AEON Stores (Hong Kong)'s (HKG:984) Stock Price Has Reduced 74% In The Past Five Years

Statistically speaking, long term investing is a profitable endeavour. But along the way some stocks are going to perform badly. For example the AEON Stores (Hong Kong) Co., Limited (HKG:984) share price dropped 74% over five years. That's not a lot of fun for true believers. We also note that the stock has performed poorly over the last year, with the share price down 40%. Furthermore, it's down 18% in about a quarter. That's not much fun for holders.

See our latest analysis for AEON Stores (Hong Kong)

AEON Stores (Hong Kong) wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, AEON Stores (Hong Kong) grew its revenue at 2.1% per year. That's far from impressive given all the money it is losing. It's not so sure that share price crash of 12% per year is completely deserved, but the market is doubtless disappointed. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

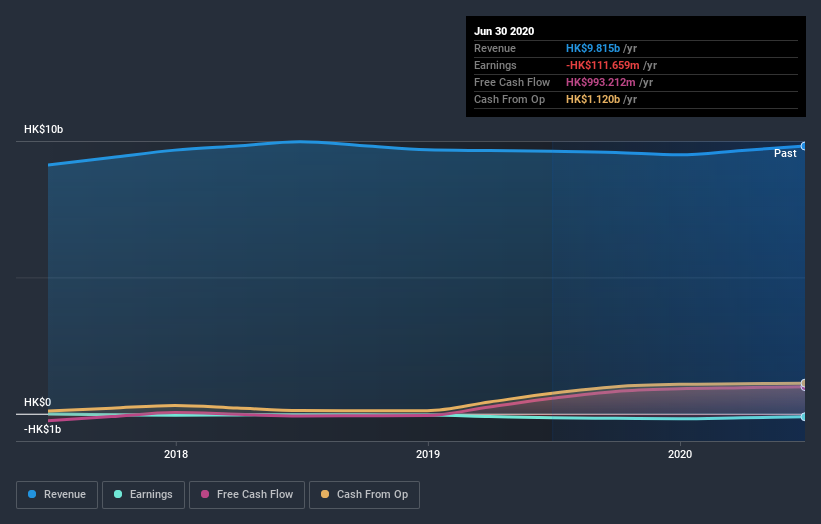

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling AEON Stores (Hong Kong) stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for AEON Stores (Hong Kong) the TSR over the last 5 years was -62%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

AEON Stores (Hong Kong) shareholders are down 37% for the year (even including dividends), but the market itself is up 6.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand AEON Stores (Hong Kong) better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for AEON Stores (Hong Kong) (of which 1 makes us a bit uncomfortable!) you should know about.

Of course AEON Stores (Hong Kong) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading AEON Stores (Hong Kong) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:984

AEON Stores (Hong Kong)

Operates retail stores in Hong Kong and Mainland China.

Good value with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success