- Hong Kong

- /

- Real Estate

- /

- SEHK:83

Is Sino Land’s Scrip Dividend Option Shaping a New Capital Allocation Approach for SEHK:83?

Reviewed by Sasha Jovanovic

- On October 22, 2025, Sino Land Company Limited approved amendments to its Articles of Association and declared a final dividend of HK$0.43 per ordinary share, offering investors the option to receive a scrip dividend.

- This combination of corporate governance changes alongside the reaffirmation of shareholder payouts could shape investor perceptions of the company's future direction and capital management priorities.

- We'll examine how the scrip dividend option reflects Sino Land's approach to rewarding shareholders and managing capital allocation.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Sino Land's Investment Narrative?

For investors considering Sino Land, the big picture centers on the company’s ability to balance capital returns with the realities facing Hong Kong’s property sector. The latest announcement of amendments to the Articles of Association, alongside a reaffirmed final dividend with a scrip option, indicates continuity in shareholder rewards but doesn’t materially shift the major short-term catalysts or risks currently in focus. These remain the pressure on earnings growth, ongoing board transition, and valuation concerns given the company’s higher price-to-earnings multiple compared to peers. The dividend’s sustainability has been questioned recently, and the option for a scrip dividend may subtly support capital retention, but is unlikely to significantly alter the near-term risk profile. With the business still facing slow revenue and profit momentum relative to the market, investors should be attentive to the company’s ability to improve profitability and maintain its payouts.

But, against steady dividends, a risk remains: dividend coverage from cash flows is not robust.

Exploring Other Perspectives

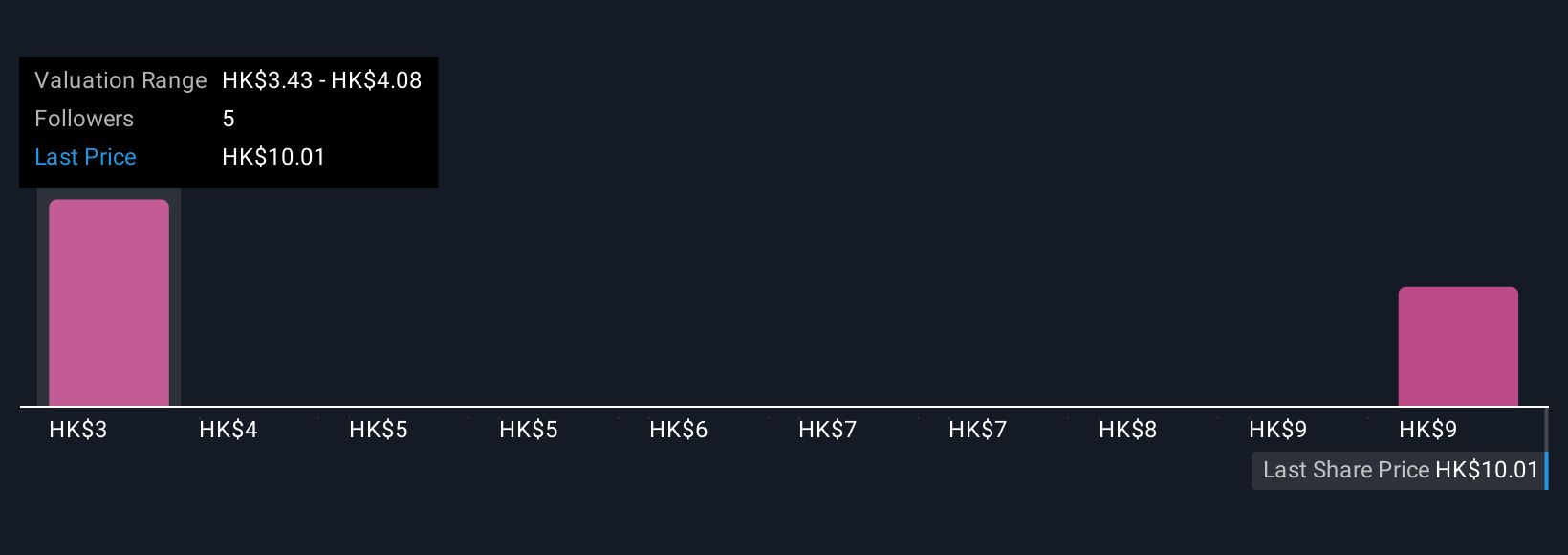

Explore 2 other fair value estimates on Sino Land - why the stock might be worth less than half the current price!

Build Your Own Sino Land Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sino Land research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Sino Land research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sino Land's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:83

Sino Land

An investment holding company, invests in, develops, manages, and trades in properties.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives