- Hong Kong

- /

- Real Estate

- /

- SEHK:9983

Earnings growth of 5.7% over 3 years hasn't been enough to translate into positive returns for Central China New Life (HKG:9983) shareholders

As every investor would know, not every swing hits the sweet spot. But really bad investments should be rare. So consider, for a moment, the misfortune of Central China New Life Limited (HKG:9983) investors who have held the stock for three years as it declined a whopping 78%. That'd be enough to cause even the strongest minds some disquiet. And over the last year the share price fell 32%, so we doubt many shareholders are delighted. The falls have accelerated recently, with the share price down 21% in the last three months. However, one could argue that the price has been influenced by the general market, which is down 8.6% in the same timeframe.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Central China New Life

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate three years of share price decline, Central China New Life actually saw its earnings per share (EPS) improve by 18% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. It's good to see that Central China New Life has increased its revenue over the last three years. If the company can keep growing revenue, there may be an opportunity for investors. You might have to dig deeper to understand the recent share price weakness.

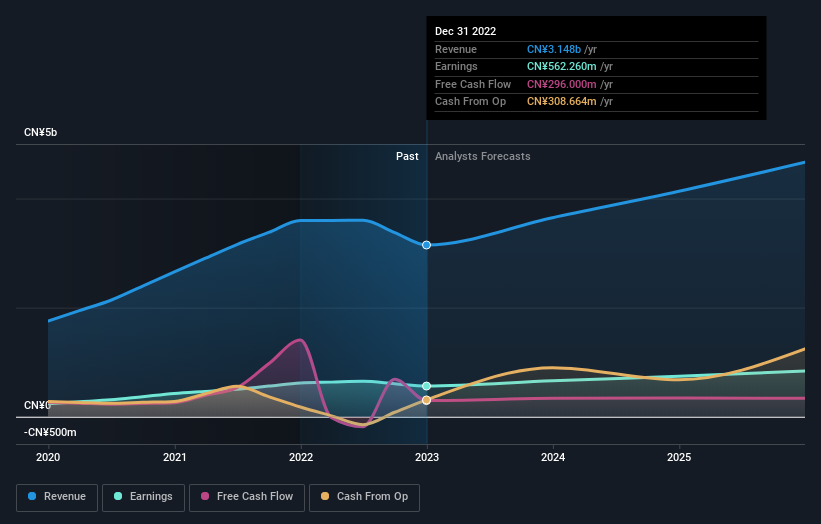

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Central China New Life will earn in the future (free profit forecasts).

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Central China New Life the TSR over the last 3 years was -71%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Central China New Life shareholders are down 22% for the year (even including dividends), falling short of the market return. Meanwhile, the broader market slid about 1.0%, likely weighing on the stock. However, the loss over the last year isn't as bad as the 20% per annum loss investors have suffered over the last three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. It's always interesting to track share price performance over the longer term. But to understand Central China New Life better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Central China New Life (including 1 which doesn't sit too well with us) .

But note: Central China New Life may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9983

Central China New Life

An investment holding company, provides property management services and value-added services in the People’s Republic of China.

Good value with adequate balance sheet.