- Hong Kong

- /

- Real Estate

- /

- SEHK:982

With EPS Growth And More, Huafa Property Services Group (HKG:982) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Huafa Property Services Group (HKG:982). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Huafa Property Services Group

How Quickly Is Huafa Property Services Group Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Huafa Property Services Group's EPS has grown 35% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

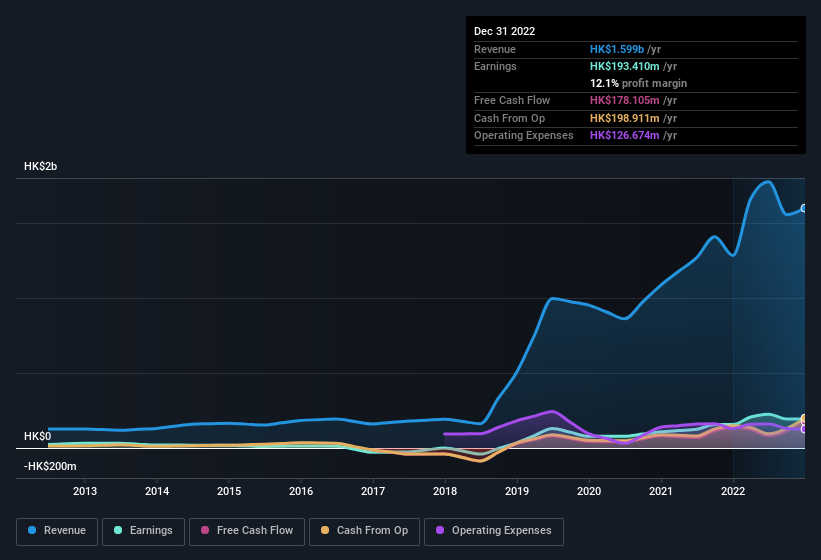

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Huafa Property Services Group achieved similar EBIT margins to last year, revenue grew by a solid 25% to HK$1.6b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Huafa Property Services Group isn't a huge company, given its market capitalisation of HK$1.3b. That makes it extra important to check on its balance sheet strength.

Are Huafa Property Services Group Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. The median total compensation for CEOs of companies similar in size to Huafa Property Services Group, with market caps between HK$784m and HK$3.1b, is around HK$2.5m.

The Huafa Property Services Group CEO received total compensation of only HK$118k in the year to December 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Huafa Property Services Group Worth Keeping An Eye On?

For growth investors, Huafa Property Services Group's raw rate of earnings growth is a beacon in the night. Strong EPS growth is a great look for the company and reasonable CEO compensation sweetens the deal for investors ass it alludes to management being conscious of frivolous spending. So this stock is well worth an addition to your watchlist as it has the potential to provide great value to shareholders. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Huafa Property Services Group , and understanding it should be part of your investment process.

Although Huafa Property Services Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Huafa Property Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:982

Huafa Property Services Group

An investment holding company, provides property management services in Hong Kong and Mainland China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives