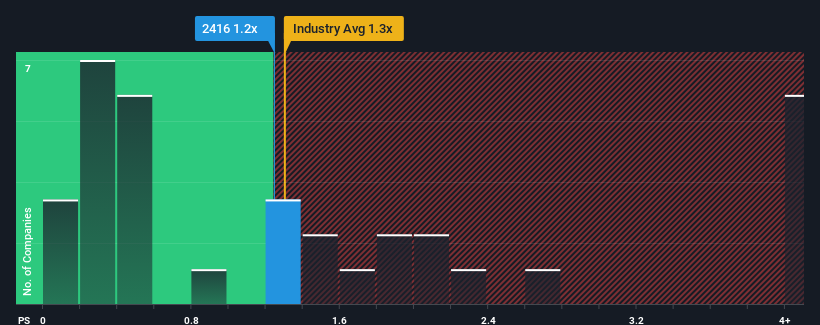

With a median price-to-sales (or "P/S") ratio of close to 1.3x in the IT industry in Hong Kong, you could be forgiven for feeling indifferent about Edianyun Limited's (HKG:2416) P/S ratio of 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Edianyun

What Does Edianyun's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Edianyun's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Edianyun will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Edianyun?

The only time you'd be comfortable seeing a P/S like Edianyun's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.4%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 56% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% per annum during the coming three years according to the lone analyst following the company. With the industry only predicted to deliver 8.3% per year, the company is positioned for a stronger revenue result.

In light of this, it's curious that Edianyun's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Edianyun's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Edianyun's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Edianyun that you should be aware of.

If these risks are making you reconsider your opinion on Edianyun, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Edianyun might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2416

Edianyun

An investment holding company, provides office internet technology integrated solutions to small-and medium-sized enterprises in the People’s Republic of China.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives