- Hong Kong

- /

- Specialty Stores

- /

- SEHK:6110

What Topsports International Holdings (SEHK:6110)'s Lower Dividend and Earnings Reveal for Shareholders

Reviewed by Sasha Jovanovic

- Topsports International Holdings Limited recently announced a lower interim dividend of RMB 0.13 per share for the six months ended August 31, 2025, to be paid in December, following the release of its half-year results showing decreased sales and net income compared to a year earlier.

- This reduction in both dividend and earnings highlights ongoing challenges in retail operations and may signal shifts in investor expectations around the company’s return profile and financial resilience.

- We’ll explore how the reduced interim dividend may alter Topsports International’s investment outlook, especially in light of softer recent earnings results.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Topsports International Holdings Investment Narrative Recap

To be a shareholder in Topsports International Holdings, you need to believe that the company can stabilize its retail operations, particularly in boosting online sales, to mitigate continued pressure in its offline channels. The recent interim dividend reduction is a clear signal of management’s caution, but it does not materially alter the short-term catalyst: the execution of inventory management and online channel growth. The biggest risk remains declining offline sales and persistent margin pressure from heavy discounting.

The most relevant announcement to the dividend cut is the half-year earnings result, which showed a year-over-year drop in both sales and net income. This underlines the challenges Topsports faces in maintaining profitability, and provides important context for the company’s decision to trim shareholder payouts amid an environment of lower sales and earnings.

On the other hand, investors should be aware of ongoing risks around gross margin if deep discounts remain necessary to...

Read the full narrative on Topsports International Holdings (it's free!)

Topsports International Holdings is projected to achieve CN¥28.6 billion in revenue and CN¥1.8 billion in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 1.9% and a CN¥0.5 billion increase in earnings from the current CN¥1.3 billion.

Uncover how Topsports International Holdings' forecasts yield a HK$3.89 fair value, a 24% upside to its current price.

Exploring Other Perspectives

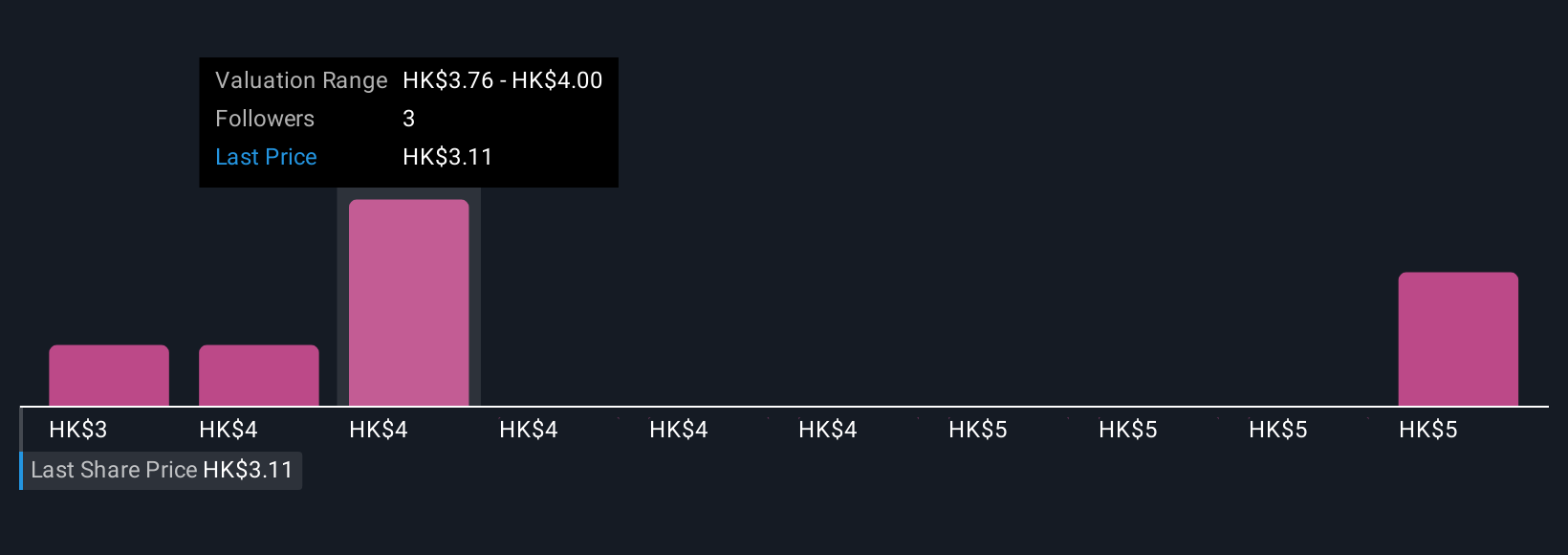

Four estimates from the Simply Wall St Community put fair value between HK$3.28 and HK$5.73 per share. Considering ongoing pressure on gross margins, it’s clear opinions vary on how Topsports will manage profitability, compare these differences to your own view of the company’s prospects.

Explore 4 other fair value estimates on Topsports International Holdings - why the stock might be worth as much as 83% more than the current price!

Build Your Own Topsports International Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Topsports International Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Topsports International Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Topsports International Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topsports International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6110

Topsports International Holdings

An investment holding company, engages in the trading of sportswear products in the People’s Republic of China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives