This month, we saw the DreamEast Group Limited (HKG:593) up an impressive 114%. But that is meagre solace in the face of the shocking decline over three years. In that time the share price has melted like a snowball in the desert, down 78%. So we're relieved for long term holders to see a bit of uplift. Of course the real question is whether the business can sustain a turnaround.

View our latest analysis for DreamEast Group

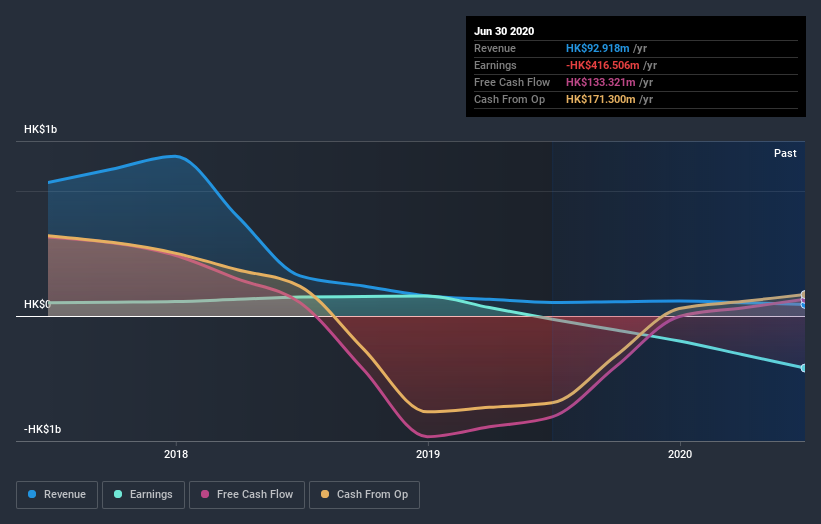

Given that DreamEast Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years DreamEast Group saw its revenue shrink by 92% per year. That means its revenue trend is very weak compared to other loss making companies. And as you might expect the share price has been weak too, dropping at a rate of 21% per year. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at DreamEast Group's financial health with this free report on its balance sheet.

A Different Perspective

Investors in DreamEast Group had a tough year, with a total loss of 48%, against a market gain of about 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for DreamEast Group (of which 2 make us uncomfortable!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade DreamEast Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:593

DreamEast Group

An investment holding company, engages in the property development and leasing, tourism park operation, and offers other services in the People’s Republic of China.

Overvalued with weak fundamentals.

Similar Companies

Market Insights

Community Narratives