- Hong Kong

- /

- Specialty Stores

- /

- SEHK:8418

Does Optima Automobile Group Holdings' (HKG:8418) Share Price Gain of 25% Match Its Business Performance?

Optima Automobile Group Holdings Limited (HKG:8418) shareholders might be concerned after seeing the share price drop 13% in the last quarter. Taking a longer term view we see the stock is up over one year. In that time, it is up 25%, which isn't bad, but is below the market return of 25%.

See our latest analysis for Optima Automobile Group Holdings

Optima Automobile Group Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Optima Automobile Group Holdings actually shrunk its revenue over the last year, with a reduction of 23%. The stock is up 25% in that time, a fine performance given the revenue drop. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

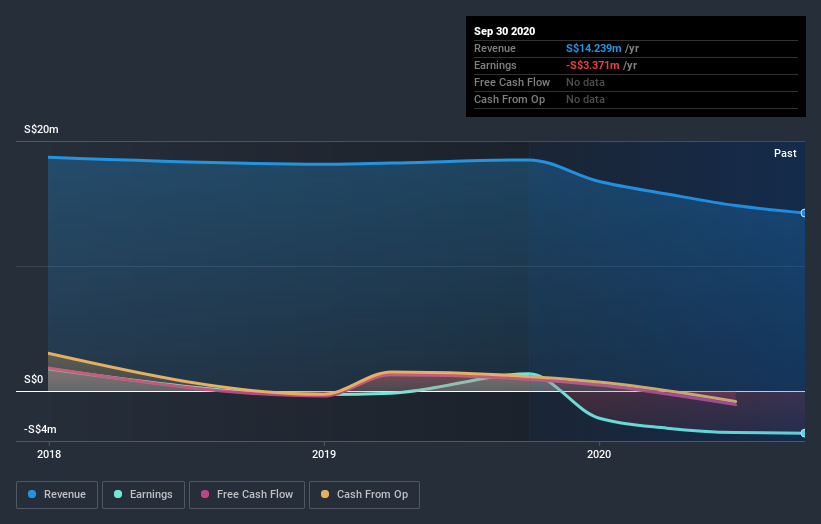

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Optima Automobile Group Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

With a TSR of 25% over the last year, Optima Automobile Group Holdings shareholders would be reasonably content, given that's not far from the broader market return of 25%. Unfortunately the share price is down 13% over the last quarter. This could simply be a short term fluctuation, though. Even the biggest winners have their down periods. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Optima Automobile Group Holdings (at least 1 which is significant) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Optima Automobile Group Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8418

Optima Automobile Group Holdings

An investment holding company, provides after-market automotive services in Singapore and the People’s Republic of China.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives