Should You Think About Buying Sinosoft Technology Group Limited (HKG:1297) Now?

Sinosoft Technology Group Limited (HKG:1297), might not be a large cap stock, but it received a lot of attention from a substantial price increase on the SEHK over the last few months. Less-covered, small caps tend to present more of an opportunity for mispricing due to the lack of information available to the public, which can be a good thing. So, could the stock still be trading at a low price relative to its actual value? Let’s take a look at Sinosoft Technology Group’s outlook and value based on the most recent financial data to see if the opportunity still exists.

Check out our latest analysis for Sinosoft Technology Group

What is Sinosoft Technology Group worth?

Good news, investors! Sinosoft Technology Group is still a bargain right now. My valuation model shows that the intrinsic value for the stock is HK$2.17, which is above what the market is valuing the company at the moment. This indicates a potential opportunity to buy low. What’s more interesting is that, Sinosoft Technology Group’s share price is theoretically quite stable, which could mean two things: firstly, it may take the share price a while to move to its intrinsic value, and secondly, there may be less chances to buy low in the future once it reaches that value. This is because the stock is less volatile than the wider market given its low beta.

What kind of growth will Sinosoft Technology Group generate?

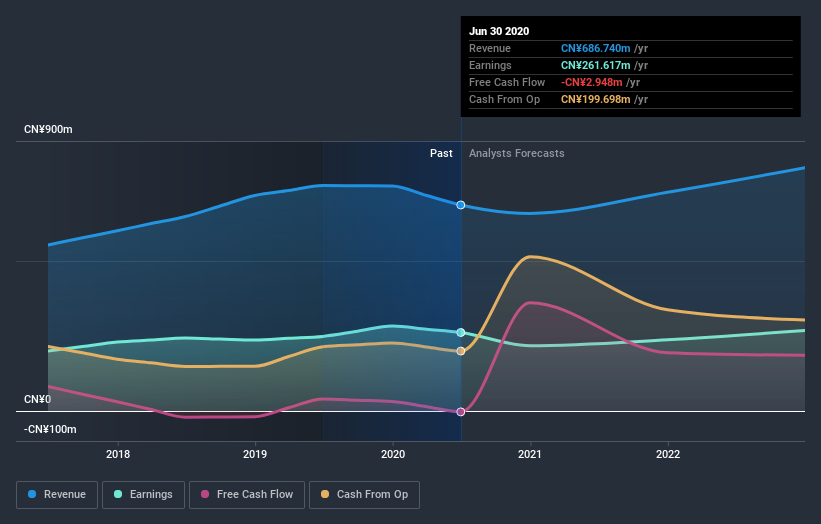

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. Though in the case of Sinosoft Technology Group, it is expected to deliver a negative earnings growth of -3.4%, which doesn’t help build up its investment thesis. It appears that risk of future uncertainty is high, at least in the near term.

What this means for you:

Are you a shareholder? Although 1297 is currently undervalued, the negative outlook does bring on some uncertainty, which equates to higher risk. I recommend you think about whether you want to increase your portfolio exposure to 1297, or whether diversifying into another stock may be a better move for your total risk and return.

Are you a potential investor? If you’ve been keeping an eye on 1297 for a while, but hesitant on making the leap, I recommend you research further into the stock. Given its current undervaluation, now is a great time to make a decision. But keep in mind the risks that come with negative growth prospects in the future.

If you want to dive deeper into Sinosoft Technology Group, you'd also look into what risks it is currently facing. At Simply Wall St, we found 1 warning sign for Sinosoft Technology Group and we think they deserve your attention.

If you are no longer interested in Sinosoft Technology Group, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

When trading Sinosoft Technology Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1297

Sinosoft Technology Group

Sinosoft Technology Group Limited, an investment holding company, provides application software products and solutions in the People’s Republic of China.

Adequate balance sheet and fair value.

Market Insights

Community Narratives