Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Tian An China Investments Company Limited (HKG:28) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Tian An China Investments

How Much Debt Does Tian An China Investments Carry?

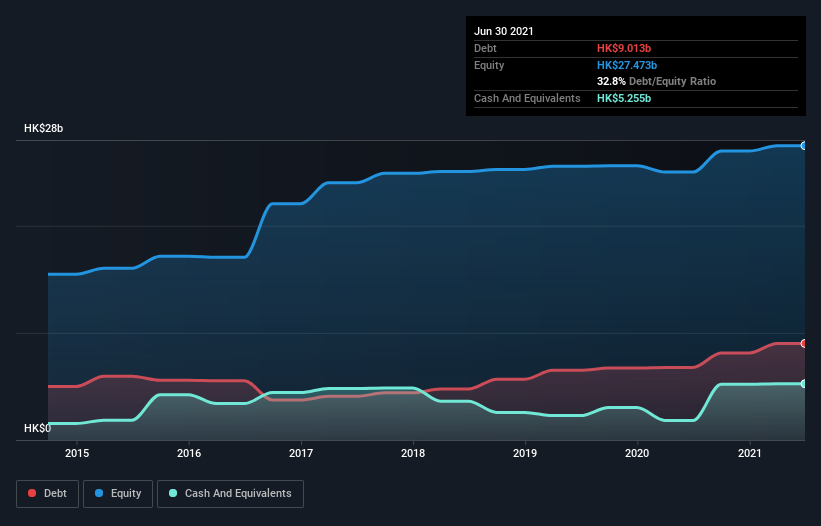

You can click the graphic below for the historical numbers, but it shows that as of June 2021 Tian An China Investments had HK$9.01b of debt, an increase on HK$6.77b, over one year. On the flip side, it has HK$5.26b in cash leading to net debt of about HK$3.76b.

A Look At Tian An China Investments' Liabilities

We can see from the most recent balance sheet that Tian An China Investments had liabilities of HK$10.7b falling due within a year, and liabilities of HK$7.69b due beyond that. Offsetting this, it had HK$5.26b in cash and HK$3.29b in receivables that were due within 12 months. So it has liabilities totalling HK$9.85b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's HK$6.64b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

As it happens Tian An China Investments has a fairly concerning net debt to EBITDA ratio of 9.2 but very strong interest coverage of 1k. This means that unless the company has access to very cheap debt, that interest expense will likely grow in the future. Shareholders should be aware that Tian An China Investments's EBIT was down 23% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Tian An China Investments will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Tian An China Investments burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, Tian An China Investments's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. Taking into account all the aforementioned factors, it looks like Tian An China Investments has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Tian An China Investments (including 1 which is a bit unpleasant) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tian An China Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:28

Tian An China Investments

An investment holding company, invests in, develops, and manages properties in the People's Republic of China, Hong Kong, and the United Kingdom.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives