- Hong Kong

- /

- Medical Equipment

- /

- SEHK:9877

November 2024 Penny Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic data and geopolitical events, investors are seeking opportunities amidst the volatility. Penny stocks, often seen as a relic of past market terminology, continue to represent intriguing prospects for growth by offering exposure to smaller or newer companies at lower price points. When these stocks are supported by strong financial health and sound fundamentals, they can present compelling opportunities for those willing to explore this niche segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.455 | £356.81M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.60 | A$70.33M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.865 | £384.4M | ★★★★☆☆ |

Click here to see the full list of 5,774 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Oiltek International (Catalist:HQU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oiltek International Limited is an investment holding company that supplies and provides engineering design and commissioning services for oil extraction equipment and plants across Asia, America, and Africa, with a market cap of SGD91.52 million.

Operations: The company's revenue is primarily derived from its Edible & Non-Edible Oil Refinery segment, contributing MYR188.17 million, followed by Product Sales and Trading at MYR19.68 million, and Renewable Energy generating MYR16.99 million.

Market Cap: SGD91.52M

Oiltek International Limited, with a market cap of SGD91.52 million, primarily generates revenue from its Edible & Non-Edible Oil Refinery segment (MYR188.17 million), supplemented by Product Sales and Trading (MYR19.68 million) and Renewable Energy (MYR16.99 million). The company is debt-free, with short-term assets exceeding both short-term and long-term liabilities, indicating financial stability. Despite an inexperienced board, Oiltek boasts high-quality earnings and a high return on equity at 32.1%. Recent announcements include an interim dividend of 0.90 Singapore cents per share to be paid in September 2024, reflecting shareholder value focus amidst stable weekly volatility over the past year.

- Unlock comprehensive insights into our analysis of Oiltek International stock in this financial health report.

- Review our growth performance report to gain insights into Oiltek International's future.

Productive Technologies (SEHK:650)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Productive Technologies Company Limited is an investment holding company involved in manufacturing equipment for the semiconductor and solar power industries in China, with a market cap of approximately HK$1.48 billion.

Operations: The company generates revenue primarily from its Semiconductor and Solar cell segment, contributing HK$386 million, and its Oil and Gas and Others segment, which brings in HK$157.66 million.

