- Hong Kong

- /

- Real Estate

- /

- SEHK:618

Asian Penny Stocks: Peking University Resources (Holdings) And 2 More To Watch Closely

Reviewed by Simply Wall St

Amidst global market fluctuations, Asian markets have been navigating challenges such as AI-related concerns and economic uncertainties. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated moniker—still represent an intriguing investment area with potential value. By focusing on those with solid financial foundations, these stocks can offer both stability and growth opportunities, making them worth a closer look for those seeking promising investments in the region.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.49 | HK$921.6M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.47 | HK$2.05B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.01 | SGD409.34M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.94 | THB2.96B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.097 | SGD50.78M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.33 | SGD13.11B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.94 | HK$2.52B | ✅ 3 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.03 | NZ$146.62M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.80 | NZ$235.47M | ✅ 4 ⚠️ 2 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.455 | SGD170.45M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 962 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Peking University Resources (Holdings) (SEHK:618)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Peking University Resources (Holdings) Company Limited operates in the e-commerce and distribution sectors across Hong Kong, Mainland China, and Singapore, with a market cap of HK$602.23 million.

Operations: The company's revenue is primarily derived from its e-commerce and distribution segment at CN¥711.86 million, followed by property development at CN¥605.23 million, medical and pharmaceutical retail at CN¥190.76 million, and property investment and management contributing CN¥110.69 million.

Market Cap: HK$602.23M

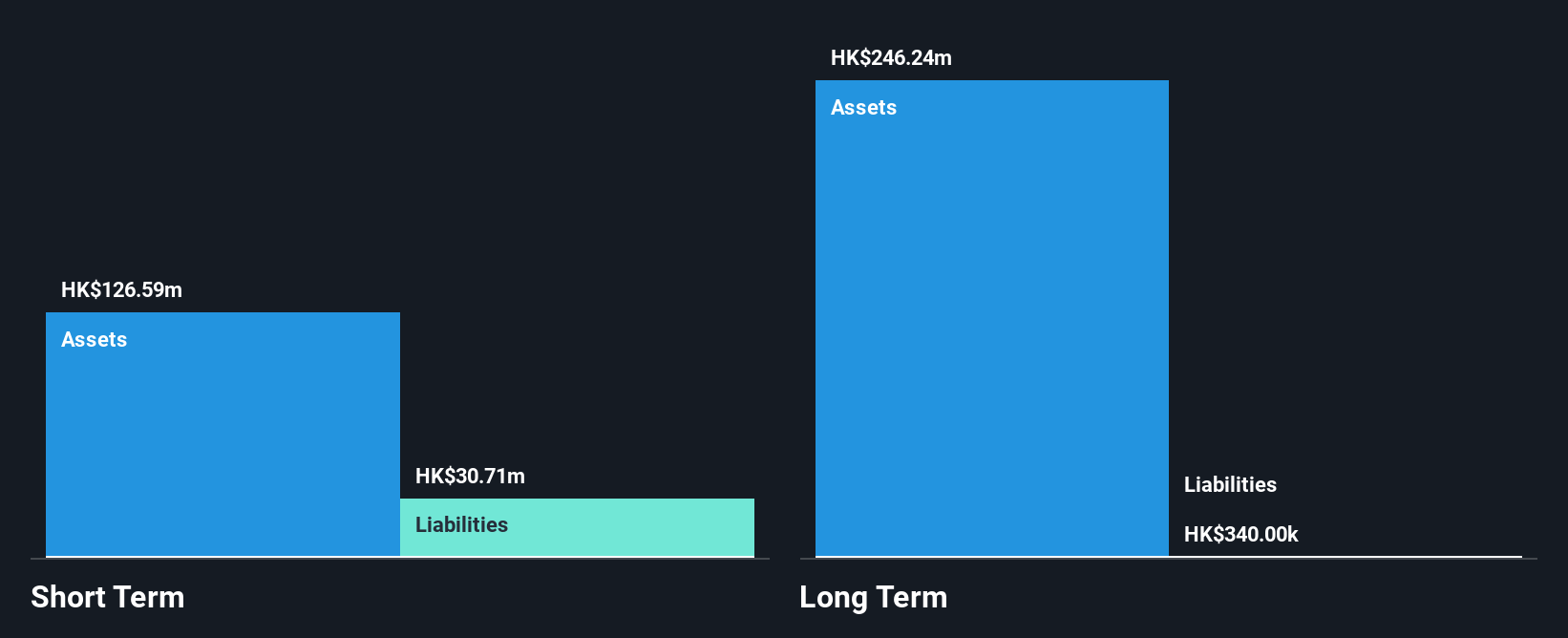

Peking University Resources (Holdings) is navigating financial challenges with a high net debt to equity ratio of 293.6% and an unprofitable status, though it has reduced its losses over the past five years. The company recently provided earnings guidance indicating a potential profit due to a significant gain from disposing of its property development business, which may alleviate some financial burdens. Additionally, the establishment of an AI Healthcare Services Advisory Board suggests strategic diversification into healthcare, potentially enhancing future growth prospects despite current volatility in share price and liabilities exceeding short-term assets.

- Navigate through the intricacies of Peking University Resources (Holdings) with our comprehensive balance sheet health report here.

- Assess Peking University Resources (Holdings)'s previous results with our detailed historical performance reports.

China Brilliant Global (SEHK:8026)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Brilliant Global Limited is an investment holding company involved in the R&D, design, wholesale, and retail of gold and jewelry in Hong Kong and China, with a market cap of HK$751.89 million.

