- Hong Kong

- /

- Retail Distributors

- /

- SEHK:915

While shareholders of Daohe Global Group (HKG:915) are in the black over 1 year, those who bought a week ago aren't so fortunate

It might be of some concern to shareholders to see the Daohe Global Group Limited (HKG:915) share price down 18% in the last month. On the other hand, over the last twelve months the stock has delivered rather impressive returns. We're very pleased to report the share price shot up 282% in that time. So it is important to view the recent reduction in price through that lense. Only time will tell if there is still too much optimism currently reflected in the share price.

While the stock has fallen 14% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Daohe Global Group

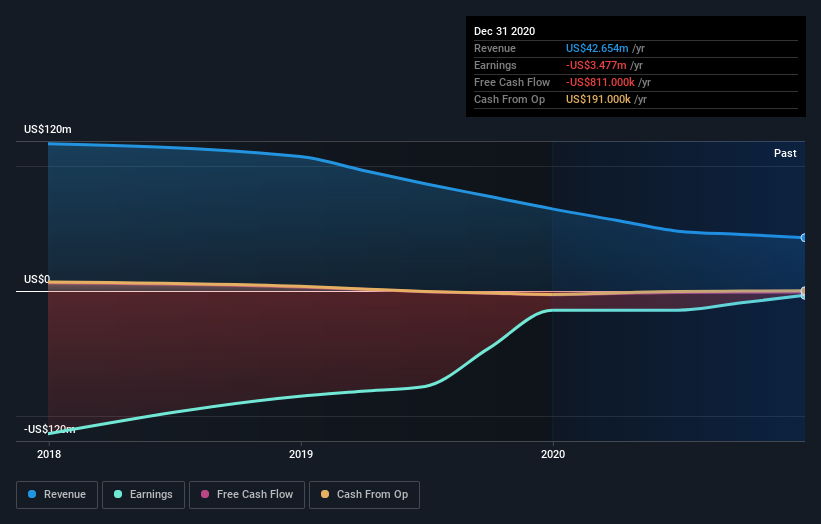

Given that Daohe Global Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Daohe Global Group actually shrunk its revenue over the last year, with a reduction of 35%. We're a little surprised to see the share price pop 282% in the last year. It just goes to show the market doesn't always pay attention to the reported numbers. Of course, it could be that the market expected this revenue drop.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Daohe Global Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Daohe Global Group has rewarded shareholders with a total shareholder return of 282% in the last twelve months. That certainly beats the loss of about 12% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Daohe Global Group you should be aware of, and 1 of them can't be ignored.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:915

Daohe Global Group

An investment holding company, engages in the sale of merchandise in the People’s Republic of China, Southern Hemisphere, North America, Europe, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives