- Hong Kong

- /

- Real Estate

- /

- SEHK:1966

Shareholders Will Probably Be Cautious Of Increasing China SCE Group Holdings Limited's (HKG:1966) CEO Compensation At The Moment

Performance at China SCE Group Holdings Limited (HKG:1966) has been reasonably good and CEO Chiu Wong has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 11 June 2021. Here is our take on why we think the CEO compensation looks appropriate.

Check out our latest analysis for China SCE Group Holdings

Comparing China SCE Group Holdings Limited's CEO Compensation With the industry

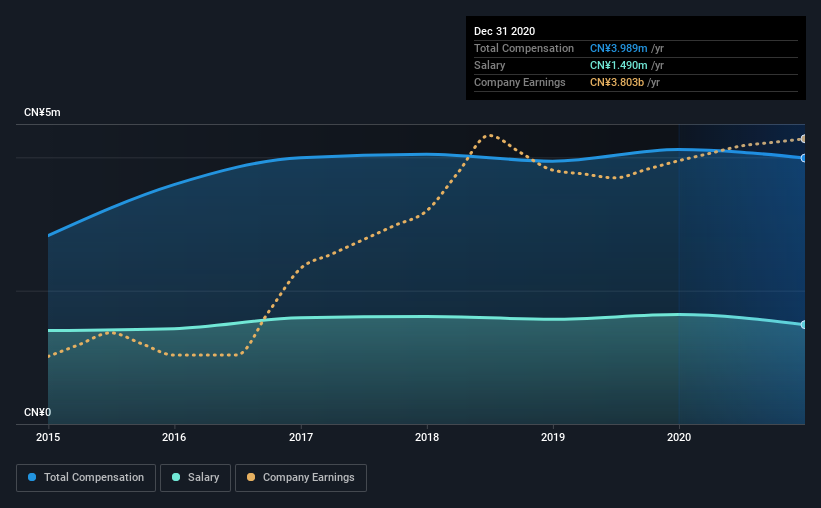

Our data indicates that China SCE Group Holdings Limited has a market capitalization of HK$15b, and total annual CEO compensation was reported as CN¥4.0m for the year to December 2020. That's a slight decrease of 3.1% on the prior year. We think total compensation is more important but our data shows that the CEO salary is lower, at CN¥1.5m.

In comparison with other companies in the industry with market capitalizations ranging from HK$7.8b to HK$25b, the reported median CEO total compensation was CN¥4.2m. This suggests that China SCE Group Holdings remunerates its CEO largely in line with the industry average. Furthermore, Chiu Wong directly owns HK$7.6b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥1.5m | CN¥1.6m | 37% |

| Other | CN¥2.5m | CN¥2.5m | 63% |

| Total Compensation | CN¥4.0m | CN¥4.1m | 100% |

On an industry level, roughly 71% of total compensation represents salary and 29% is other remuneration. In China SCE Group Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at China SCE Group Holdings Limited's Growth Numbers

China SCE Group Holdings Limited's earnings per share (EPS) grew 4.3% per year over the last three years. It achieved revenue growth of 52% over the last year.

We like the look of the strong year-on-year improvement in revenue. And in that context, the modest EPS improvement certainly isn't shabby. We wouldn't say this is necessarily top notch growth, but it is certainly promising. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has China SCE Group Holdings Limited Been A Good Investment?

China SCE Group Holdings Limited has generated a total shareholder return of 2.7% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for China SCE Group Holdings (of which 1 is a bit unpleasant!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1966

China SCE Group Holdings

An investment holding company, engages in the development, investment, and management of properties in the People’s Republic of China.

Low risk and slightly overvalued.

Market Insights

Community Narratives