Market Cap: HK$1.48B

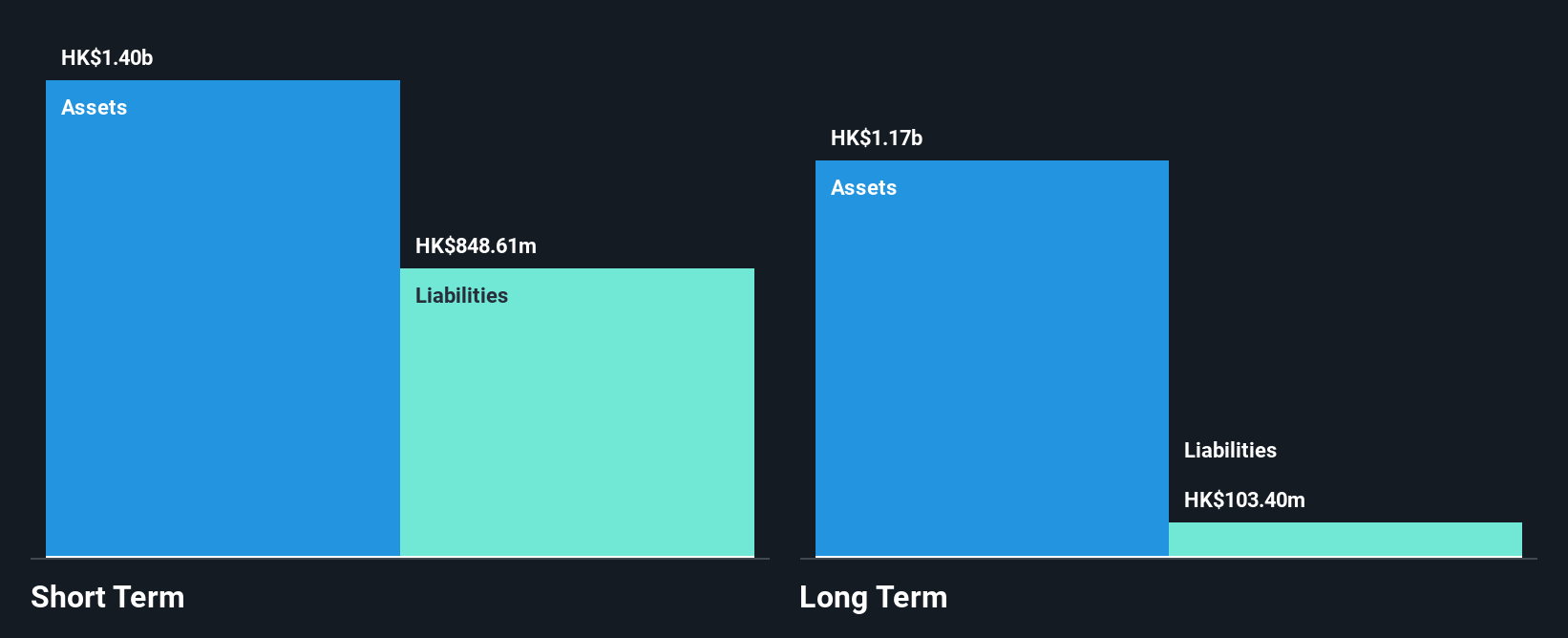

Productive Technologies Company Limited, with a market cap of approximately HK$1.48 billion, operates in the semiconductor and solar power sectors in China. Despite having more cash than total debt and short-term assets covering both short- and long-term liabilities, the company remains unprofitable with increasing losses over the past five years. Management is experienced; however, the board lacks seasoned members. The share price has been highly volatile recently, though shareholders have not faced dilution this year. With a cash runway of 1.8 years under current conditions, financial stability is maintained despite negative return on equity at -20.6%.

- Navigate through the intricacies of Productive Technologies with our comprehensive balance sheet health report here.

- Understand Productive Technologies' track record by examining our performance history report.

Jenscare Scientific (SEHK:9877)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jenscare Scientific Co., Ltd. is a medical device company focused on developing interventional products for treating structural heart diseases in China, with a market cap of HK$1.16 billion.

Operations: Jenscare Scientific Co., Ltd. has not reported any specific revenue segments.

Market Cap: HK$1.16B

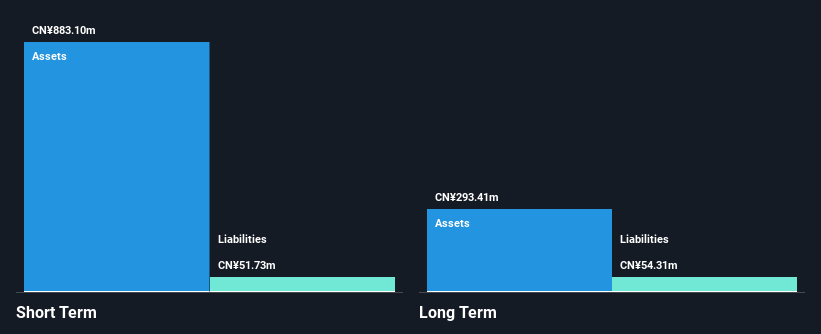

Jenscare Scientific Co., Ltd. is a medical device company with a market cap of HK$1.16 billion, focusing on interventional products for structural heart diseases in China. The company remains pre-revenue, with short-term assets (CN¥883.1M) exceeding both its short- and long-term liabilities, indicating solid financial footing despite unprofitability and negative return on equity (-28.65%). Recent clinical trial results for the LuX-Valve Plus system demonstrated safety and efficacy in treating tricuspid regurgitation, potentially boosting future growth prospects as more studies are underway globally. Jenscare maintains a cash runway of over two years without significant shareholder dilution recently.

- Take a closer look at Jenscare Scientific's potential here in our financial health report.

- Gain insights into Jenscare Scientific's future direction by reviewing our growth report.

Summing It All Up

- Embark on your investment journey to our 5,774 Penny Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9877

Jenscare Scientific

A medical device company, engages in the research and development of interventional products for the treatment of structural heart diseases in the People’s Republic of China.

Excellent balance sheet low.