- Hong Kong

- /

- Specialty Stores

- /

- SEHK:6110

Is Topsports International Holdings Limited's (HKG:6110) Recent Stock Performance Influenced By Its Financials In Any Way?

Most readers would already know that Topsports International Holdings' (HKG:6110) stock increased by 4.6% over the past month. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to investigate if the company's decent financials had a hand to play in the recent price move. In this article, we decided to focus on Topsports International Holdings' ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Topsports International Holdings is:

13% = CN¥1.2b ÷ CN¥9.0b (Based on the trailing twelve months to August 2025).

The 'return' refers to a company's earnings over the last year. So, this means that for every HK$1 of its shareholder's investments, the company generates a profit of HK$0.13.

See our latest analysis for Topsports International Holdings

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Topsports International Holdings' Earnings Growth And 13% ROE

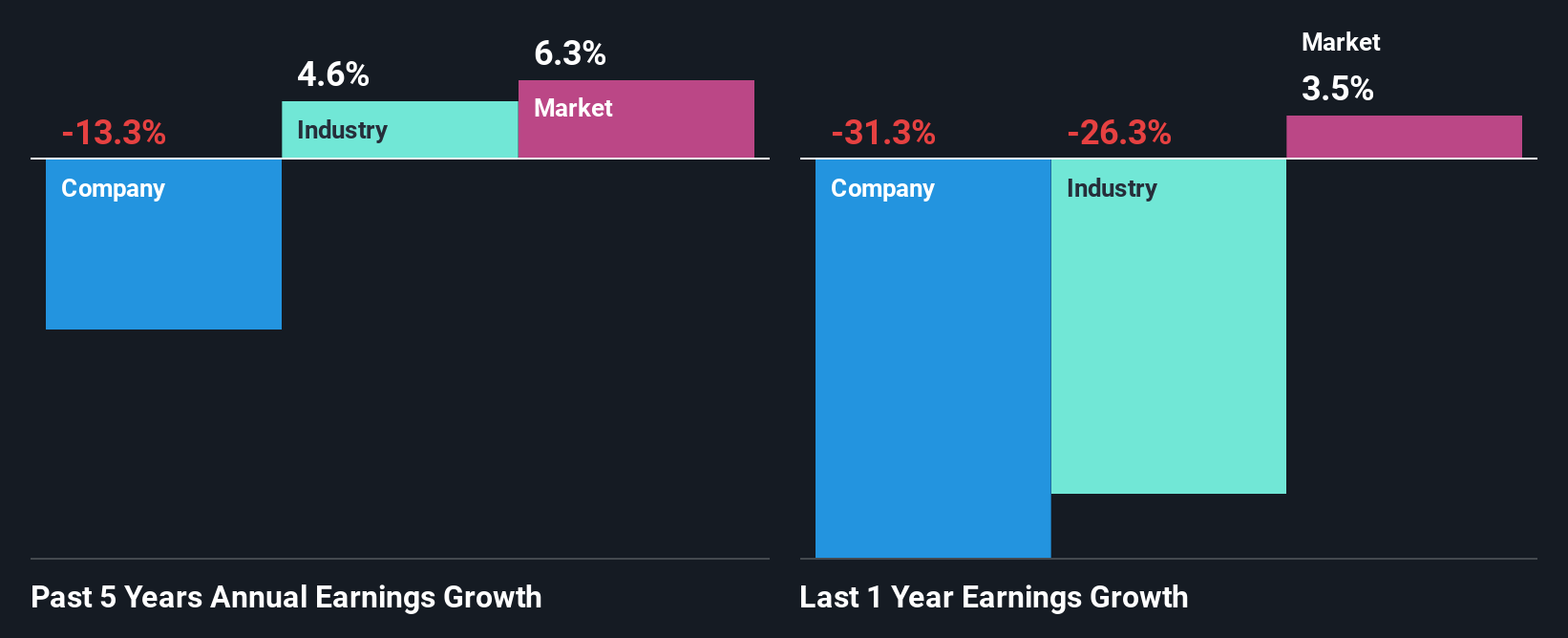

To begin with, Topsports International Holdings seems to have a respectable ROE. Further, the company's ROE compares quite favorably to the industry average of 5.6%. For this reason, Topsports International Holdings' five year net income decline of 13% raises the question as to why the high ROE didn't translate into earnings growth. We reckon that there could be some other factors at play here that are preventing the company's growth. These include low earnings retention or poor allocation of capital.

However, when we compared Topsports International Holdings' growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 4.6% in the same period. This is quite worrisome.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Has the market priced in the future outlook for 6110? You can find out in our latest intrinsic value infographic research report.

Is Topsports International Holdings Using Its Retained Earnings Effectively?

Topsports International Holdings' declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 63% (or a retention ratio of 37%). The business is only left with a small pool of capital to reinvest - A vicious cycle that doesn't benefit the company in the long-run.

Additionally, Topsports International Holdings has paid dividends over a period of six years, which means that the company's management is rather focused on keeping up its dividend payments, regardless of the shrinking earnings. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 74%. Regardless, the future ROE for Topsports International Holdings is predicted to rise to 22% despite there being not much change expected in its payout ratio.

Conclusion

In total, it does look like Topsports International Holdings has some positive aspects to its business. Yet, the low earnings growth is a bit concerning, especially given that the company has a high rate of return. Investors could have benefitted from the high ROE, had the company been reinvesting more of its earnings. As discussed earlier, the company is retaining a small portion of its profits. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're here to simplify it.

Discover if Topsports International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6110

Topsports International Holdings

An investment holding company, engages in the trading of sportswear products in the People’s Republic of China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success