- Hong Kong

- /

- Real Estate

- /

- SEHK:960

If You Like EPS Growth Then Check Out Longfor Group Holdings (HKG:960) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Longfor Group Holdings (HKG:960). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Longfor Group Holdings

Longfor Group Holdings's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Longfor Group Holdings managed to grow EPS by 12% per year, over three years. That's a good rate of growth, if it can be sustained.

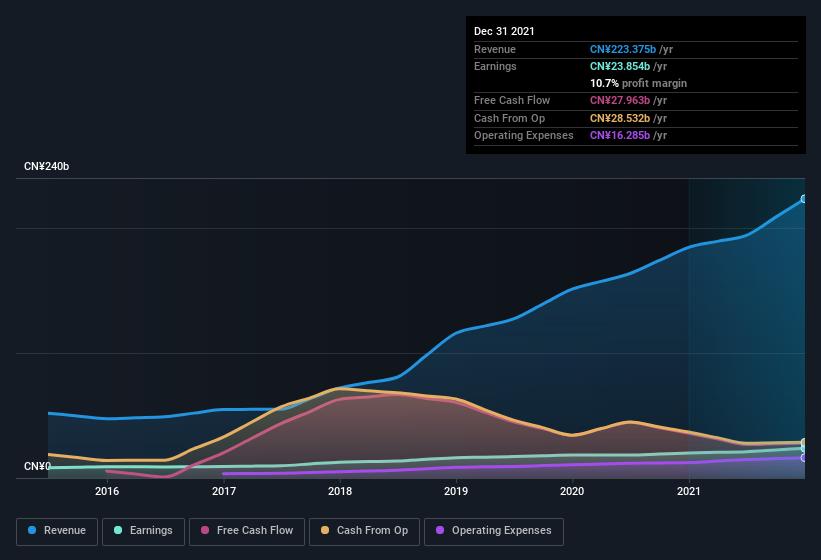

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the one hand, Longfor Group Holdings's EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Longfor Group Holdings's forecast profits?

Are Longfor Group Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold -CN¥9.9m worth of shares. But that's far less than the CN¥160m insiders spend purchasing stock. This makes me even more interested in Longfor Group Holdings because it suggests that those who understand the company best, are optimistic. It is also worth noting that it was Kwong Ching Woo who made the biggest single purchase, worth HK$70m, paying HK$41.25 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Longfor Group Holdings insiders own more than a third of the company. In fact, they own 52% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. And their holding is extremely valuable at the current share price, totalling CN¥123b. Now that's what I call some serious skin in the game!

Does Longfor Group Holdings Deserve A Spot On Your Watchlist?

One important encouraging feature of Longfor Group Holdings is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. What about risks? Every company has them, and we've spotted 4 warning signs for Longfor Group Holdings (of which 1 is a bit unpleasant!) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Longfor Group Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:960

Longfor Group Holdings

An investment holding company, engages in the property development, investment, and management businesses in the People’s Republic of China.

Undervalued moderate and pays a dividend.