Hang Lung Group Limited (HKG:10) has announced that it will pay a dividend of HK$0.65 per share on the 19th of May. This means the dividend yield will be fairly typical at 5.7%.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Hang Lung Group's stock price has increased by 41% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Hang Lung Group

Hang Lung Group's Earnings Easily Cover The Distributions

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Before making this announcement, Hang Lung Group was easily earning enough to cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

EPS is set to fall by 12.5% over the next 12 months if recent trends continue. Assuming the dividend continues along recent trends, we believe the payout ratio could be 49%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Hang Lung Group Has A Solid Track Record

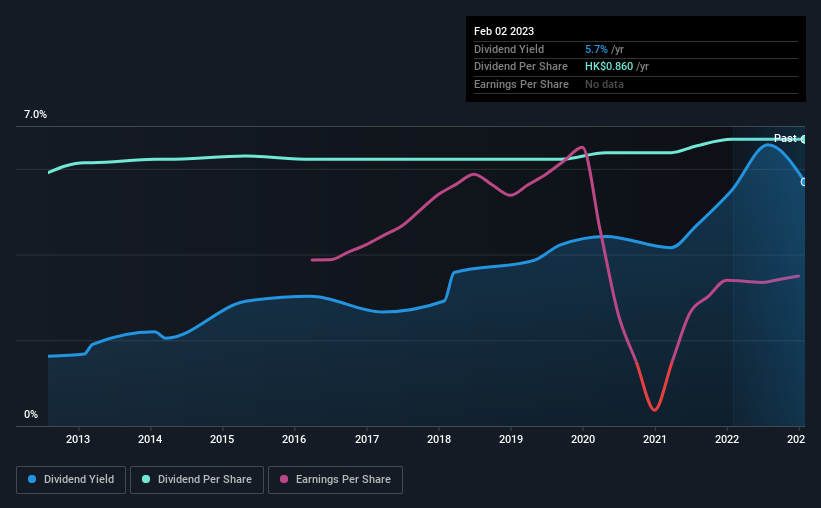

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from an annual total of HK$0.76 in 2013 to the most recent total annual payment of HK$0.86. This implies that the company grew its distributions at a yearly rate of about 1.2% over that duration. Dividends have grown relatively slowly, which is not great, but some investors may value the relative consistency of the dividend.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately things aren't as good as they seem. Over the past five years, it looks as though Hang Lung Group's EPS has declined at around 13% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

Our Thoughts On Hang Lung Group's Dividend

Overall, a consistent dividend is a good thing, and we think that Hang Lung Group has the ability to continue this into the future. While the payments look sustainable for now, earnings have been shrinking so the dividend could come under pressure in the future. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 1 warning sign for Hang Lung Group that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Hang Lung Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:10

Hang Lung Group

An investment holding company, operates as a property developer in Hong Kong and Mainland China.

Established dividend payer and fair value.

Market Insights

Community Narratives