- Hong Kong

- /

- Real Estate

- /

- SEHK:6968

What To Know Before Buying Ganglong China Property Group Limited (HKG:6968) For Its Dividend

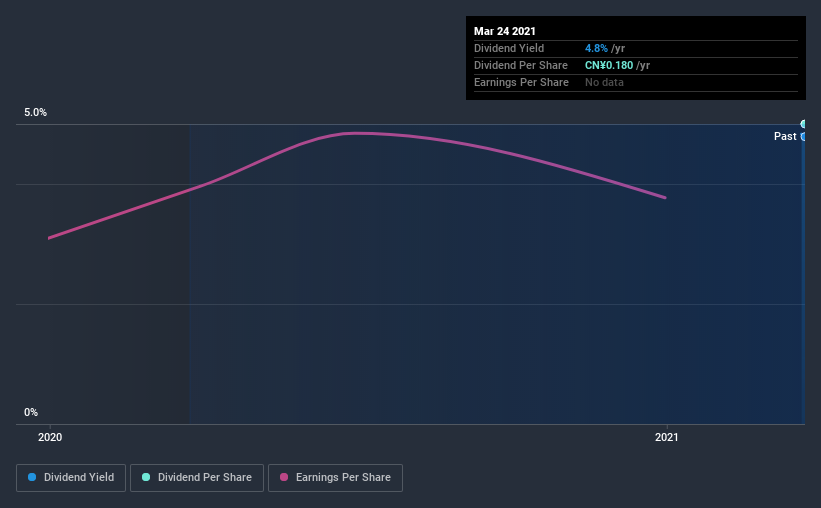

Dividend paying stocks like Ganglong China Property Group Limited (HKG:6968) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on Ganglong China Property Group!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Ganglong China Property Group paid out 27% of its profit as dividends, over the trailing twelve month period. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

Remember, you can always get a snapshot of Ganglong China Property Group's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock. Its most recent annual dividend was CN¥0.2 per share.

It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. Ganglong China Property Group has grown its EPS 22% over the past 12 months. It's good to see earnings per share rising, but one year is too short a period to get excited about. Were this trend to continue, we'd be interested. With high earnings per share growth in recent times and a modest payout ratio, we think this is an attractive combination if earnings can be reinvested to generate further growth. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're glad to see Ganglong China Property Group has a low payout ratio, as this suggests earnings are being reinvested in the business. Next, earnings growth has been good, but unfortunately the company has not been paying dividends as long as we'd like. Overall, we think there are a lot of positives to Ganglong China Property Group from a dividend perspective.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 4 warning signs for Ganglong China Property Group (of which 1 is a bit unpleasant!) you should know about.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you’re looking to trade Ganglong China Property Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6968

Ganglong China Property Group

An investment holding company, engages in the development of real estate projects in the People’s Republic of China.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.