Operations: The company generates revenue from its Gold and Jewellery Business (HK$48.42 million), Property Management Services Business (HK$29.42 million), and Lending Business (HK$0.51 million).

Market Cap: HK$751.89M

China Brilliant Global Limited has achieved profitability in the past year, supported by a seasoned management team and experienced board. The company's debt is well covered by operating cash flow, and it holds more cash than total debt, indicating robust financial health. However, its return on equity remains low at 2.9%, and share price volatility is high compared to other Hong Kong stocks. Recent earnings reported sales of HK$44.81 million for the half-year ending September 2025, with net income slightly declining from the previous year, reflecting stable yet modest financial performance amidst market fluctuations.

- Dive into the specifics of China Brilliant Global here with our thorough balance sheet health report.

- Gain insights into China Brilliant Global's historical outcomes by reviewing our past performance report.

AGTech Holdings (SEHK:8279)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AGTech Holdings Limited is an investment holding company that offers digital banking and payment services in Mainland China, Macau, and internationally, with a market cap of HK$2.39 billion.

Operations: The company's revenue is primarily derived from its Electronic Payment and Related Services segment at HK$307.26 million, followed by Lottery Operation at HK$239.95 million, and Banking Business contributing HK$67.76 million.

Market Cap: HK$2.39B

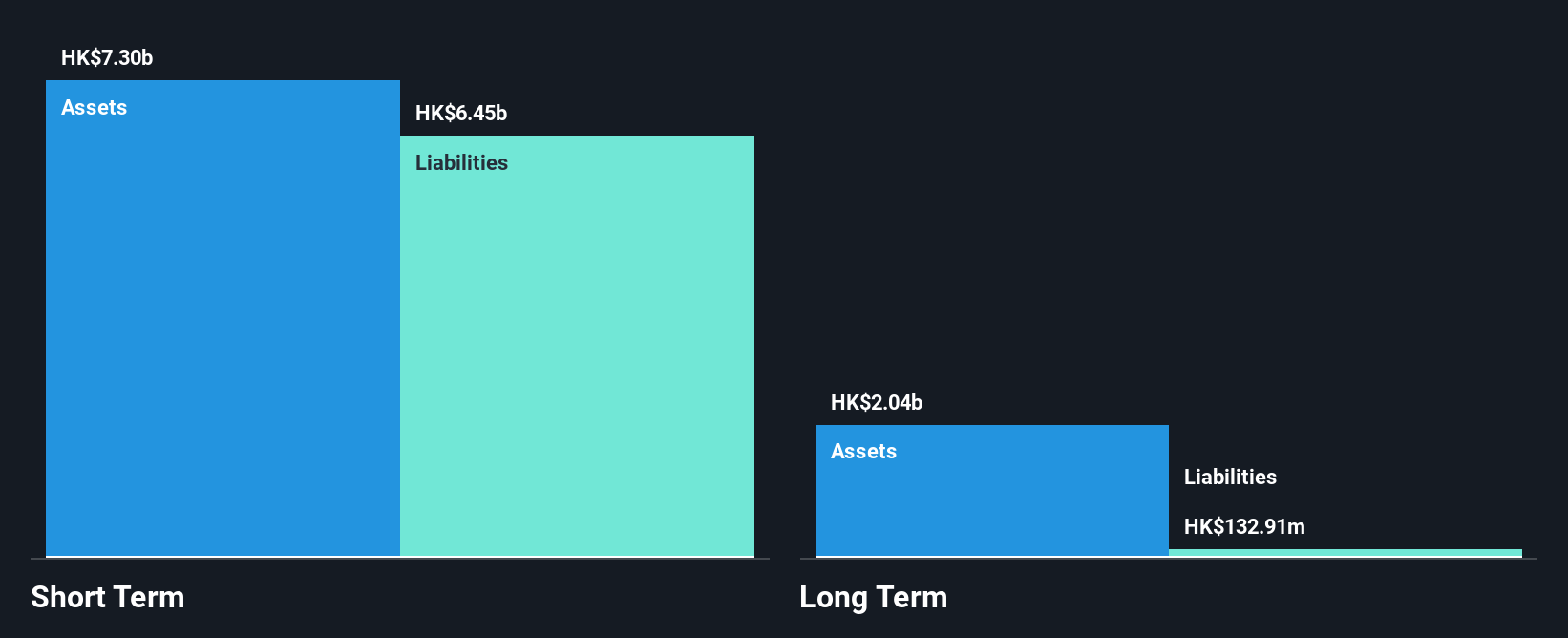

AGTech Holdings is navigating financial challenges despite a significant revenue increase due to the full consolidation of Ant Bank (Macao). The company's short-term assets exceed its liabilities, and it has no debt, indicating solid liquidity. However, AGTech remains unprofitable with a negative return on equity and reported increased losses attributable to higher operating expenses and interest costs from Ant Bank (Macao). While cash reserves provide a runway for over three years, recent guidance anticipates further losses driven by foreign exchange impacts and fair value adjustments on loans. Management tenure data is insufficient for assessing experience levels.

- Click here to discover the nuances of AGTech Holdings with our detailed analytical financial health report.

- Explore historical data to track AGTech Holdings' performance over time in our past results report.

Taking Advantage

- Take a closer look at our Asian Penny Stocks list of 962 companies by clicking here.

- Curious About Other Options? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:618

Peking University Resources (Holdings)

Engages in e-commerce and distribution business in Hong Kong, Mainland China, and Singapore.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives