- Hong Kong

- /

- Specialty Stores

- /

- SEHK:2209

Asian Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

As the Asian markets navigate a complex landscape marked by global economic shifts and evolving investor sentiment, opportunities in niche sectors like penny stocks continue to capture attention. Despite their somewhat antiquated name, penny stocks represent smaller or newer companies that can offer significant growth potential at accessible price points. By focusing on those with strong financial foundations and solid fundamentals, investors may find these under-the-radar options provide a unique chance for portfolio diversification amidst broader market dynamics.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.48 | HK$927.78M | ✅ 4 ⚠️ 1 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.98 | THB3.09B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.49 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.06 | SGD429.61M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.94 | THB2.96B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.10 | SGD52.35M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.39 | SGD13.34B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.94 | HK$2.52B | ✅ 3 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.04 | NZ$148.04M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.80 | NZ$239.67M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 949 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

YesAsia Holdings (SEHK:2209)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: YesAsia Holdings Limited (SEHK:2209) is an investment holding company involved in trading Asian fashion, lifestyle, beauty, cosmetics, accessories, and entertainment products with a market cap of HK$1.98 billion.

Operations: The company generates revenue from two primary segments: Entertainment Products, contributing $1.86 million, and Fashion & Lifestyle and Beauty Products, which account for $424.02 million.

Market Cap: HK$1.98B

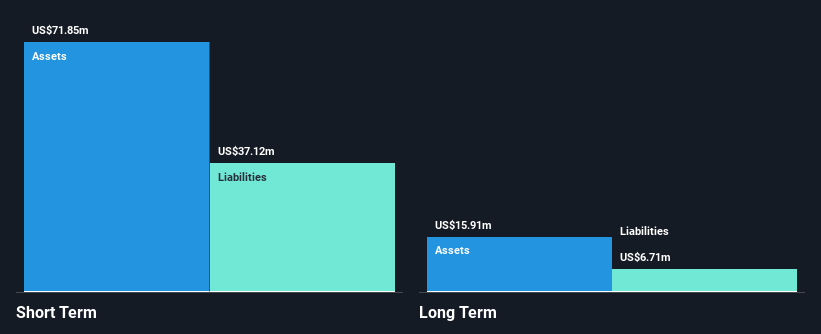

YesAsia Holdings has demonstrated robust financial performance, with earnings growing by 28.9% over the past year and surpassing industry averages. The company recently completed a follow-on equity offering of HK$22.76 million, strengthening its capital base without significant shareholder dilution. Its seasoned management and board provide strategic stability, while strong operating cash flow effectively covers debt obligations. Despite a decrease in net profit margins from 6.2% to 5.2%, the company's return on equity remains high at 33.2%. YesAsia's short-term assets comfortably cover both short- and long-term liabilities, reflecting solid financial health in the penny stock sector.

- Unlock comprehensive insights into our analysis of YesAsia Holdings stock in this financial health report.

- Evaluate YesAsia Holdings' prospects by accessing our earnings growth report.

China Shanshui Cement Group (SEHK:691)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Shanshui Cement Group Limited is an investment holding company involved in the manufacture and sale of cement, clinker, concrete, and related products in China with a market capitalization of approximately HK$3.22 billion.

Operations: The company's revenue is primarily derived from its manufacturing and trading operations of cement, clinker, and concrete, amounting to CN¥13.50 billion.

Market Cap: HK$3.22B

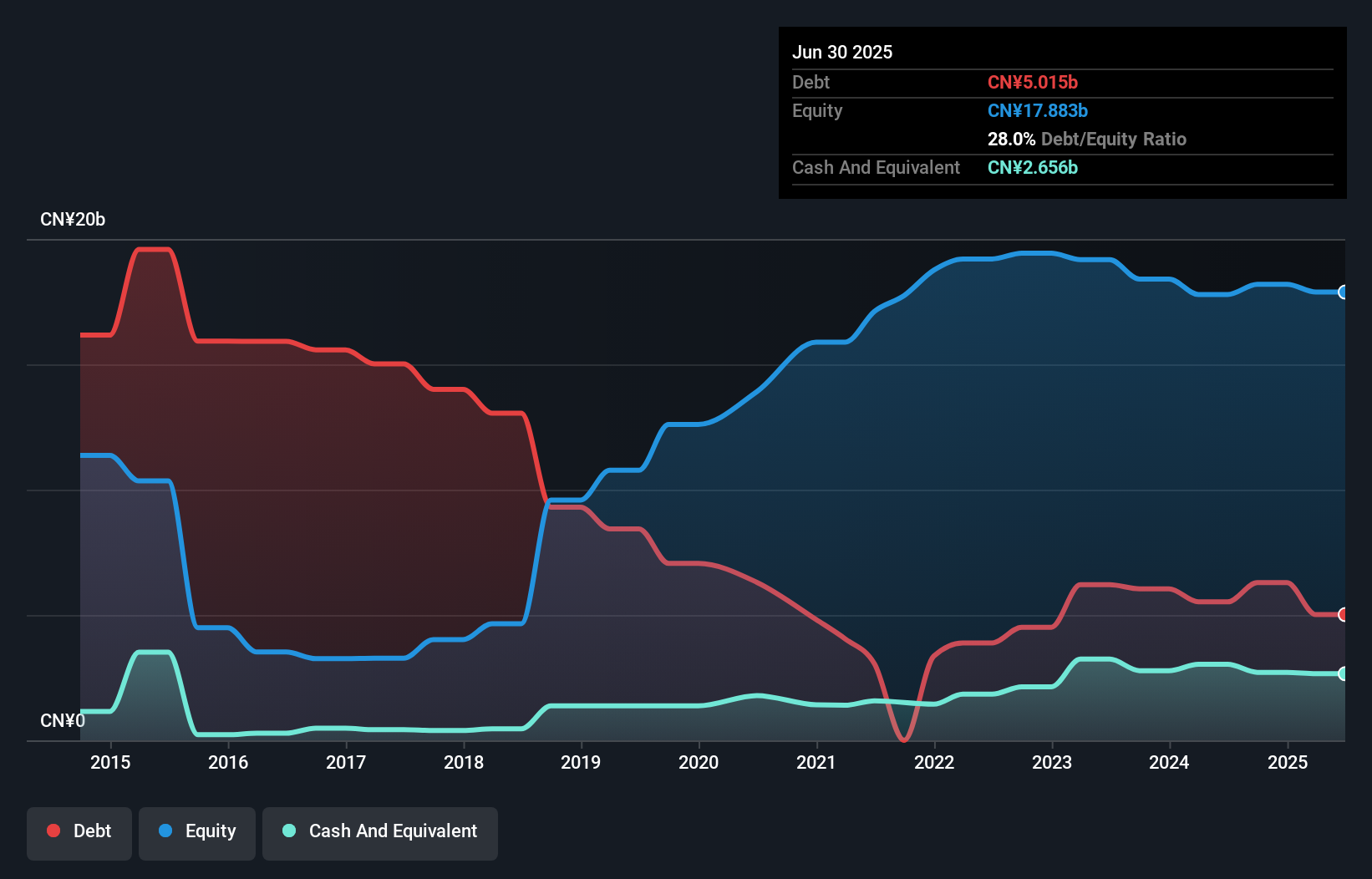

China Shanshui Cement Group has recently turned profitable, contrasting its previous five-year earnings decline. Despite this shift, the company's return on equity remains low at 0.7%, and short-term liabilities of CN¥9.7 billion exceed assets by CN¥1.5 billion, indicating liquidity constraints. However, long-term liabilities are well-covered by short-term assets of CN¥8.2 billion. The board's average tenure is 7.3 years, suggesting experienced governance, while debt levels have improved with a satisfactory net debt to equity ratio of 18.3%. Interest payments are well-covered by EBIT at 9.3 times coverage despite operating cash flow inadequately covering debt obligations.

- Click here and access our complete financial health analysis report to understand the dynamics of China Shanshui Cement Group.

- Assess China Shanshui Cement Group's previous results with our detailed historical performance reports.

Thai Wah (SET:TWPC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thai Wah Public Company Limited, with a market cap of THB2.55 billion, operates in the manufacturing and distribution of vermicelli, starch, and other food and agricultural products across Thailand, Vietnam, China, Cambodia, and Indonesia.

Operations: The company's revenue is primarily derived from its Starch segment, which generated THB6.99 billion, and its Food segment, which contributed THB2.53 billion.

Market Cap: THB2.55B

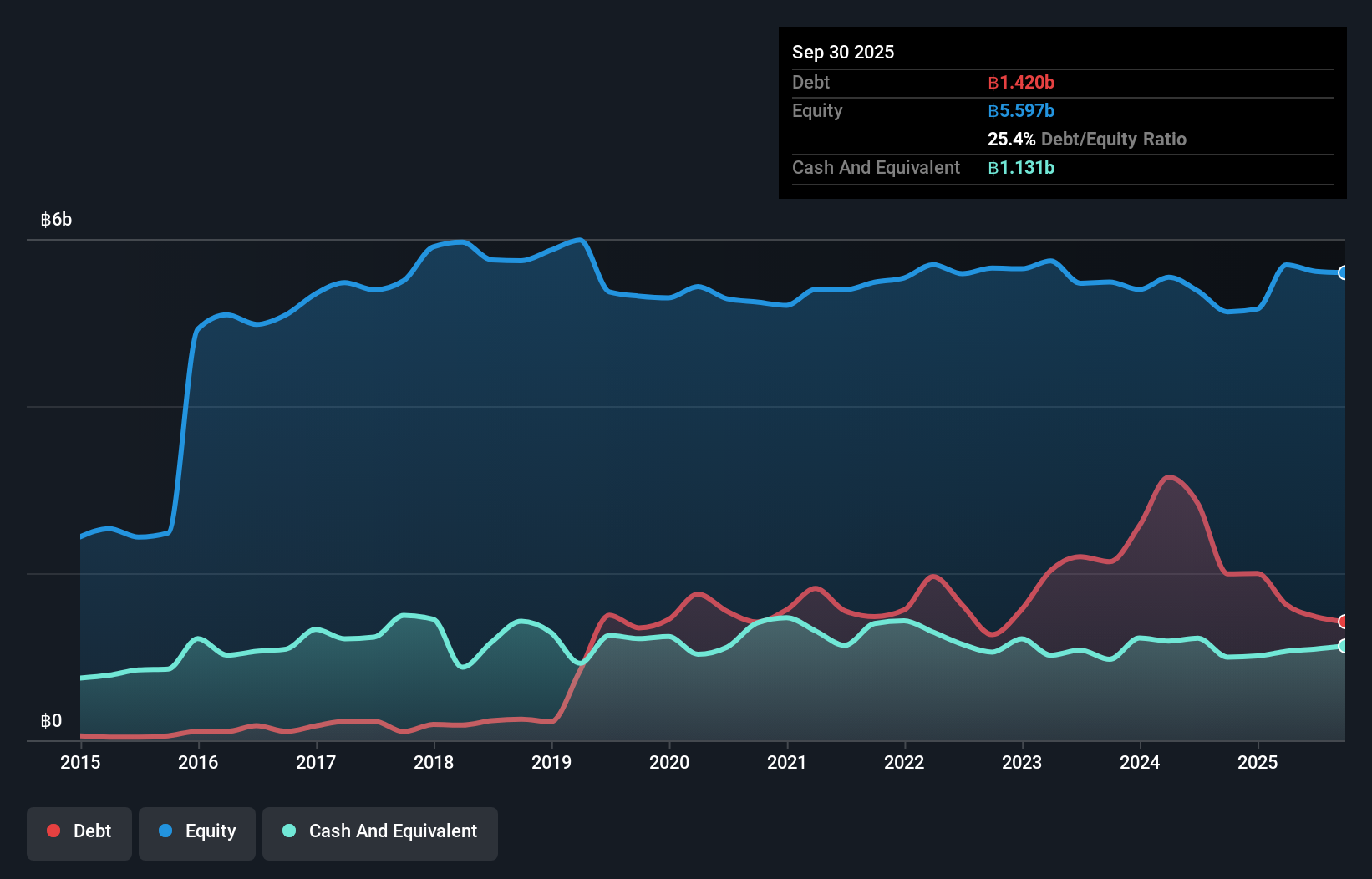

Thai Wah Public Company Limited has recently achieved profitability, reversing its previous earnings decline. The company's net income for the third quarter of 2025 reached THB17.7 million, a significant improvement from a net loss in the previous year. With a market cap of THB2.55 billion, Thai Wah benefits from satisfactory debt management, evidenced by a net debt to equity ratio of 5.2% and strong interest coverage at 6.3 times EBIT. However, its return on equity remains low at 2.8%. Recent developments include an acquisition proposal by Ho KwonPing to increase his stake in the company, highlighting investor interest despite share price volatility.

- Jump into the full analysis health report here for a deeper understanding of Thai Wah.

- Understand Thai Wah's earnings outlook by examining our growth report.

Seize The Opportunity

- Navigate through the entire inventory of 949 Asian Penny Stocks here.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2209

YesAsia Holdings

An investment holding company, engages in trading of Asian fashion and lifestyle, beauty, cosmetics, accessories, and entertainment products.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives