- Hong Kong

- /

- Retail REITs

- /

- SEHK:823

Link Real Estate Investment Trust (SEHK:823) Eyes Growth with Product Innovations and Market Opportunities

Reviewed by Simply Wall St

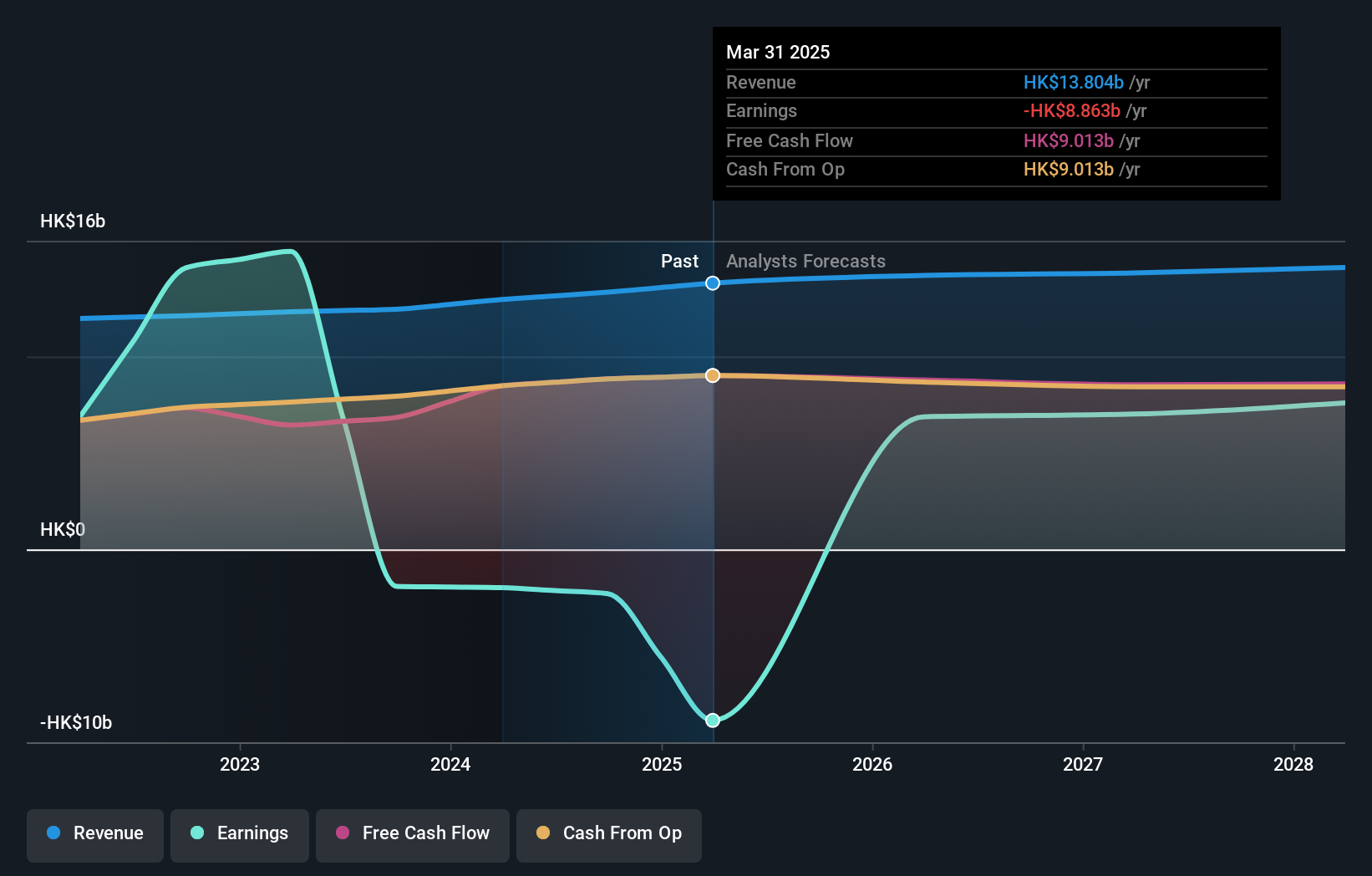

Link Real Estate Investment Trust (SEHK:823) has demonstrated significant growth with a 15% revenue increase year-over-year, fueled by strategic expansion and innovative product launches in the Asia-Pacific region. However, challenges such as unprofitability and rising operational costs present hurdles that require strategic management. In the following report, readers can expect a detailed analysis of Link REIT's financial health, market opportunities, and the external factors that may impact its future performance.

Dive into the specifics of Link Real Estate Investment Trust here with our thorough analysis report.

Key Assets Propelling Link Real Estate Investment Trust Forward

Link REIT's strategic expansion in the Asia-Pacific region has driven a remarkable 15% revenue growth year-over-year, underscoring its strong market position. This growth trajectory is complemented by innovative product launches that exceeded sales projections by 20%, showcasing the company's responsiveness to market demands. Additionally, the trust's seasoned management, with an average tenure of 4.6 years, provides stability and strategic foresight, crucial for navigating complex market dynamics. Financially, Link REIT maintains a satisfactory net debt to equity ratio of 31.3%, with interest payments well-covered by EBIT, indicating solid fiscal health. Despite trading at a Price-To-Sales Ratio of 7.3x, which is higher than the Asian Retail REITs average of 6.9x, it remains competitively valued against peers.

To gain deeper insights into Link Real Estate Investment Trust's historical performance, explore our detailed analysis of past performance.Internal Limitations Hindering Link Real Estate Investment Trust's Growth

Challenges arise as Link REIT grapples with unprofitability and a return on equity of -1.38%. Revenue growth forecasts of 4.3% lag behind the Hong Kong market's 7.7%, highlighting potential strategic misalignments. The volatility in dividend payments over the past decade further complicates investor confidence. Additionally, the company's operational costs have surged by 10% due to supply chain disruptions, necessitating strategic cost management initiatives. These financial hurdles, coupled with an expensive Price-To-Sales Ratio, underscore the need for a recalibrated market approach.

To dive deeper into how Link Real Estate Investment Trust's valuation metrics are shaping its market position, check out our detailed analysis of Link Real Estate Investment Trust's Valuation.Emerging Markets Or Trends for Link Real Estate Investment Trust

Trading at 17.1% below estimated fair value, Link REIT presents a compelling opportunity for price appreciation. The forecasted earnings growth of 37.17% per year signals potential for substantial financial improvement. Strategic alliances and product innovations could further bolster its market position, enabling the trust to capitalize on emerging trends and expand its footprint. By leveraging these opportunities, Link REIT can enhance its competitive edge and drive long-term growth.

See what the latest analyst reports say about Link Real Estate Investment Trust's future prospects and potential market movements.External Factors Threatening Link Real Estate Investment Trust

Economic headwinds, including inflation and currency fluctuations, pose significant risks to Link REIT's financial performance. Regulatory changes in key markets could introduce compliance costs, impacting operational efficiency. Additionally, supply chain vulnerabilities remain a persistent challenge, requiring proactive measures to mitigate risks. The unstable dividend track record may deter potential investors, emphasizing the need for consistent financial strategies to maintain market confidence.

Learn about Link Real Estate Investment Trust's dividend strategy and how it impacts shareholder returns and financial stability.Conclusion

Link REIT's strategic expansion and innovative product launches have driven significant revenue growth, underscoring its strong market position and financial health. However, internal challenges such as unprofitability and rising operational costs highlight the need for strategic realignment to enhance profitability and investor confidence. Despite trading at a higher Price-To-Sales Ratio of 7.3x compared to the industry average, its valuation is competitive against peers, suggesting potential for future price appreciation. By addressing external threats like economic fluctuations and regulatory changes, and capitalizing on emerging market opportunities, Link REIT can strengthen its market position and achieve sustainable growth.

Next Steps

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:823

Link Real Estate Investment Trust

Link Real Estate Investment Trust, managed by Link Asset Management Limited, is the largest REIT in Asia, and a leading real estate investor and asset manager in the world.

Average dividend payer and fair value.