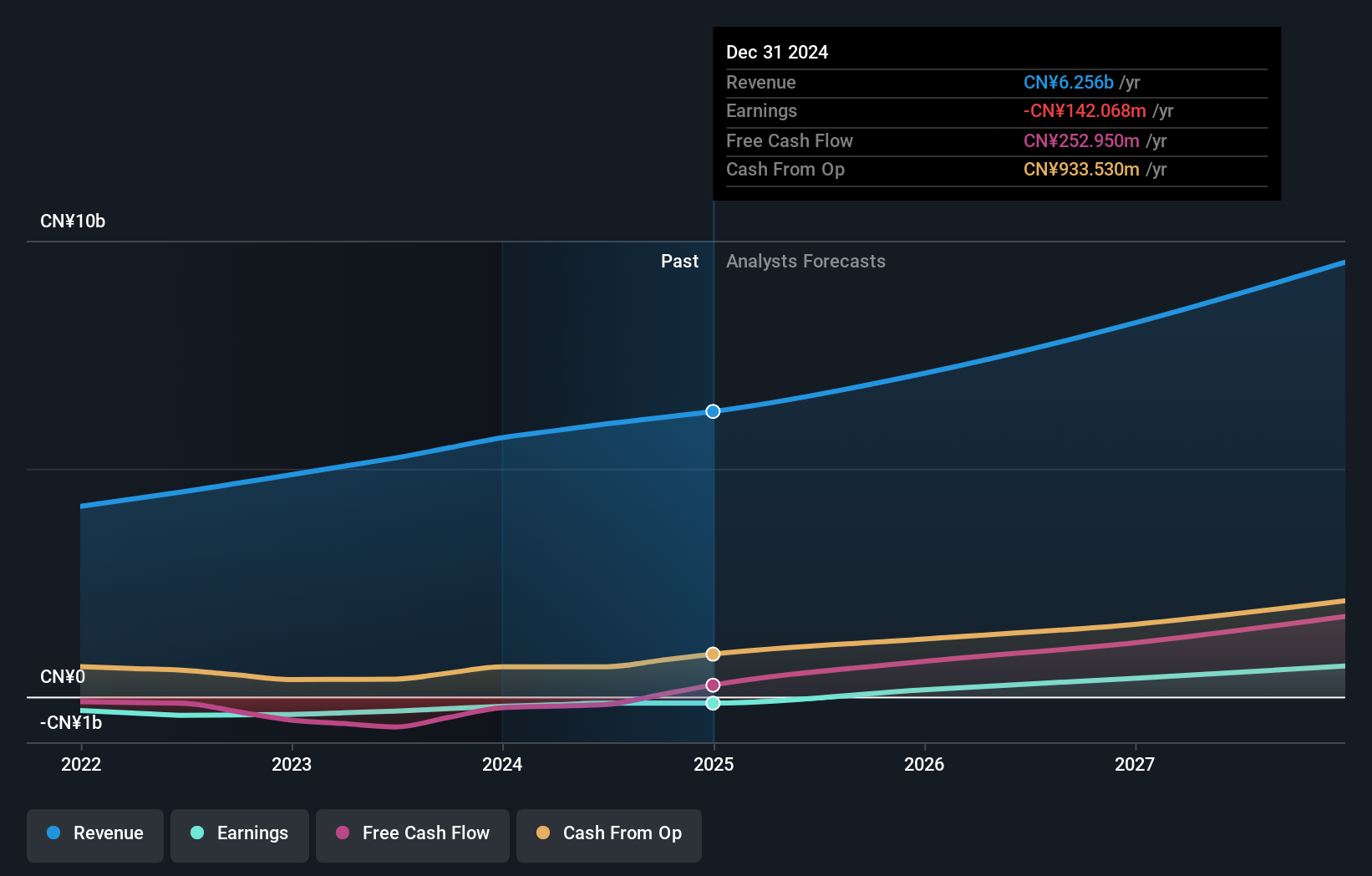

Kingdee International Software Group, a key contender in Asia's high-growth tech sector, is navigating a dynamic landscape with its strategic pivot towards cloud-based solutions. With an annual revenue growth of 14%, the company outpaces Hong Kong's market average of 8.5%, yet trails the more aggressive industry benchmarks. Notably, its R&D commitment—integral to sustaining innovation and competitive edge—has seen substantial investment, aligning with its vision for future profitability. The firm recently highlighted this direction in their Global Inventors meeting, underscoring a focus on harnessing cutting-edge technologies to drive future growth. Despite current unprofitability and significant insider selling over the past quarter, Kingdee's projected earnings growth of 43.36% per annum signals robust potential ahead.

Shenzhen Topband (SZSE:002139)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Topband Co., Ltd. operates in the research, development, production, and sale of intelligent control system solutions both in China and internationally, with a market cap of CN¥16.20 billion.

