- Hong Kong

- /

- Real Estate

- /

- SEHK:277

We Wouldn't Be Too Quick To Buy Tern Properties Company Limited (HKG:277) Before It Goes Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Tern Properties Company Limited (HKG:277) is about to go ex-dividend in just three days. If you purchase the stock on or after the 11th of December, you won't be eligible to receive this dividend, when it is paid on the 28th of December.

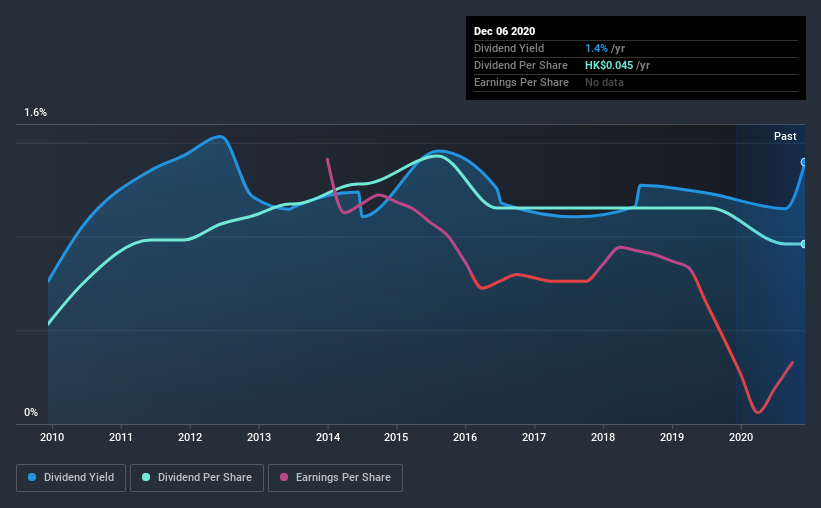

Tern Properties's next dividend payment will be HK$0.015 per share, on the back of last year when the company paid a total of HK$0.045 to shareholders. Last year's total dividend payments show that Tern Properties has a trailing yield of 1.4% on the current share price of HK$3.22. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Tern Properties can afford its dividend, and if the dividend could grow.

See our latest analysis for Tern Properties

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Tern Properties's dividend is not well covered by earnings, as the company lost money last year. This is not a sustainable state of affairs, so it would be worth investigating if earnings are expected to recover. Given that the company reported a loss last year, we now need to see if it generated enough free cash flow to fund the dividend. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. Thankfully its dividend payments took up just 50% of the free cash flow it generated, which is a comfortable payout ratio.

Click here to see how much of its profit Tern Properties paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Tern Properties reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the past 10 years, Tern Properties has increased its dividend at approximately 6.1% a year on average.

We update our analysis on Tern Properties every 24 hours, so you can always get the latest insights on its financial health, here.

To Sum It Up

Should investors buy Tern Properties for the upcoming dividend? We're a bit uncomfortable with it paying a dividend while being loss-making. However, we note that the dividend was covered by cash flow. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Tern Properties.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Tern Properties. Be aware that Tern Properties is showing 3 warning signs in our investment analysis, and 1 of those is significant...

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Tern Properties or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tern Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:277

Tern Properties

An investment holding company, engages in property investment and treasury investment businesses in Hong Kong.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives