A Look At Shirble Department Store Holdings (China)'s (HKG:312) Share Price Returns

As every investor would know, you don't hit a homerun every time you swing. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. It must have been painful to be a Shirble Department Store Holdings (China) Limited (HKG:312) shareholder over the last year, since the stock price plummeted 72% in that time. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. Notably, shareholders had a tough run over the longer term, too, with a drop of 35% in the last three years. It's down 1.3% in the last seven days.

See our latest analysis for Shirble Department Store Holdings (China)

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Shirble Department Store Holdings (China) share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

It's surprising to see the share price fall so much, despite the improved EPS. So it's easy to justify a look at some other metrics.

We don't see any weakness in the Shirble Department Store Holdings (China)'s dividend so the steady payout can't really explain the share price drop. We'd be more worried about the fact that revenue fell 26% year on year. The market may be extrapolating the decline, leading to questions around the sustainability of the EPS.

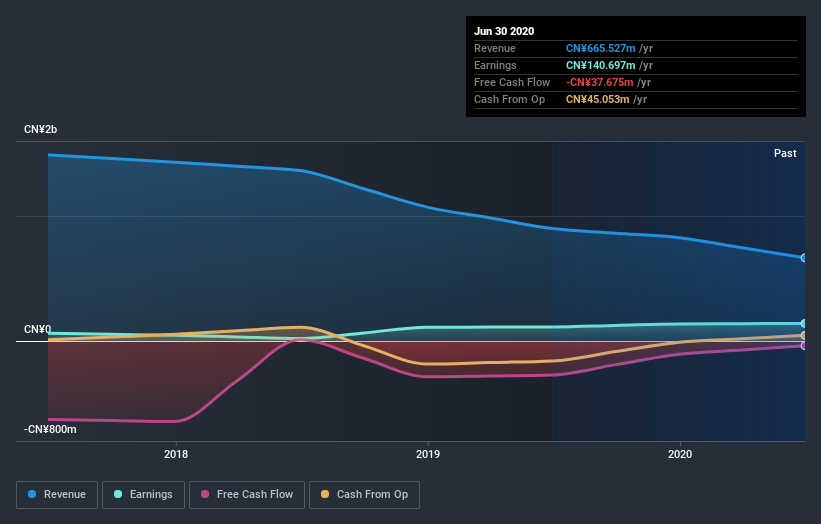

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in Shirble Department Store Holdings (China) had a tough year, with a total loss of 71% (including dividends), against a market gain of about 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Shirble Department Store Holdings (China) better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Shirble Department Store Holdings (China) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Shirble Department Store Holdings (China), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:312

Shirble Department Store Holdings (China)

An investment holding company, engages in department store operations and property development in the People’s Republic of China.

Good value with mediocre balance sheet.

Market Insights

Community Narratives