- Hong Kong

- /

- Semiconductors

- /

- SEHK:8490

Health Check: How Prudently Does Niche-Tech Group (HKG:8490) Use Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Niche-Tech Group Limited (HKG:8490) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Niche-Tech Group

How Much Debt Does Niche-Tech Group Carry?

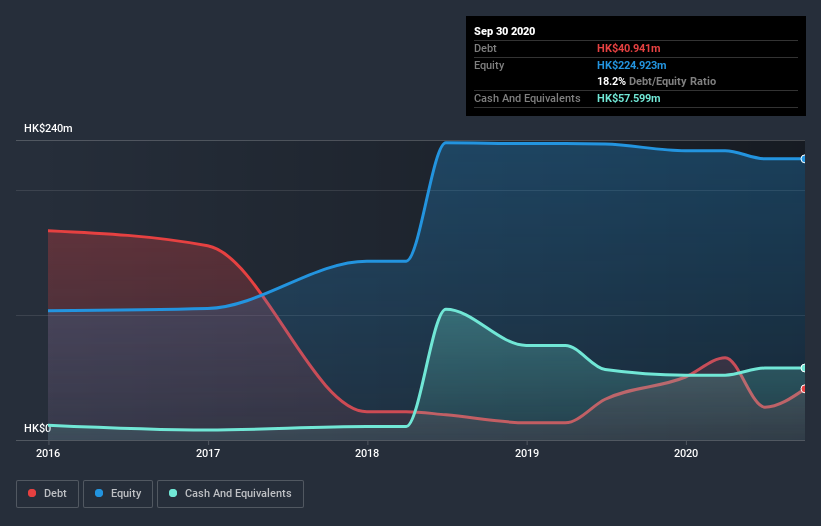

You can click the graphic below for the historical numbers, but it shows that Niche-Tech Group had HK$26.3m of debt in June 2020, down from HK$50.4m, one year before. However, its balance sheet shows it holds HK$57.6m in cash, so it actually has HK$31.3m net cash.

How Healthy Is Niche-Tech Group's Balance Sheet?

The latest balance sheet data shows that Niche-Tech Group had liabilities of HK$40.6m due within a year, and liabilities of HK$19.0m falling due after that. On the other hand, it had cash of HK$57.6m and HK$75.4m worth of receivables due within a year. So it can boast HK$73.3m more liquid assets than total liabilities.

This surplus liquidity suggests that Niche-Tech Group's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. On this basis we think its balance sheet is strong like a sleek panther or even a proud lion. Simply put, the fact that Niche-Tech Group has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Niche-Tech Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Niche-Tech Group had a loss before interest and tax, and actually shrunk its revenue by 12%, to HK$175m. That's not what we would hope to see.

So How Risky Is Niche-Tech Group?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Niche-Tech Group lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of HK$18m and booked a HK$8.1m accounting loss. Given it only has net cash of HK$31.3m, the company may need to raise more capital if it doesn't reach break-even soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Niche-Tech Group (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Niche-Tech Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Niche-Tech Semiconductor Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8490

Niche-Tech Semiconductor Materials

An investment holding company, engages in the development, manufacture, and sale of semiconductor packaging materials in the People’s Republic of China, Hong Kong, and internationally.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026