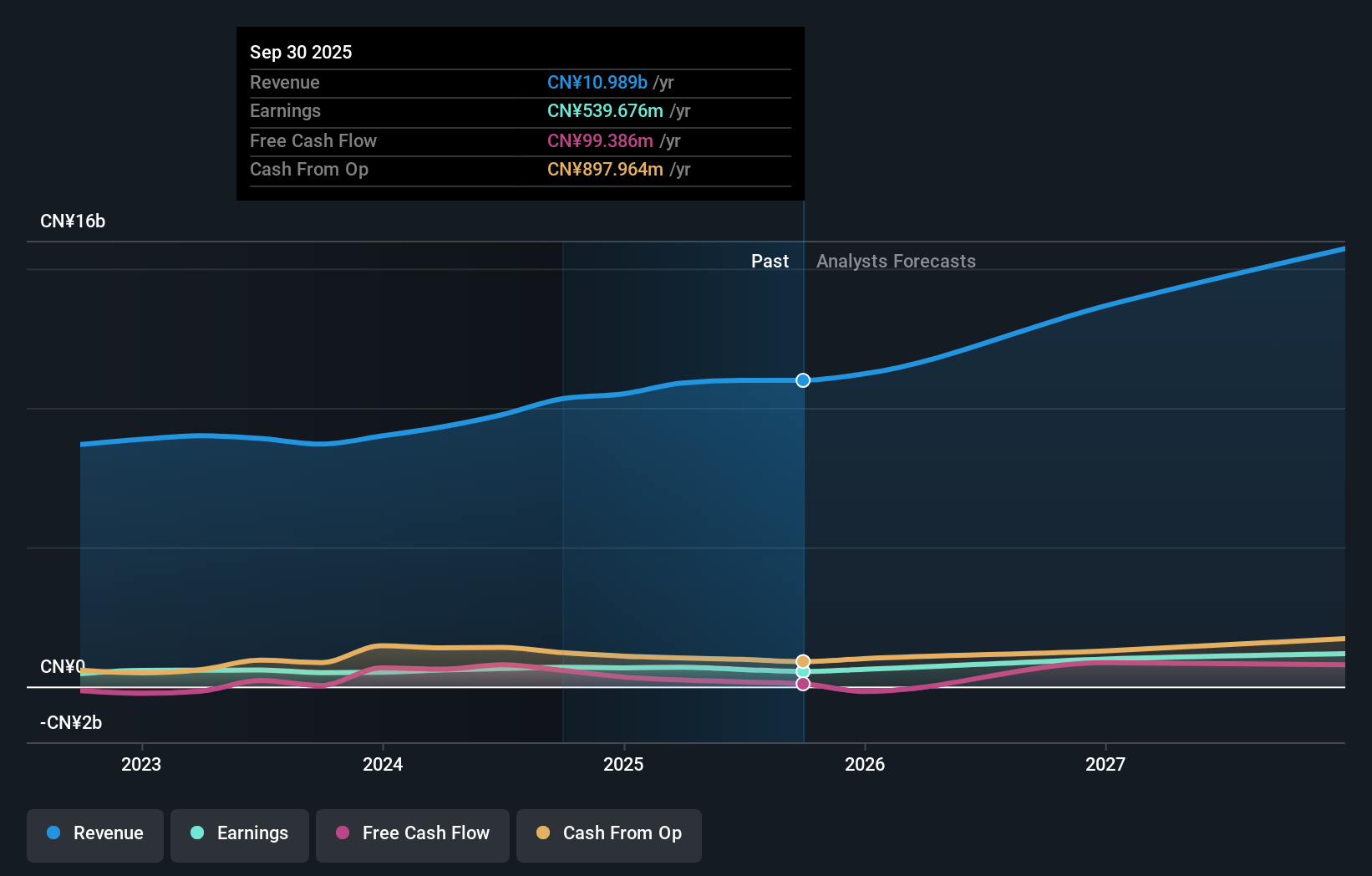

Operations: The company primarily generates revenue from its Intelligent Control Electronics Industry segment, which totaled CN¥10.99 billion.

Shenzhen Topband's strategic alignment with WIK Far East underscores its commitment to innovation and sustainability, particularly in smart manufacturing and eco-friendly solutions. This collaboration is poised to enhance production efficiency and drive growth within the home appliance sector, reflecting a proactive approach to industry challenges such as climate change. Financially, Topband reported a revenue increase to CNY 8.19 billion from CNY 7.70 billion year-over-year for the nine months ending September 2025, although net income dipped to CNY 420.46 million from CNY 552.22 million in the same period last year. This financial trajectory, coupled with its strategic initiatives, positions Topband uniquely within Asia's competitive tech landscape, suggesting a focus on long-term market relevance through technological adaptability and strategic partnerships.

Nan Ya Printed Circuit Board (TWSE:8046)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nan Ya Printed Circuit Board Corporation is a company that manufactures and sells printed circuit boards (PCBs) across Taiwan, the United States, Mainland China, Korea, and other international markets with a market cap of NT$162.19 billion.

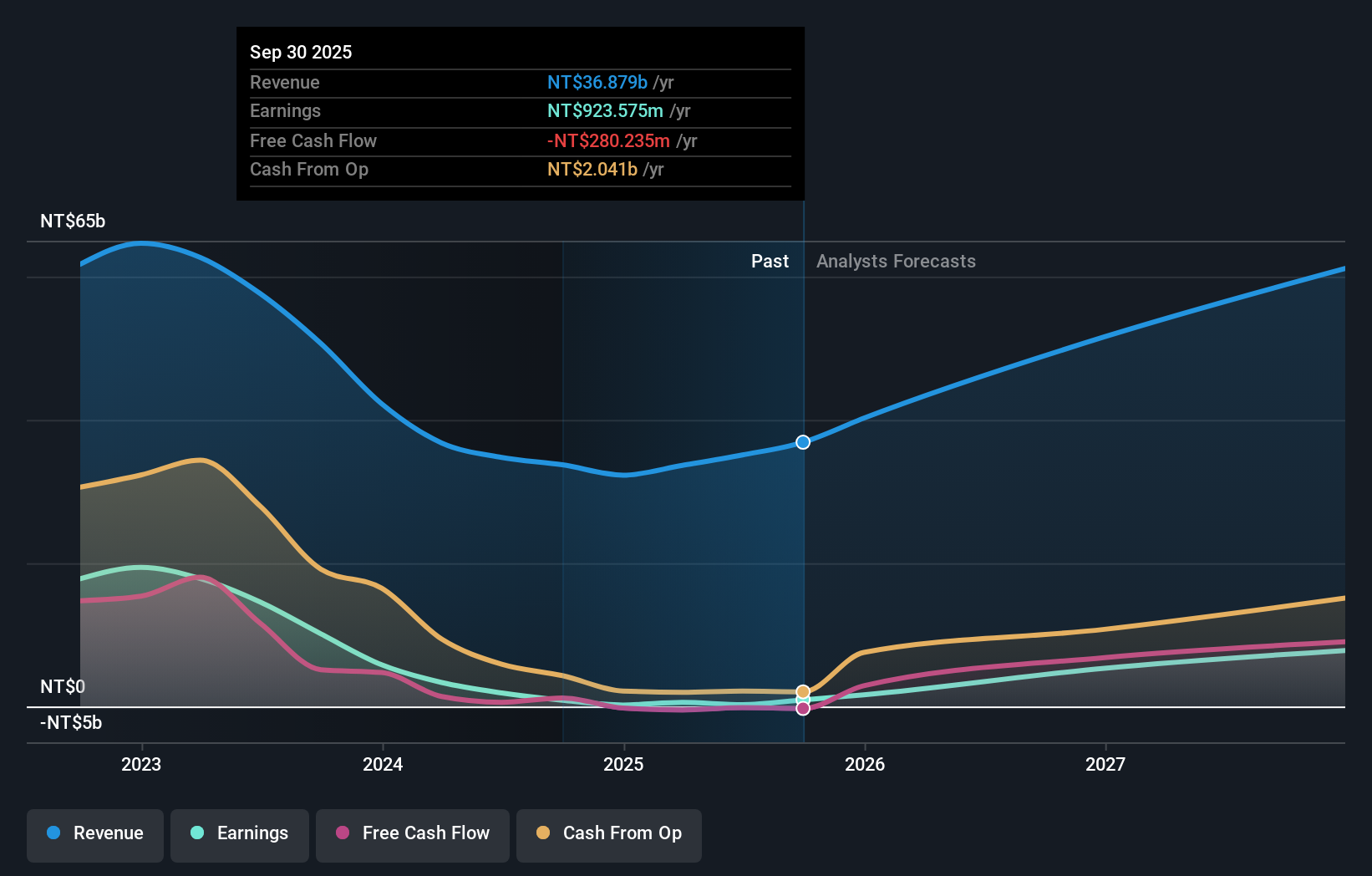

Operations: The company generates revenue primarily from its domestic market, accounting for NT$26.67 billion, followed by Asia at NT$14.39 billion and America at a significantly smaller NT$30.35 million.

Nan Ya Printed Circuit Board has demonstrated robust growth with a 22.4% annual increase in revenue, outpacing the Taiwanese market's average of 13.3%. This uptick is supported by a significant surge in earnings, projected at an 80% annual growth rate, well above the industry norm of 20.3%. The company's commitment to innovation is evident from its recent financial reports; Q3 sales jumped to TWD 10.97 billion from TWD 9.19 billion year-over-year, and net income soared to TWD 724.87 million from TWD 58.89 million, reflecting strategic adaptations and operational efficiency improvements within the tech sector.

Seize The Opportunity

- Unlock our comprehensive list of 189 Asian High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002139

Shenzhen Topband

Engages in the research and development, production, and sale of intelligent control system solutions in China and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives